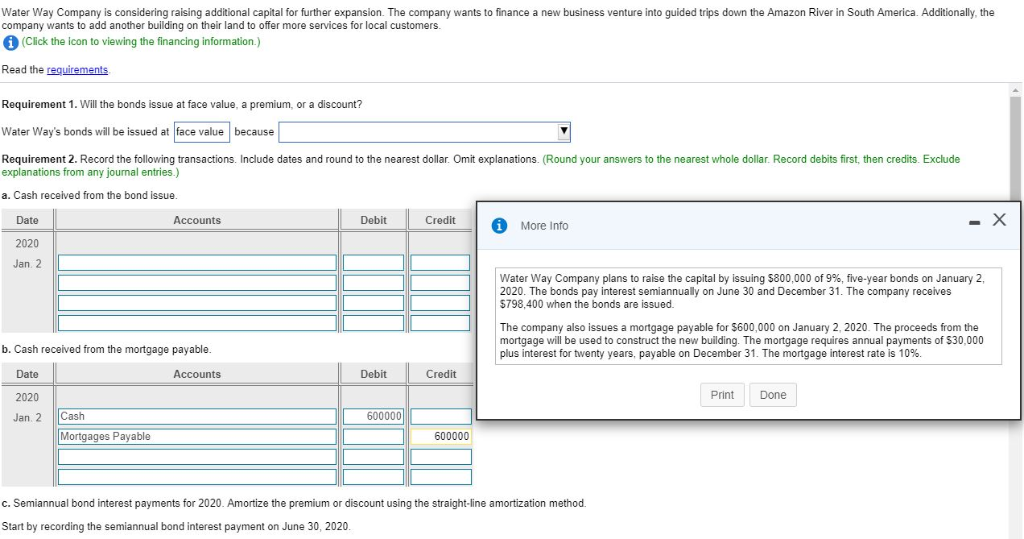

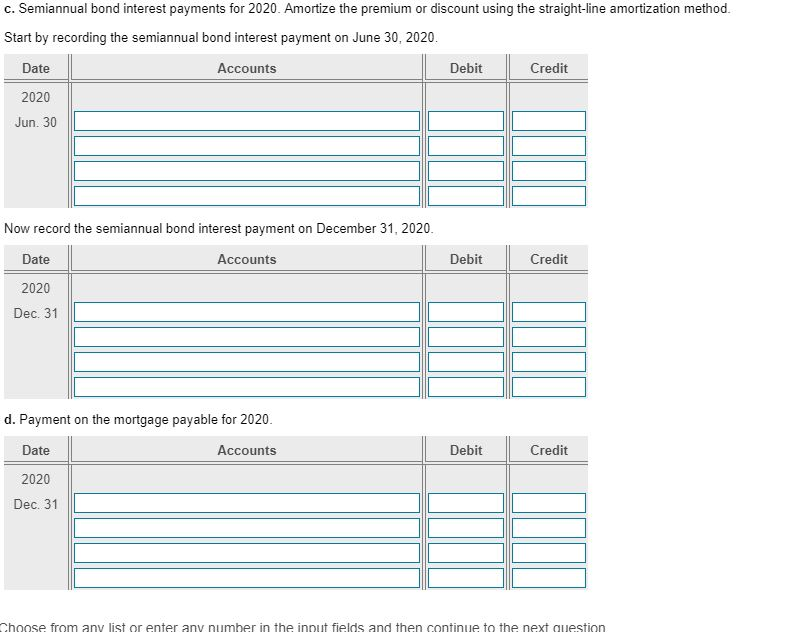

Water Way Company is considering raising additional capital for further expansion. The company wants to finance a new business venture into guided trips down the Amazon River in South America. Additionally, the company wants to add another building on their land to offer more services for local customers (Click the icon to viewing the financing information.) Read the requirements Requirement 1. Will the bonds issue at face value, a premium, or a discount? Water Way's bonds will be issued at face value because Requirement 2. Record the following transactions. Include dates and round to the nearest dollar. Omit explanations. (Round your answers to the nearest whole dollar. Record debits first, then credits. Exclude explanations from any journal entries.) a. Cash received from the bond issue Debit Credit Date 2020 Jan 2 Accounts More Info Water Way Company plans to raise the capital by issuing $800,000 of 9%, five-year bonds on January 2, 2020. The bonds pay interest semiannually on June 30 and December 31. The company receives $798,400 when the bonds are issued The company also issues a mortgage payable for $600,000 on January 2, 2020. The proceeds from the mortgage will be used to construct the new building. The mortgage requires annual payments of $30,000 plus interest for twenty years, payable on December 31, The mortgage interest rate is 10%. b. Cash received from the mortgage payable. Debit Credit Date 2020 Jan 2 Cash Accounts PrintDone 600000 Mortgages Payable 600000 c. Semiannual bond interest payments for 2020. Amortize the premium or discount using the straight-line amortization method Start by recording the semiannual bond interest payment on June 30, 2020 c. Semiannual bond interest payments for 2020. Amortize the premium or discount using the straight-line amortization method. Start by recording the semiannual bond interest payment on June 30, 2020. Date 2020 Jun. 30 Accounts Debit Credit Now record the semiannual bond interest payment on December 31, 2020 Date 2020 Dec. 31 Accounts Debit Credit d. Payment on the mortgage payable for 2020 Debit Date 2020 Dec. 31 Accounts Credit Choose from any list or enter any number in the innut fields and then continue to the next