Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wanting to check my understand for practice . Exercise 11-2A Materials and compensation costs in manufacturing versus service companies Morland Company started year I with

wanting to check my

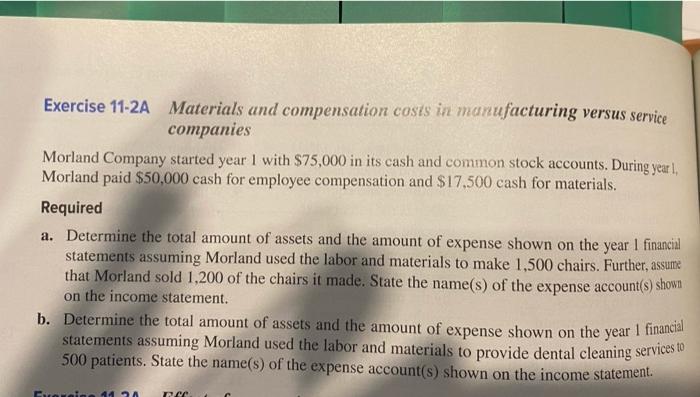

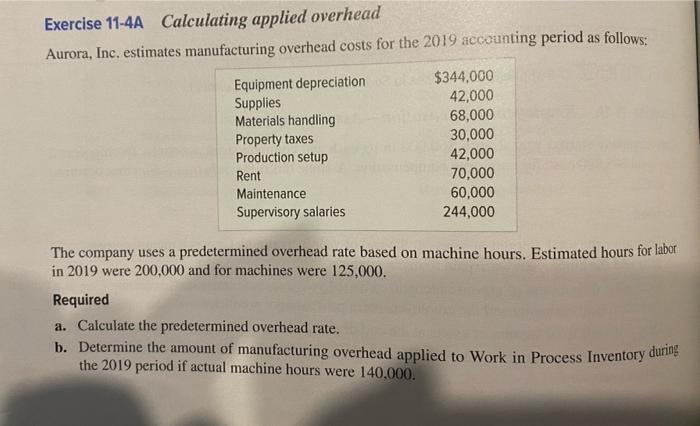

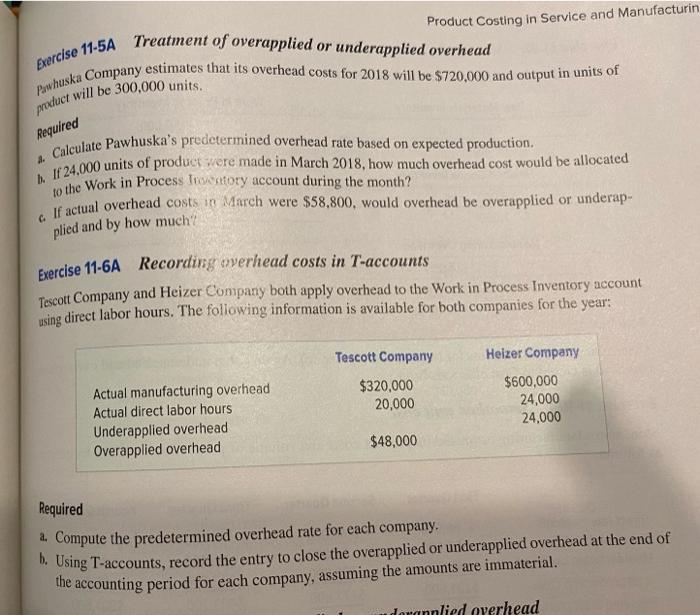

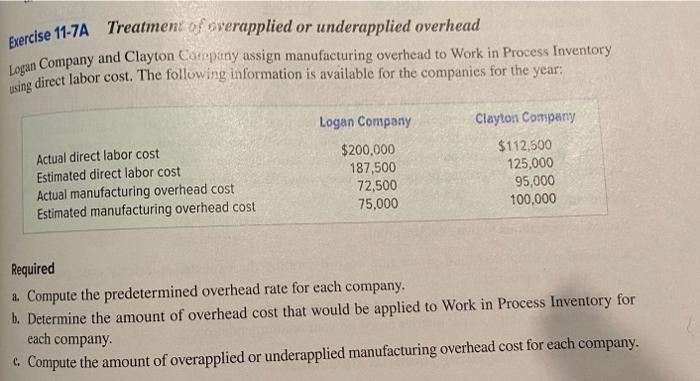

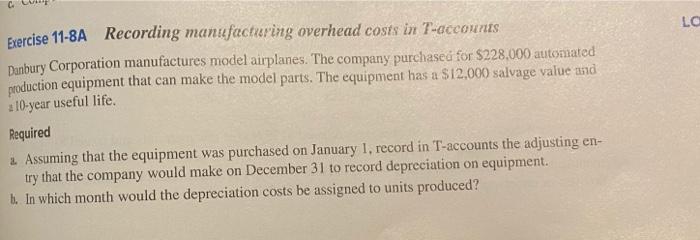

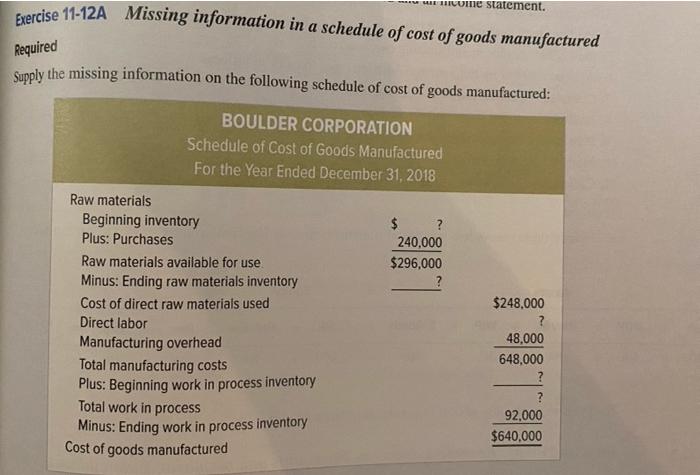

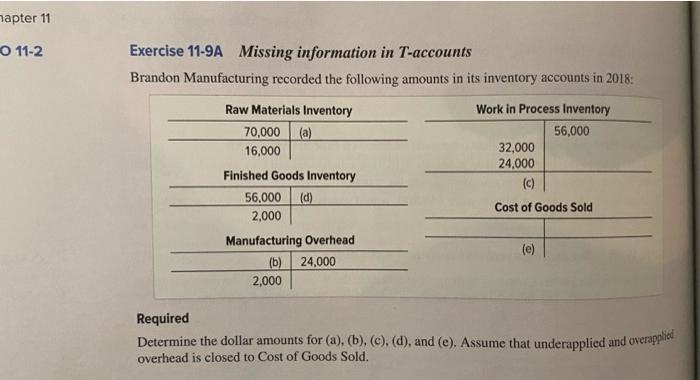

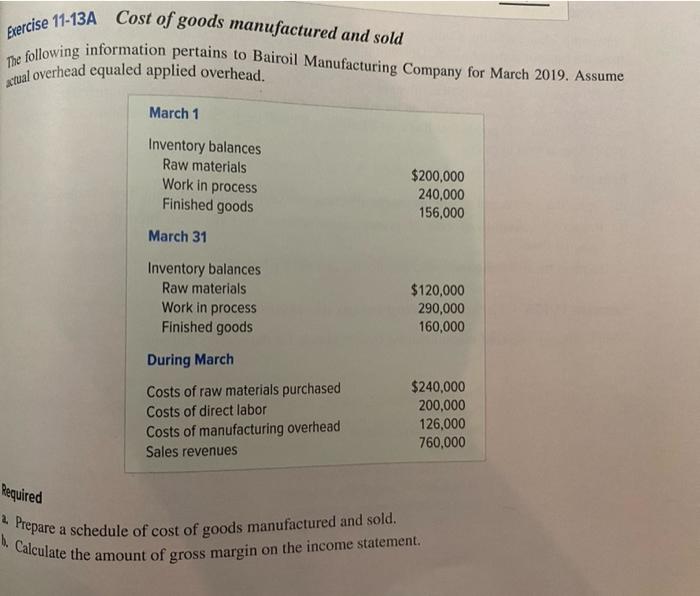

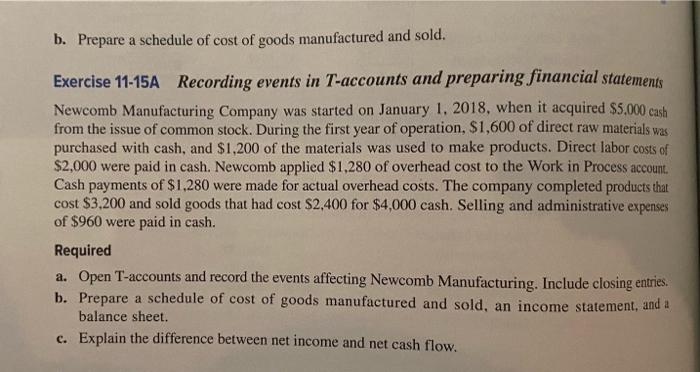

Exercise 11-2A Materials and compensation costs in manufacturing versus service companies Morland Company started year I with $75,000 in its cash and common stock accounts. During year 1, Morland paid $50,000 cash for employee compensation and $17.500 cash for materials. Required a. Determine the total amount of assets and the amount of expense shown on the year 1 financial statements assuming Morland used the labor and materials to make 1,500 chairs. Further, assume that Morland sold 1,200 of the chairs it made. State the name(s) of the expense account(s) shown on the income statement. b. Determine the total amount of assets and the amount of expense shown on the year 1 financial statements assuming Morland used the labor and materials to provide dental cleaning services to 500 patients. State the name(s) of the expense account(s) shown on the income statement. in 11 INC Exercise 11-4A Calculating applied overhead Aurora, Inc. estimates manufacturing overhead costs for the 2019 accounting period as follows: Equipment depreciation Supplies Materials handling Property taxes Production setup Rent Maintenance Supervisory salaries $344,000 42,000 68,000 30,000 42,000 70,000 60,000 244,000 The company uses a predetermined overhead rate based on machine hours. Estimated hours for labor in 2019 were 200,000 and for machines were 125,000. Required a. Calculate the predetermined overhead rate. b. Determine the amount of manufacturing overhead applied to Work in Process Inventory during the 2019 period if actual machine hours were 140,000. Product Costing in Service and Manufacturin Exercise 11-5A Treatment of overapplied or underapplied overhead Pywhuska Company estimates that its overhead costs for 2018 will be $720,000 and output in units of will be 300,000 units. product Required 1. Calculate Pawhuska's predetermined overhead rate based on expected production. h If 24.000 units of product were made in March 2018, how much overhead cost would be allocated to the Work in Process Temory account during the month? If actual overhead costs in March were $58,800, would overhead be overapplied or underap- plied and by how much Exercise 11-6A Recording overhead costs in T-accounts Tescott Company and Heizer Company both apply overhead to the Work in Process Inventory account using direct labor hours. The following information is available for both companies for the year: Tescott Company Heizer Company $320,000 20,000 Actual manufacturing overhead Actual direct labor hours Underapplied overhead Overapplied overhead $600,000 24,000 24,000 $48,000 Required a. Compute the predetermined overhead rate for each company. 6. Using T-accounts, record the entry to close the overapplied or underapplied overhead at the end of the accounting period for each company, assuming the amounts are immaterial. darannlied overhead Exercise 11-7A Treatment of overapplied or underapplied overhead Logan Company and Clayton Company assign manufacturing overhead to Work in Process Inventory using direct labor cost. The following information is available for the companies for the year, Actual direct labor cost Estimated direct labor cost Actual manufacturing overhead cost Estimated manufacturing overhead cost Logan Company $200,000 187,500 72,500 75,000 Clayton Company $112,500 125,000 95,000 100,000 Required 2. Compute the predetermined overhead rate for each company. b. Determine the amount of overhead cost that would be applied to Work in Process Inventory for each company C. Compute the amount of overapplied or underapplied manufacturing overhead cost for each company. . LC Exercise 11-8A Recording manufacturing overhead costs in 7-accounts Danbury Corporation manufactures model airplanes. The company purchased for $228,000 automated production equipment that can make the model parts. The equipment has a $12,000 salvage value and a 10-year useful life. Required 2. Assuming that the equipment was purchased on January 1, record in T-accounts the adjusting en- try that the company would make on December 31 to record depreciation on equipment. b. In which month would the depreciation costs be assigned to units produced? HIIUM statement. Exercise 11-12A Missing information in a schedule of cost of goods manufactured Required Supply the missing information on the following schedule of cost of goods manufactured: BOULDER CORPORATION Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2018 $ ? 240,000 $296,000 ? Raw materials Beginning inventory Plus: Purchases Raw materials available for use Minus: Ending raw materials inventory Cost of direct raw materials used Direct labor Manufacturing overhead Total manufacturing costs Plus: Beginning work in process inventory Total work in process Minus: Ending work in process inventory Cost of goods manufactured $248.000 ? 48,000 648,000 ? 92.000 $640,000 hapter 11 O 11-2 Exercise 11-9A Missing information in T-accounts Brandon Manufacturing recorded the following amounts in its inventory accounts in 2018: Work in Process Inventory 56,000 32,000 24.000 (c) Raw Materials Inventory 70,000 16,000 Finished Goods Inventory 56,000 (d) 2,000 Manufacturing Overhead (b) 24,000 2,000 Cost of Goods Sold Required Determine the dollar amounts for (a), (b), (c), (d), and (e). Assume that underapplied and overapplied overhead is closed to Cost of Goods Sold. Exercise 11-13A Cost of goods manufactured and sold The following information pertains to Bairoil Manufacturing Company for March 2019. Assume atual overhead equaled applied overhead. March 1 Inventory balances Raw materials Work in process Finished goods $200,000 240,000 156,000 March 31 Inventory balances Raw materials Work in process Finished goods $120,000 290,000 160,000 During March Costs of raw materials purchased Costs of direct labor Costs of manufacturing overhead Sales revenues $240,000 200,000 126,000 760,000 Required 2. Prepare a schedule of cost of goods manufactured and sold. Calculate the amount of gross margin on the income statement. b. Prepare a schedule of cost of goods manufactured and sold. Exercise 11-15A Recording events in T-accounts and preparing financial statements Newcomb Manufacturing Company was started on January 1, 2018, when it acquired $5,000 cash from the issue of common stock. During the first year of operation, $1,600 of direct raw materials was purchased with cash, and $1,200 of the materials was used to make products. Direct labor costs of $2,000 were paid in cash. Newcomb applied $1,280 of overhead cost to the Work in Process account. Cash payments of $1,280 were made for actual overhead costs. The company completed products that cost $3.200 and sold goods that had cost $2.400 for $4,000 cash. Selling and administrative expenses of $960 were paid in cash. Required a. Open T-accounts and record the events affecting Newcomb Manufacturing. Include closing entries. b. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet. c. Explain the difference between net income and net cash flow understand for practice .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started