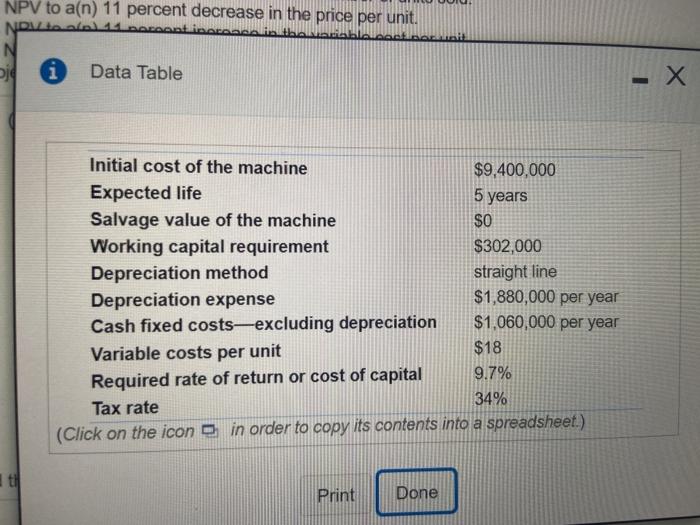

Wat ) Question Help (Related to Checkpoint 13.2 and Checkpoint 13.3) (Comprehensive risk analysis) Blinkeria is considering introducing a new line of hand corners that can be used to co material and then download it into a personal computer. Those scanners are expected to sell for an average price of $100 each, and the company analysts performing the ana expect that the firm can sell 103,000 units per year at this price for a period of five years, after which time they expect demand for the product to end as a result of new techno In addition, variable costs are expected to be $18 per unit and fixed costs, not including depreciation, are forecast to be $1,000,000 per year. To manufacture is product.Ele will need to buy a computerized production machine for $9.4 million that has no residual or salvage value, and will have an expected life of five years. In addition, the fim exp will have to invest an additional $302,000 in working capital to support the new business. Other pertinent information concerning the business venture is provided here: a. Calculate the project's NPV. b. Determine the sensitivity of the project's NPV to an) 11 percent decrease in the number of units sold. c. Determine the sensitivity of the project's NPV to ain) 11 percent decrease in the price per unit d. Determine the sensitivity of the projects NPV to a(n) 11 percent increase in the variable cost per unit e. Determine the sensitivity of the project's NPV to a(n) 11 percent increase in the annual fixed operating costs Use scenario analysis to evaluate the project's NPV under worst- and best-case scenarios for the project's value drivers. The values for the expected or buse-cane allora a. The NPV for the base-case will be $ (Round to the nearest dollar) nter your answer in the answer box and then click Check Answer Check Clear AB parts remaining NPV to a(n) 11 percent decrease in the price per unit. Wald N Dig i Data Table . 5 years Initial cost of the machine $9,400,000 Expected life Salvage value of the machine SO Working capital requirement $302,000 Depreciation method straight line Depreciation expense $1,880,000 per year Cash fixed costsexcluding depreciation $1,060,000 per year Variable costs per unit $18 Required rate of return or cost of capital 9.7% 34% Tax rate (Click on the icon in order to copy its contents into a spreadsheet.) Print Done