Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Warren, a division manager of Walker Enterprises, is under pressure to boost the performance of the Lighting Division in 2014. Unfortunately, recent profits have

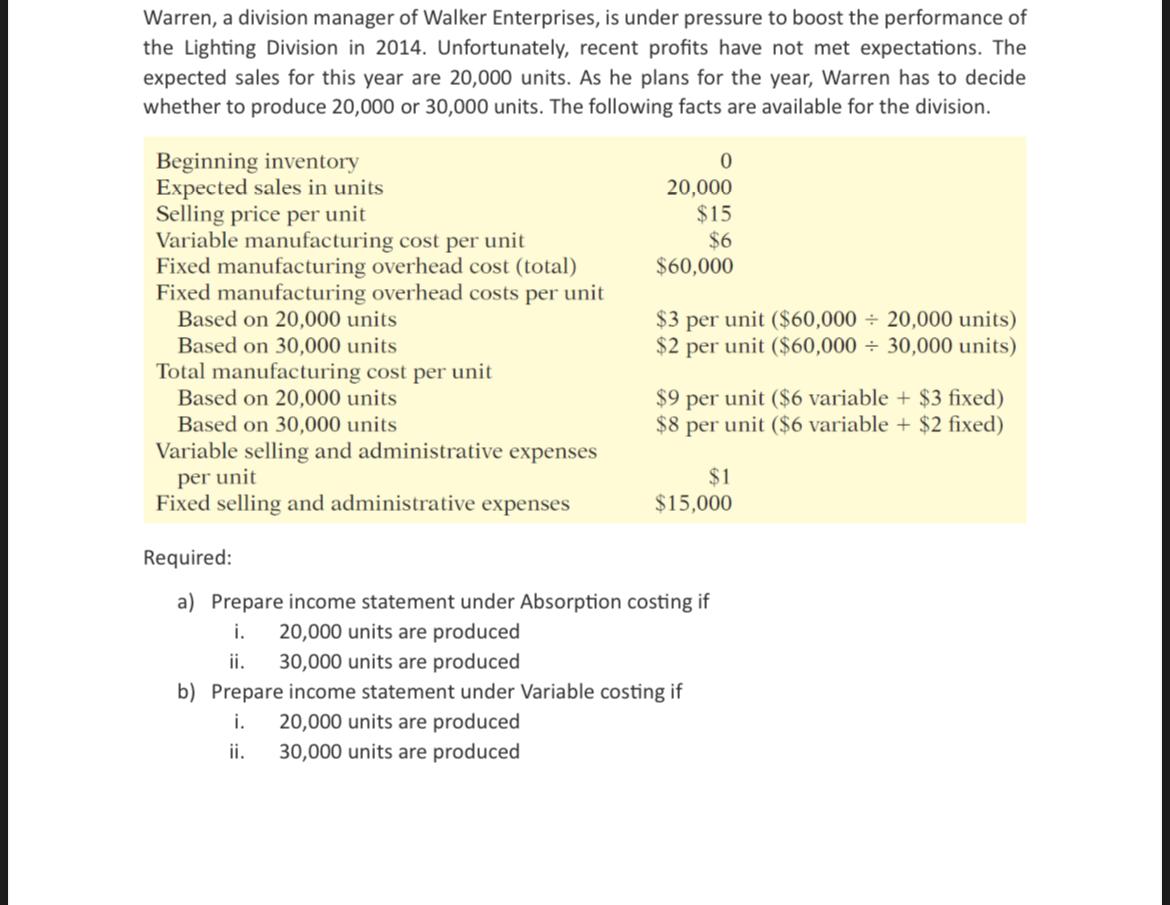

Warren, a division manager of Walker Enterprises, is under pressure to boost the performance of the Lighting Division in 2014. Unfortunately, recent profits have not met expectations. The expected sales for this year are 20,000 units. As he plans for the year, Warren has to decide whether to produce 20,000 or 30,000 units. The following facts are available for the division. Beginning inventory Expected sales in units Selling price per unit Variable manufacturing cost per unit Fixed manufacturing overhead cost (total) Fixed manufacturing overhead costs per unit Based on 20,000 units Based on 30,000 units Total manufacturing cost per unit Based on 20,000 units Based on 30,000 units Variable selling and administrative expenses per unit Fixed selling and administrative expenses 0 20,000 $15 $6 $60,000 $3 per unit ($60,000 20,000 units) $2 per unit ($60,000 30,000 units) $9 per unit ($6 variable + $3 fixed) $8 per unit ($6 variable + $2 fixed) $1 $15,000 Required: a) Prepare income statement under Absorption costing if i. 20,000 units are produced ii. 30,000 units are produced b) Prepare income statement under Variable costing if i. 20,000 units are produced ii. 30,000 units are produced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Walker Enterprises Lighting Division Income Statements 2014 a Absorption Costing i 20000 Units Produced DescriptionAmount Sales Revenue 20000 units 15...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started