Answered step by step

Verified Expert Solution

Question

1 Approved Answer

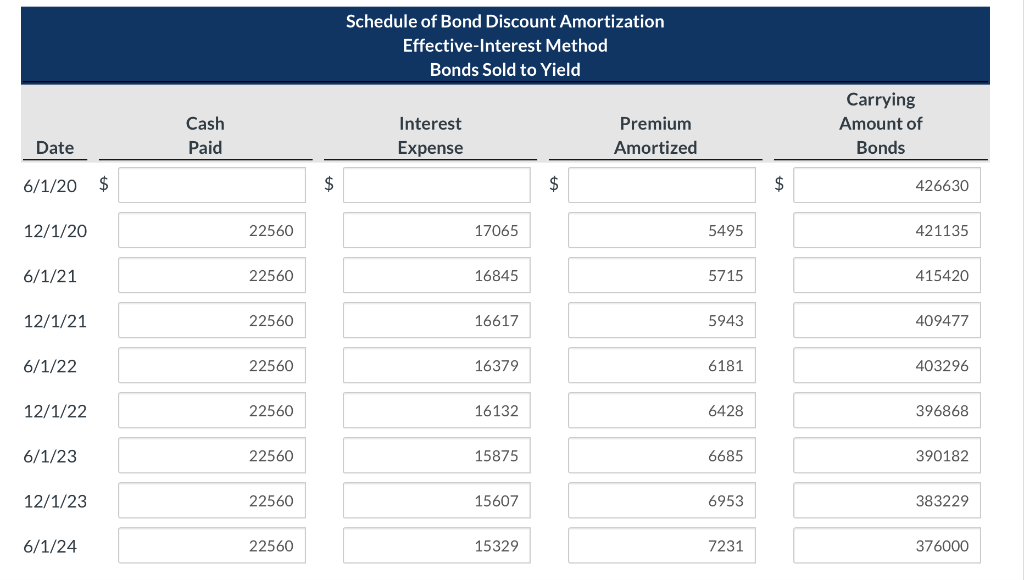

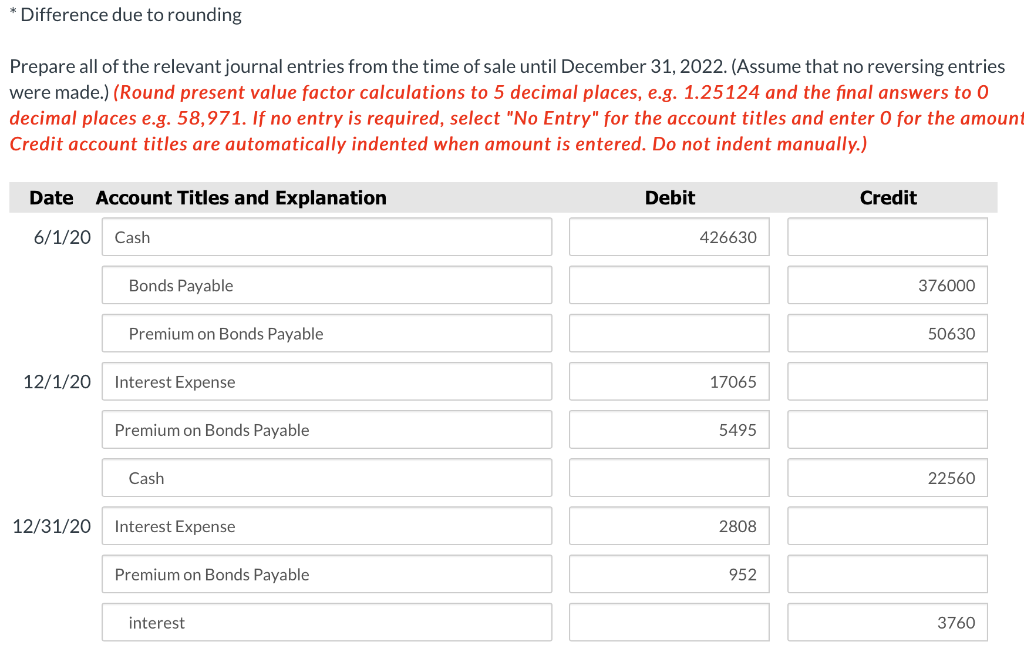

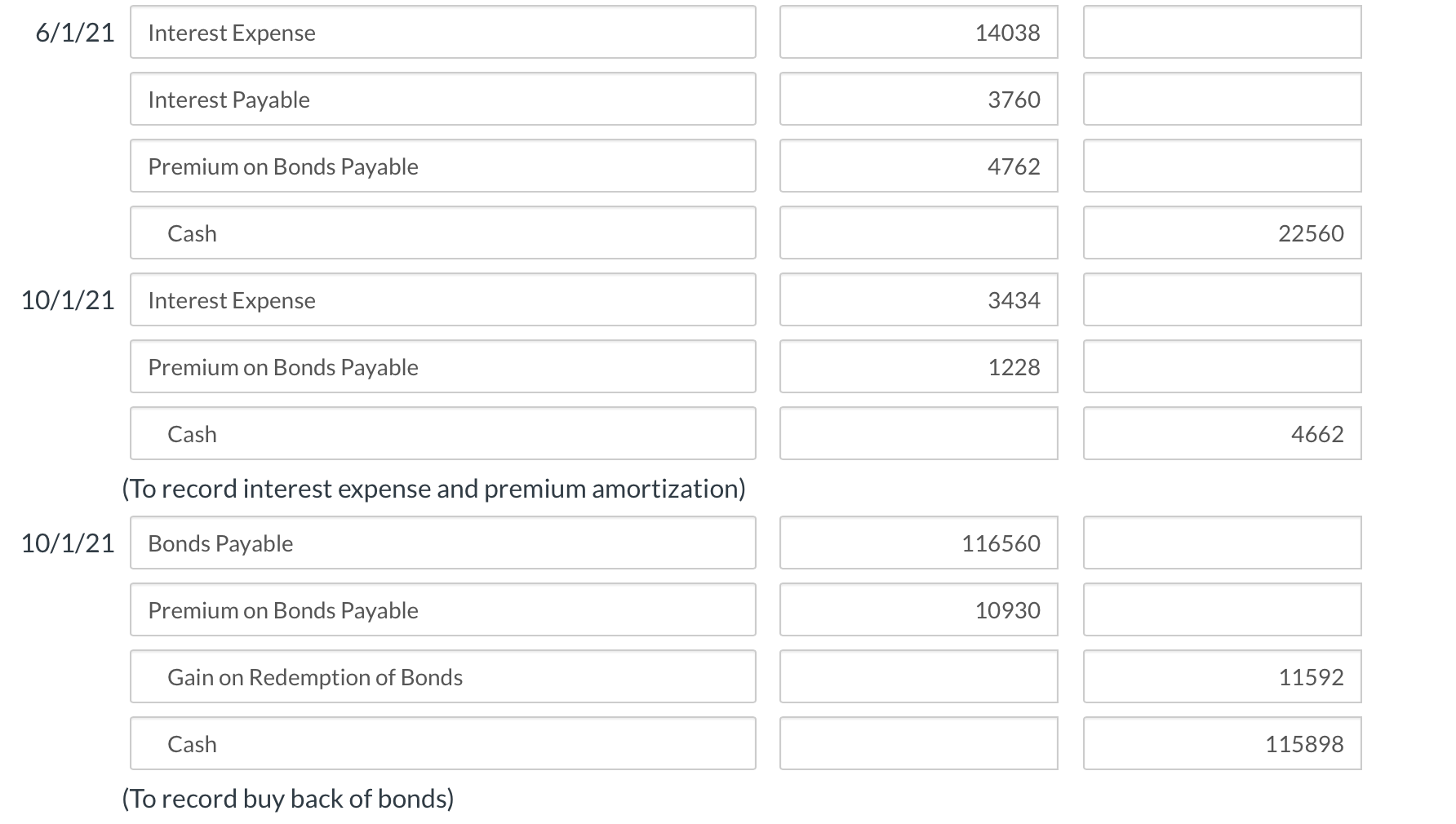

Waterway Co. sells $376,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of

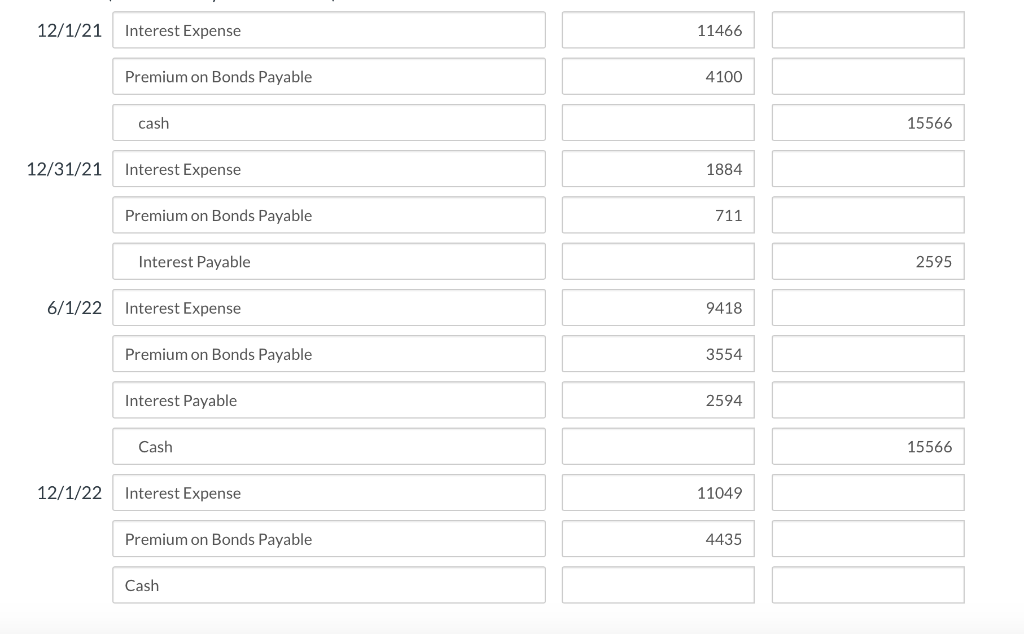

Waterway Co. sells $376,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Waterway buys back $116,560 worth of bonds for $120,560 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started