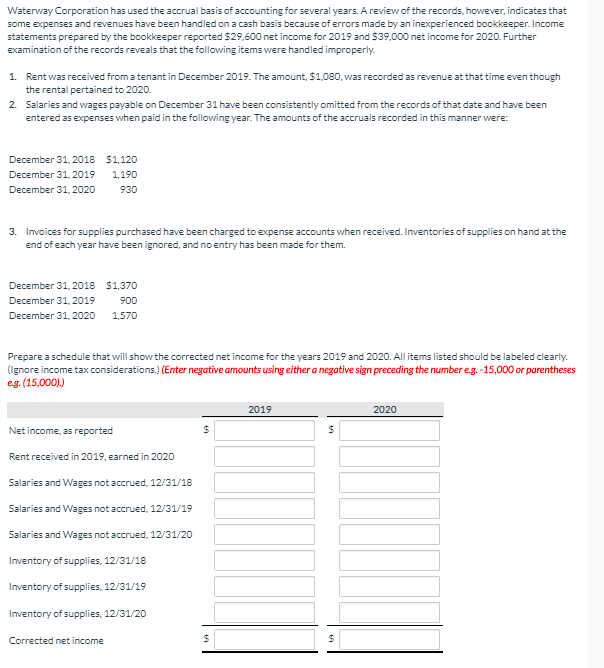

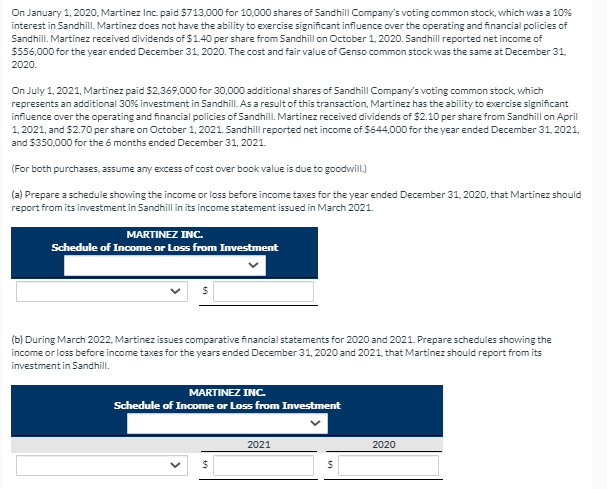

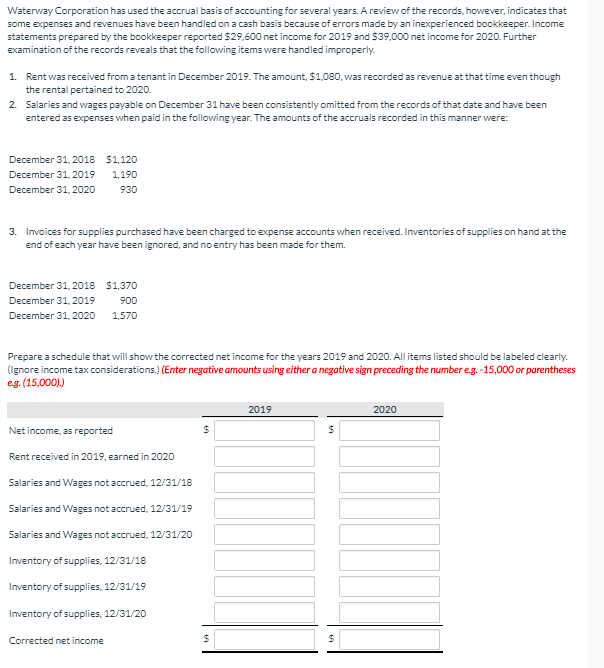

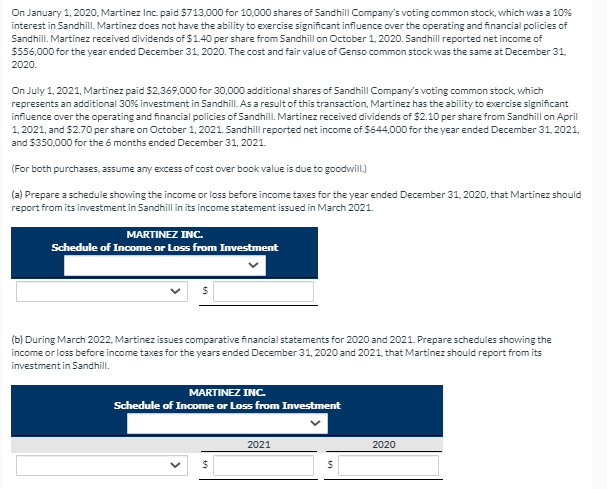

Waterway Corporation has used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced bookkeeper. Income statements prepared by the bookkeeper reported $29.600 net income for 2019 and $39,000 net income for 2020. Further examination of the records reveals that the following items were handled improperly. 1. Rent was received from a tenant in December 2019. The amount, $1,080, was recorded as revenue at that time even though the rental pertained to 2020. 2. Salaries and wages payable on December 31 have been consistently omitted from the records of that date and have been entered as expenses when paid in the following year. The amounts of the accruals recorded in this manner were: December 31, 2018 $1.120 December 31, 2019 1,190 December 31, 2020 930 3. Invoices for supplies purchased have been charged to expense accounts when received. Inventories of supplies on hand at the end of each year have been ignored, and no entry has been made for them. December 31, 2018 $1,370 December 31, 2019 900 December 31, 2020 1,570 Prepare a schedule that will show the corrected net income for the years 2019 and 2020. All items listed should be labeled clearly. (Ignore income tax considerations.) (Enter negative amounts using either a negative sign preceding the number e.g. -15,000 or parentheses eg. (15,000.) 2019 2020 Net income, as reported $ $ Rent received in 2019, earned in 2020 Salaries and Wages not accrued, 12/31/18 Salaries and Wages not accrued, 12/31/19 Salaries and Wages not accrued, 12/31/20 Inventory of supplies, 12/31/18 Inventory of supplies, 12/31/19 Inventory of supplies, 12/31/20 Corrected net income $ $ On January 1, 2020, Martinez Inc. paid $713,000 for 10,000 shares of Sandhill Company's voting common stock, which was a 10% interest in Sandhill. Martinez does not have the ability to exercise significant influence over the operating and financial policies of Sandhill. Martinez received dividends of $1.40 per share from Sandhill on October 1, 2020. Sandhill reported net income of $556,000 for the year ended December 31, 2020. The cost and fair value of Genso common stock was the same at December 31, 2020 On July 1, 2021, Martinez paid $2,369,000 for 30,000 additional shares of Sandhill Company's voting common stock, which represents an additional 30% investment in Sandhill. As a result of this transaction, Martinez has the ability to exercise significant influence over the operating and financial policies of Sandhill. Martinez received dividends of $2.10 per share from Sandhill on April 1,2021, and $2.70 per share on October 1, 2021. Sandhill reported net income of $644,000 for the year ended December 31, 2021, and $350,000 for the 6 months ended December 31, 2021. (For both purchases, assume any excess of cost over book value is due to goodwill.) (a) Prepare a schedule showing the income or loss before income taxes for the year ended December 31, 2020, that Martinez should report from its investment in Sandhill in its income statement issued in March 2021. MARTINEZ INC. Schedule of Income or Loss from Investment (b) During March 2022. Martinez issues comparative financial statements for 2020 and 2021. Prepare schedules showing the income or loss before income taxes for the years ended December 31, 2020 and 2021, that Martinez should report from its investment in Sandhill. MARTINEZ INC. Schedule of Income or Loss from Investment 2021 2020 $ $