Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Watertown Industries This problem should serve as a review of material you have covered previously on the preparation of a simple cash flow statement.

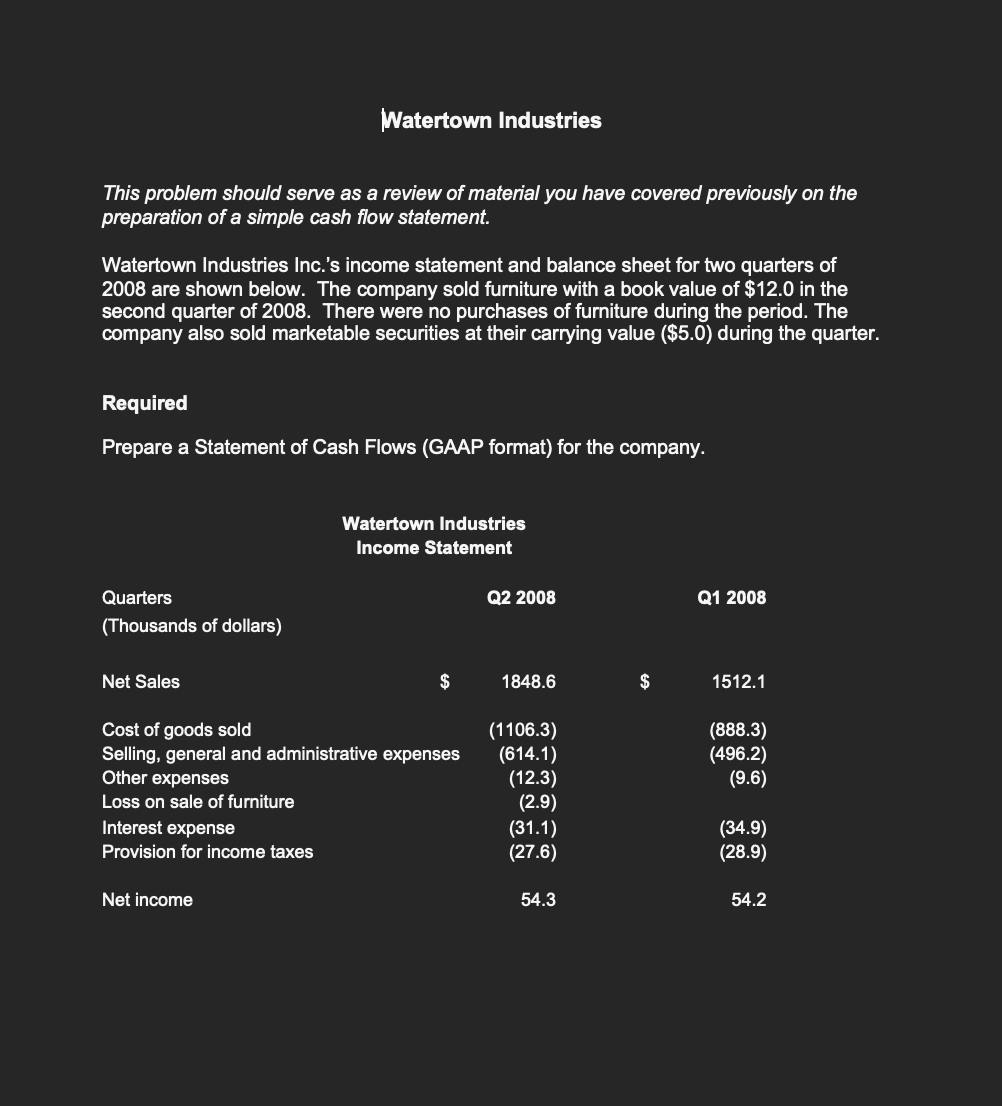

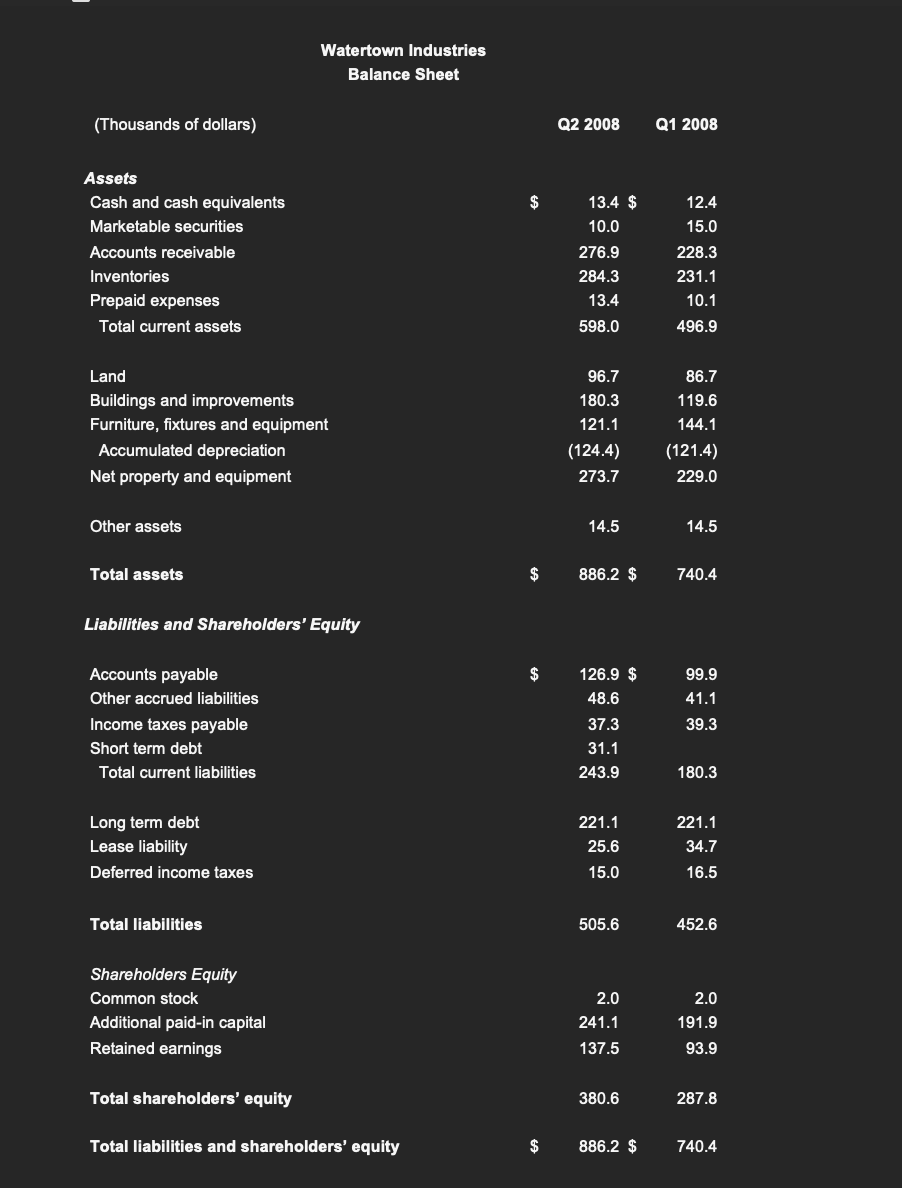

Watertown Industries This problem should serve as a review of material you have covered previously on the preparation of a simple cash flow statement. Watertown Industries Inc.'s income statement and balance sheet for two quarters of 2008 are shown below. The company sold furniture with a book value of $12.0 in the second quarter of 2008. There were no purchases of furniture during the period. The company also sold marketable securities at their carrying value ($5.0) during the quarter. Required Prepare a Statement of Cash Flows (GAAP format) for the company. Quarters (Thousands of dollars) Watertown Industries Income Statement Q2 2008 Q1 2008 Net Sales $ 1848.6 $ 1512.1 Cost of goods sold (1106.3) (888.3) Selling, general and administrative expenses (614.1) (496.2) Other expenses (12.3) (9.6) Loss on sale of furniture (2.9) Interest expense (31.1) (34.9) Provision for income taxes (27.6) (28.9) Net income 54.3 54.2 (Thousands of dollars) Assets Cash and cash equivalents Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Watertown Industries Balance Sheet Q2 2008 Q1 2008 13.4 $ 12.4 10.0 15.0 276.9 228.3 284.3 231.1 13.4 10.1 598.0 496.9 Land 96.7 86.7 Buildings and improvements 180.3 119.6 Furniture, fixtures and equipment 121.1 144.1 Accumulated depreciation (124.4) (121.4) Net property and equipment 273.7 229.0 Other assets Total assets Liabilities and Shareholders' Equity Accounts payable Other accrued liabilities 14.5 14.5 $ 886.2 $ 740.4 Income taxes payable Short term debt Total current liabilities 126.9 $ 99.9 48.6 41.1 37.3 39.3 31.1 243.9 180.3 Long term debt 221.1 221.1 Lease liability 25.6 34.7 Deferred income taxes 15.0 16.5 Total liabilities 505.6 452.6 Shareholders Equity Common stock Additional paid-in capital Retained earnings 2.0 2.0 241.1 191.9 137.5 93.9 Total shareholders' equity 380.6 287.8 Total liabilities and shareholders' equity 886.2 $ 740.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started