Question

Walters Accounting Company receives its annual property tax bill for the calendar year on May 1, 2018. The bill is for $ 32,000 and

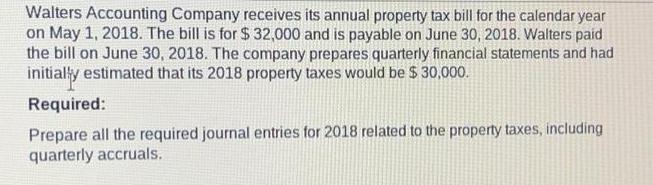

Walters Accounting Company receives its annual property tax bill for the calendar year on May 1, 2018. The bill is for $ 32,000 and is payable on June 30, 2018. Walters paid the bill on June 30, 2018. The company prepares quarterly financial statements and had initially estimated that its 2018 property taxes would be $ 30,000. Required: Prepare all the required journal entries for 2018 related to the property taxes, including quarterly accruals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

7th Canadian Edition Volume 1

1119048508, 978-1119048503

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App