Question

Walton Bookstore has two type of next year's calendars it could order. They need to determine how much to order in each typeof calendars. Irrespective

Walton Bookstore has two type of next year's calendars it could order. They need to determine how much to order in each typeof calendars.

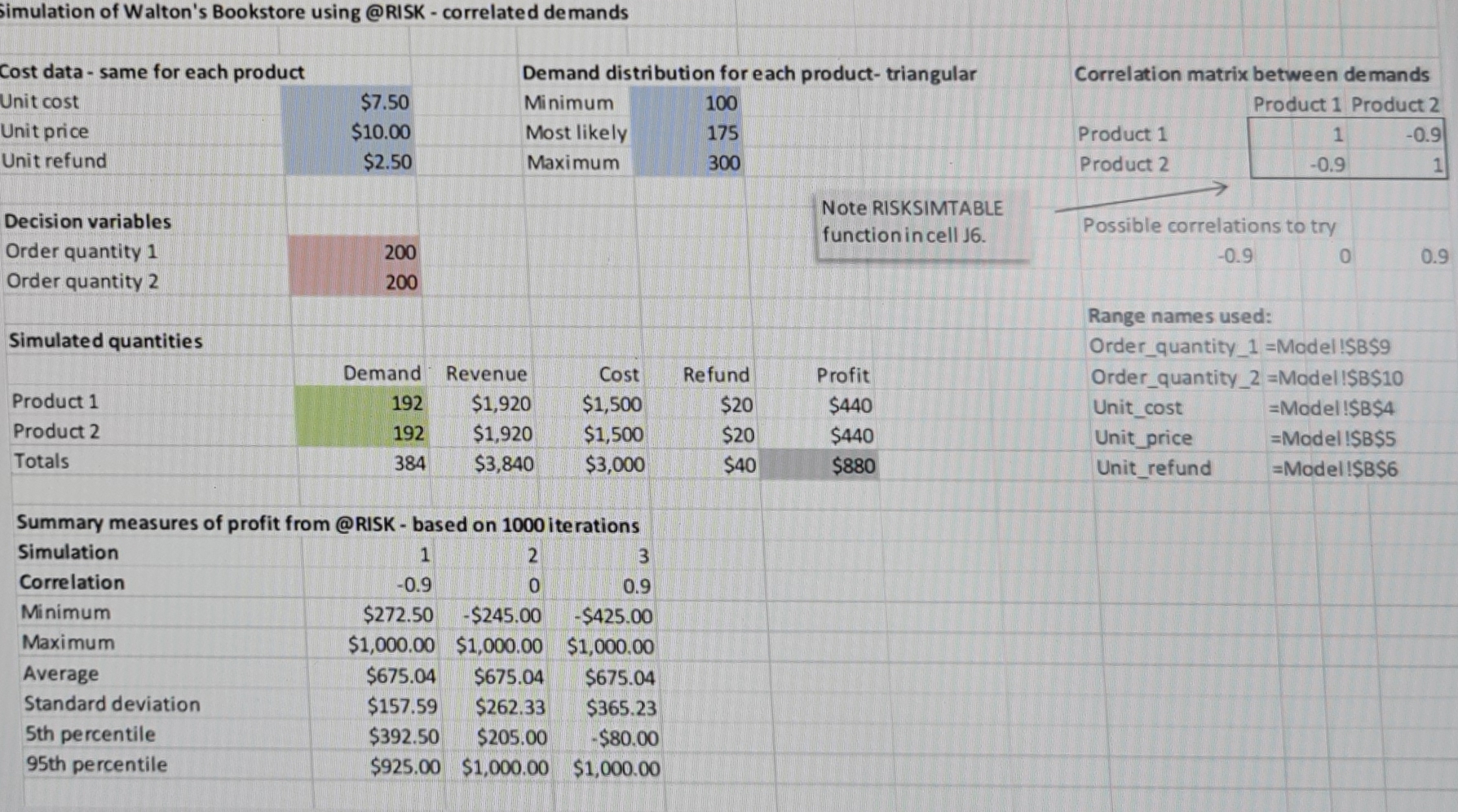

Irrespective of the type, each calendar costs the bookstore $7.50 and sells for $10. After January 1, all unsold calendars will be returned to the publisher for a refund of $2.50 per calendar.

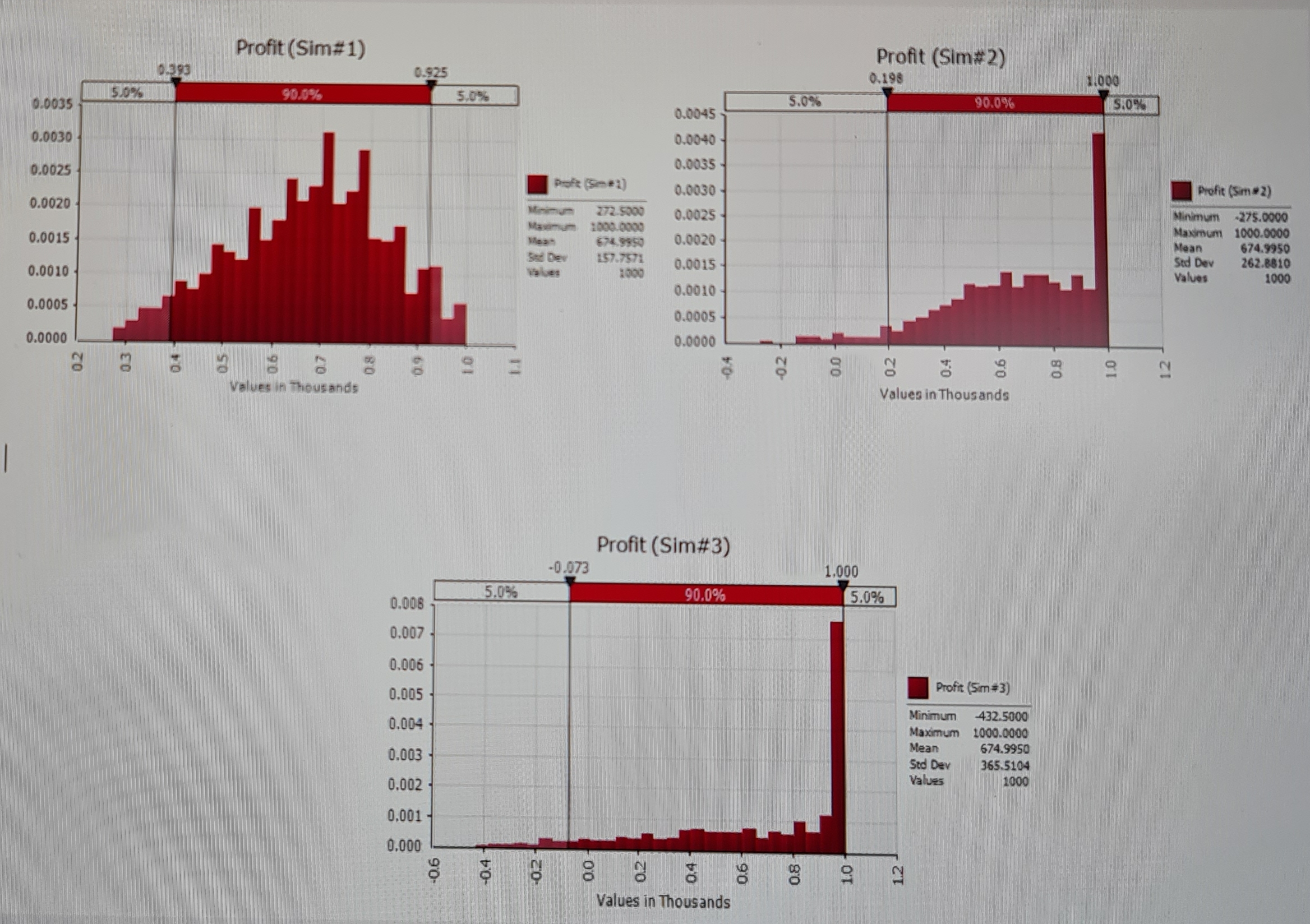

Walton believes that the demand for each type of calendar follows a triangular distribution given in Table 1.Walton Bookstore is unsure whether the demands for the two types of calendars are positively correlated or negatively correlated or not correlated.Hence they have considered three scenarios namely, the correlation between the demand of the two types of calendars is [1] -0.9, [2] 0.0, and [3] 0.9.

You may useTables, 1 and 2provided with the information needed foranswering the question below:

Table 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started