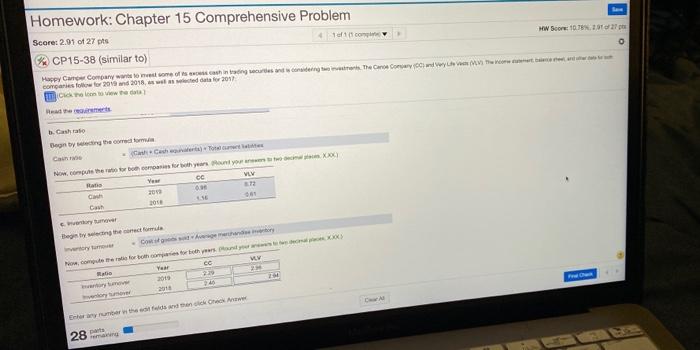

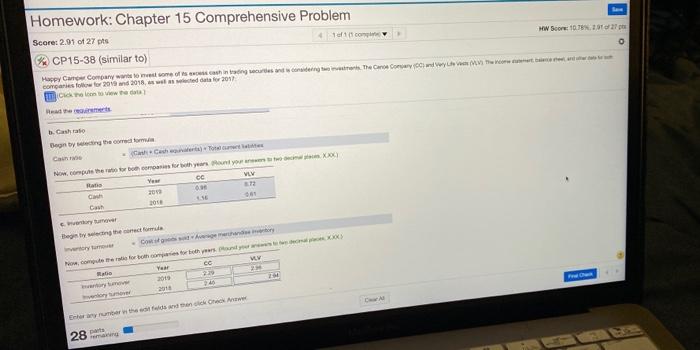

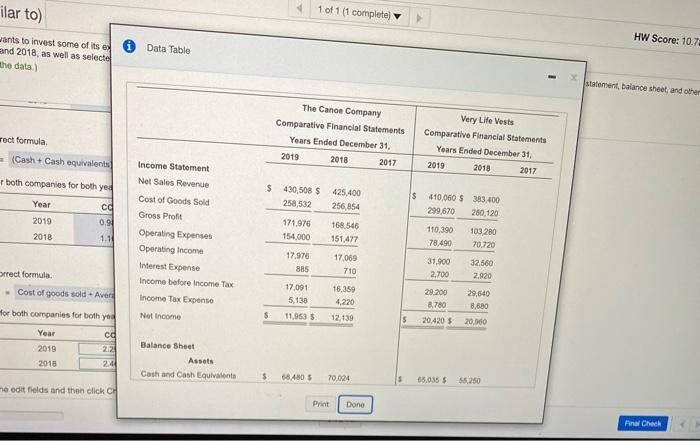

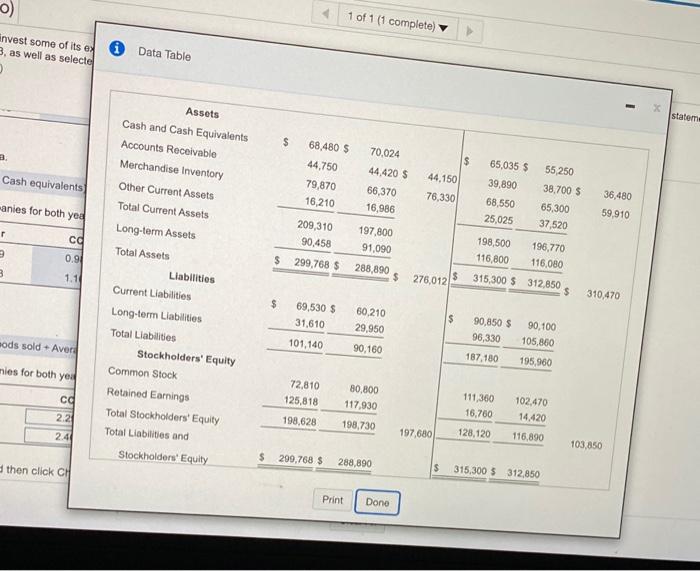

Water Way Company wants to invest some of its excess cash in trading securities and is considering two investments, The Canoe Company (CC) and Very Life Vest (VLV). The incomestatement, balance sheet, and other data for both companies follow for 2019and 2018, as well as selected data for 20172017:

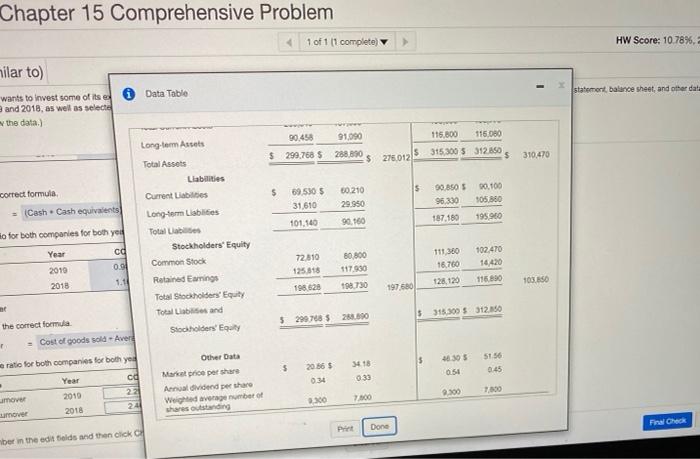

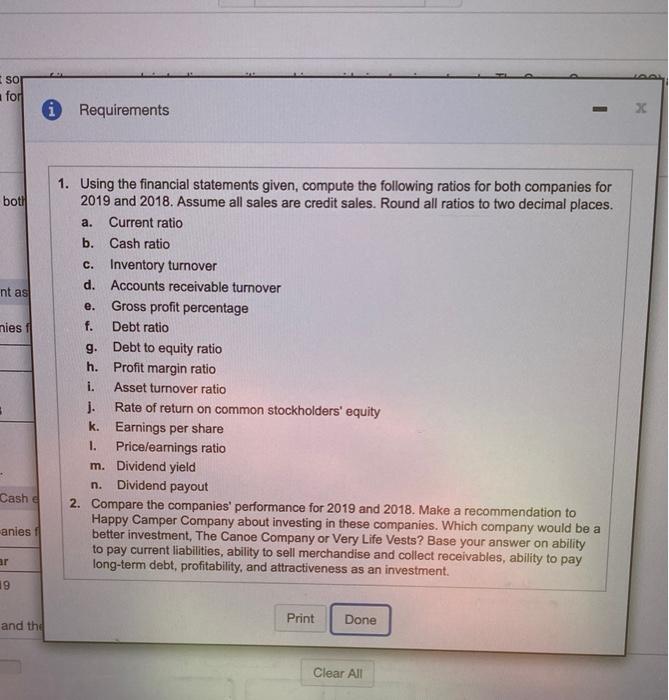

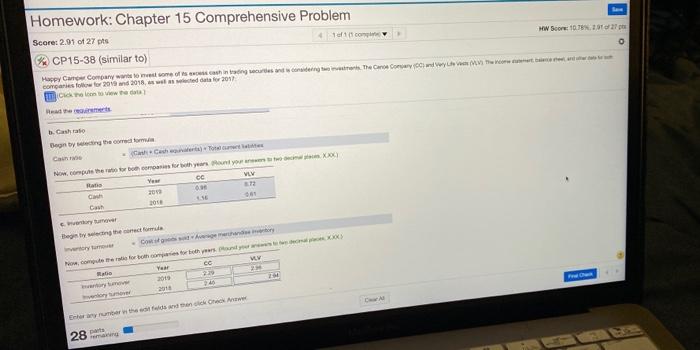

Homework: Chapter 15 Comprehensive Problem Score: 2.91 of 27 pts 11 com HW Score: 10.8.2017 CP15-38 (similar to) Mapy Cow Company was to meet some of things we considering to the Cane Corydych how to cores follow for 2018 2018, willed data for 2017 sve te . Gashi Ben by the comedom Can - Cash Cache) Nother to be companies for years Mountyor) artis OC V G 312 C 2014 wym thegy ting the conecta Cory 2012 Now, come riforms for XXX) Yew VY mo 2019 29 2018 . rumah 28 ilar to) 1 of 1 (1 complete) HW Score: 10.7 wants to invest some of itse and 2018, as well as selecte the data) Data Table statement, balance sheet and other The Canoe Company Comparative Financial Statements Years Ended December 31, 2018 2017 rect formula Very Life Vests Comparative Financial Statements Years Ended December 31 2019 2017 = (Cash + Cash equivalents 2019 2018 $ both companies for both yed Year ca 2019 0.9 2018 1.1 430,508 $ 258,532 425,400 256,854 $ 410,060 $ 383.400 299,670 280,120 Income Statement Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Operating Income Interest Expense Income before Income Tax Income Tax Expense Not Income 171.976 154.000 168546 151,477 110.390 103.280 70.720 78.490 17,976 885 17.060 710 orrect formula Cost of goods sold + Aver 17001 5,138 11,950 $ 16,359 4.220 31.900 32 560 2.700 2.920 29.200 29.640 8.780 8,680 20,420 $ 20,000 Hor both companies for both yod 12.139 5 Year 2019 2018 2.2 Balance Sheet Assets Cash and Cash Equivalents 241 684805 70,024 5 05.0355 56.250 edit fields and then click C Print Done Final Check 0) 1 of 1 (1 complete) invest some of its ex 3, as well as selecte Data Table statem: $ 68,480 $ 3 44,750 $ 65,035 $ Cash equivalents 70,024 44,420 S 66,370 16,986 44.150 79,870 16,210 76,330 55,250 38,700 $ 65,300 37,520 39,890 68,550 25,025 anies for both yed 36,480 59,910 co 209,310 90.458 $ 299,768 $ 197,800 91,090 0.91 288,890 $ 3 198,500 196,770 116,800 116,080 315,300 $ 312,850 $ Assets Cash and Cash Equivalents Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets Long-term Assets Total Assets Liabilities Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 1.11 276,012 $ 310,470 $ 69,530 $ 31.610 60.210 29,950 $ sods sold - Averd 101,140 90,850 $ 96,330 187.180 90, 160 90,100 105,860 195,960 mies for both yea 72,810 125,818 ca 80.800 117,930 198,730 2.2 198.628 111,360 16,760 128,120 102.470 14.420 116.890 2.4 197,680 103,850 $ 299,768 $ 288,890 then click CH $ 315.300 5 312,850 Print Dono Chapter 15 Comprehensive Problem 1 of 1 11 complete HW Score: 10.78% hilar to) Data Table statement balance sheet, and other data wants to invest some of itsed and 2018, as well as selected the data) 91,090 115,800 115080 $ 299,768 $288.800 $ 276.012 5315,300 5 312.850 $ 310,470 $ s correct formula = (Cash Cash equivalents 69.530 5 31 610 80.210 29.950 30.850 96.330 30.00 105.880 195.900 187.180 101.140 90.160 Ho for both companies for both yold Long-term Assets Total Assets Liabilities Current Labbes Long-term Lisbilities Total Labs Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liband Stockholders' Equity Year 2010 2018 cd 0.0 1.1 72.510 125.818 111 30 16760 80.800 117030 102470 14,420 116.890 126. 120 198.730 103 SO 198.520 197680 $ 315300 $312.50 5 290788 $288.800 the correct formula - Cost of goods sold - Aver $ SA 20.56 $ $ 8.305 054 5156 0:45 033 ratio for both companies for both yo - Year ca mover 2010 2018 24 Other Data Market price per share Ang dividend per share Weid avage number of share outstanding 2.300 7800 3.300 7.500 Print Done Final Check in the edit fields and then click SOT for 1 Requirements 30 boti nt as nies 1 1. Using the financial statements given, compute the following ratios for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio b. Cash ratio c. Inventory turnover d. Accounts receivable turnover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share 1. Pricelearnings ratio m. Dividend yield Dividend payout 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Happy Camper Company about investing in these companies. Which company would be a better investment, The Canoe Company or Very Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. n. Cash -anies ar 19 Print Done and the Clear All