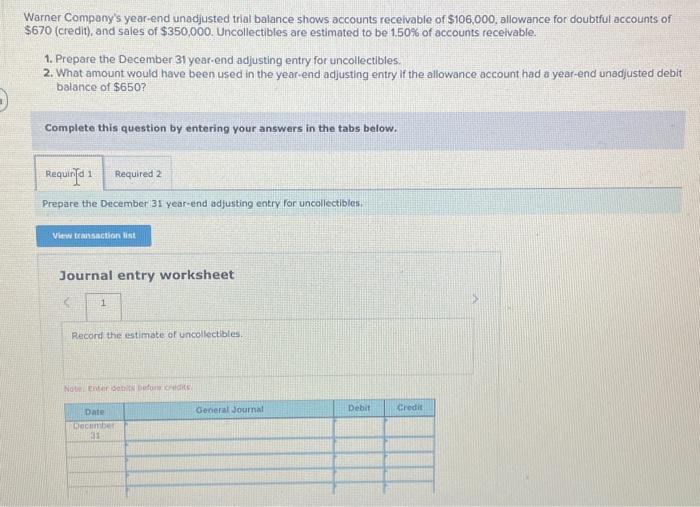

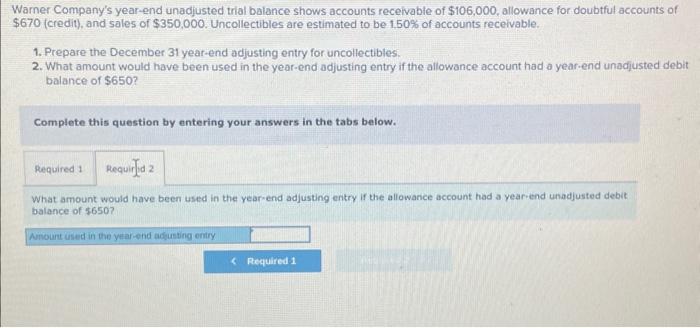

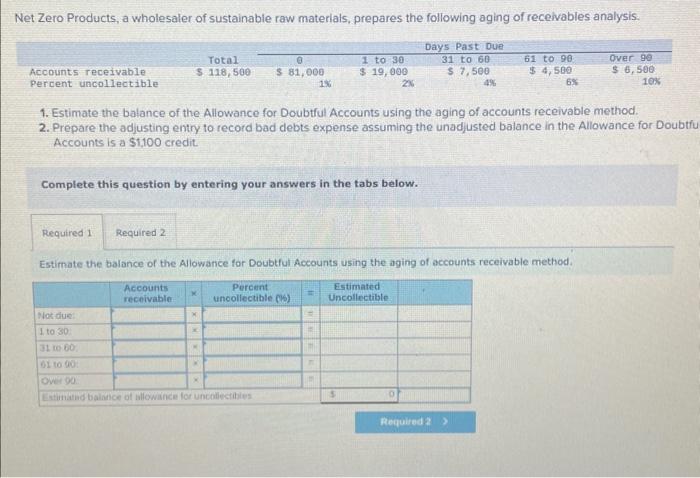

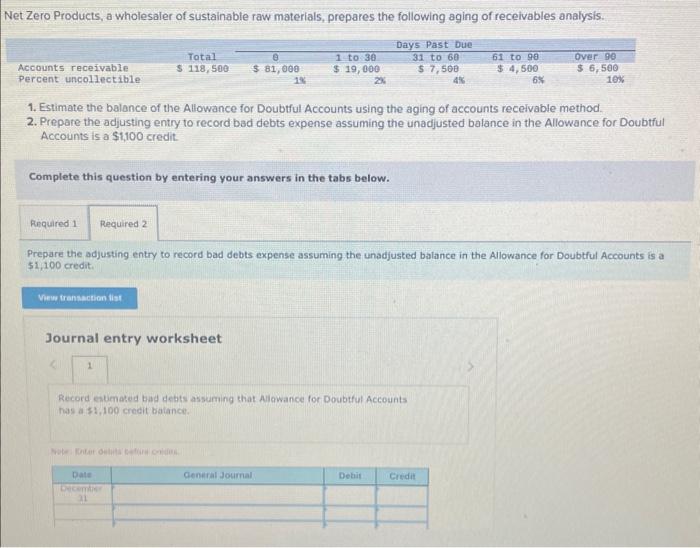

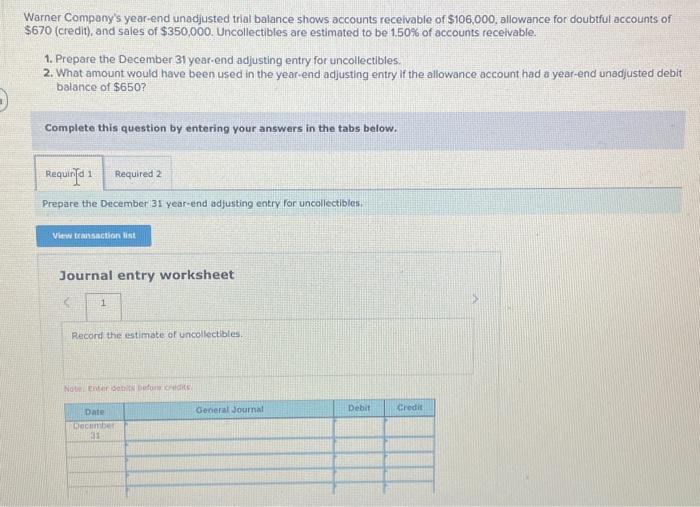

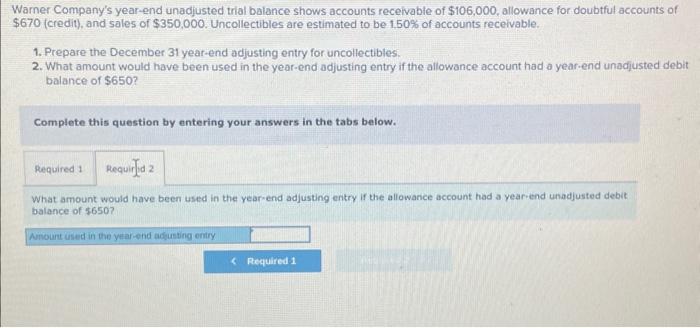

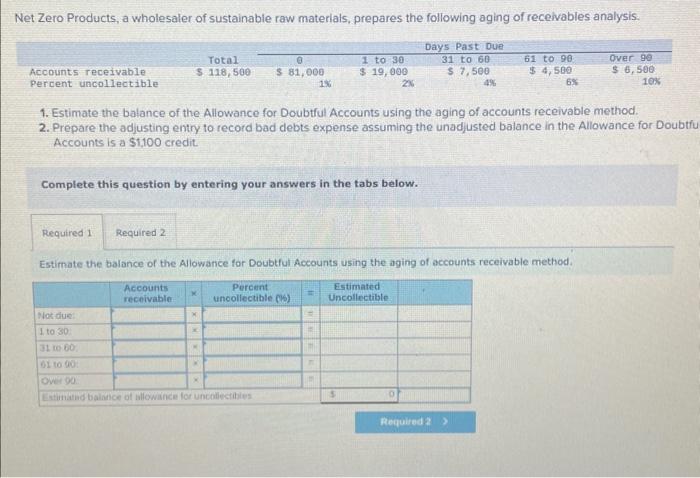

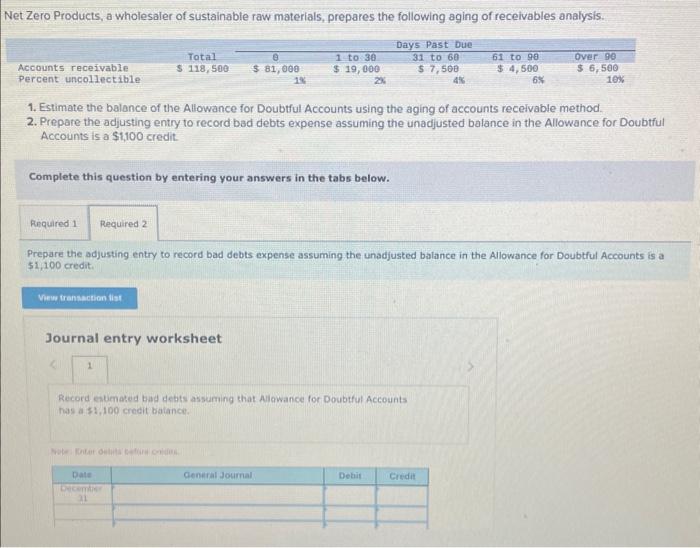

Warner Company's year-end unadjusted trial balance shows accounts recelvable of $106,000, allowance for doubtful accounts of $670 (credit), and sates of $350,000. Uncollectibles are estimated to be 1,50% of accounts receivable. 1. Prepare the December 31 year-end adjusting entry for uncollectibles. 2. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $650 ? Complete this question by entering your answers in the tabs below. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit. balance of $650 ? Net Zero Products, a wholesaler of sustainable raw materials, prepares the following aging of receivables analysis. 1. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method. 2. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doub Accounts is a $1,100 credit. Complete this question by entering your answers in the tabs below. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method. Warner Company's year-end unadjusted trial balance shows accounts recelvable of $106,000, allowance for doubtful accounts of $670 (credit), and sales of $350,000. Uncollectibles are estimated to be 1.50% of accounts recelvable. 1. Prepare the December 31 year-end adjusting entry for uncollectibles. 2. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit batance of $650 ? Complete this question by entering your answers in the tabs below. Prepare the December 31 year-end adfusting entry for uncollectibles. Journal entry worksheet let Zero Products, a wholesaler of sustainable raw materials, prepares the following aging of receivables analysis. 1. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts recelvable method. 2. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $1,100 credit. Complete this question by entering your answers in the tabs below. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $1,100 credit. Journal entry worksheet Record entimated bad debts assuming that Allowance for Doubtful Accounts has a $1,100 crecit balance