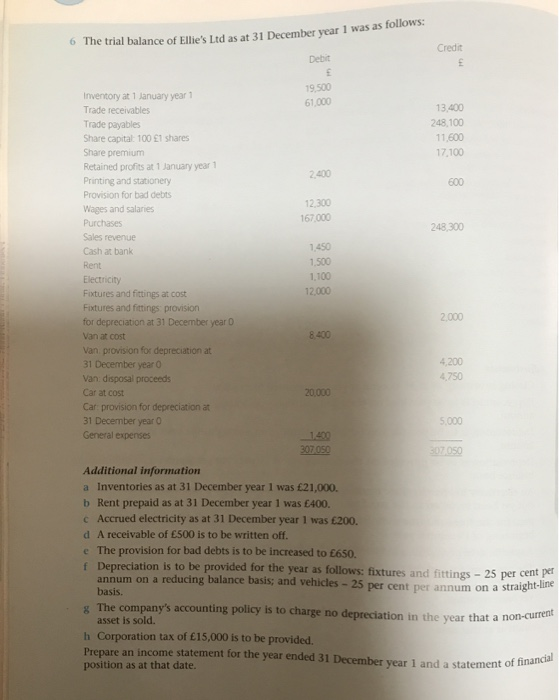

was as follows: 6 The trial balance of Ellie's Ltd as at 31 December year 1 was as follow Credit Debit 19.500 61,000 13.400 248,100 11.600 17,100 2.400 600 12.300 167.000 248,300 Inventory at 1 January year 1 Trade receivables Trade payables Share capital: 100 1 shares Share premium Retained profits at 1 January year 1 Printing and stationery Provision for bad debts Wages and salaries Purchases Sales revenue Cash at bank Rent Electricity Fixtures and fittings at cost Fixtures and fittings provision for depreciation at 31 December year o Van at cost van provision for depreciation at 31 December year o Van: disposal proceeds Car at cost Car: provision for depreciation at 31 December year 0 General expenses 1.450 1.500 1.100 12,000 2.000 8.400 4,200 4.750 20,000 5.000 307.050 307050 Additional information a Inventories as at 31 December year I was 21,000. b Rent prepaid as at 31 December year I was 400. c Accrued electricity as at 31 December year I was 200. d A receivable of 500 is to be written off. e The provision for bad debts is to be increased to 650. f Depreciation is to be provided for the year as follows: fixtures and fittings - 25 per cent po annum on a reducing balance basis; and vehicles - 25 per cent per annum on a straight-line basis. The company's accounting policy is to charge no depreciation in the year that a non-cune asset is sold. h Corporation tax of 15,000 is to be provided. Prepare an income statement for the year ended 31 December year 1 and a statement of position as at that date. fement of financial was as follows: 6 The trial balance of Ellie's Ltd as at 31 December year 1 was as follow Credit Debit 19.500 61,000 13.400 248,100 11.600 17,100 2.400 600 12.300 167.000 248,300 Inventory at 1 January year 1 Trade receivables Trade payables Share capital: 100 1 shares Share premium Retained profits at 1 January year 1 Printing and stationery Provision for bad debts Wages and salaries Purchases Sales revenue Cash at bank Rent Electricity Fixtures and fittings at cost Fixtures and fittings provision for depreciation at 31 December year o Van at cost van provision for depreciation at 31 December year o Van: disposal proceeds Car at cost Car: provision for depreciation at 31 December year 0 General expenses 1.450 1.500 1.100 12,000 2.000 8.400 4,200 4.750 20,000 5.000 307.050 307050 Additional information a Inventories as at 31 December year I was 21,000. b Rent prepaid as at 31 December year I was 400. c Accrued electricity as at 31 December year I was 200. d A receivable of 500 is to be written off. e The provision for bad debts is to be increased to 650. f Depreciation is to be provided for the year as follows: fixtures and fittings - 25 per cent po annum on a reducing balance basis; and vehicles - 25 per cent per annum on a straight-line basis. The company's accounting policy is to charge no depreciation in the year that a non-cune asset is sold. h Corporation tax of 15,000 is to be provided. Prepare an income statement for the year ended 31 December year 1 and a statement of position as at that date. fement of financial