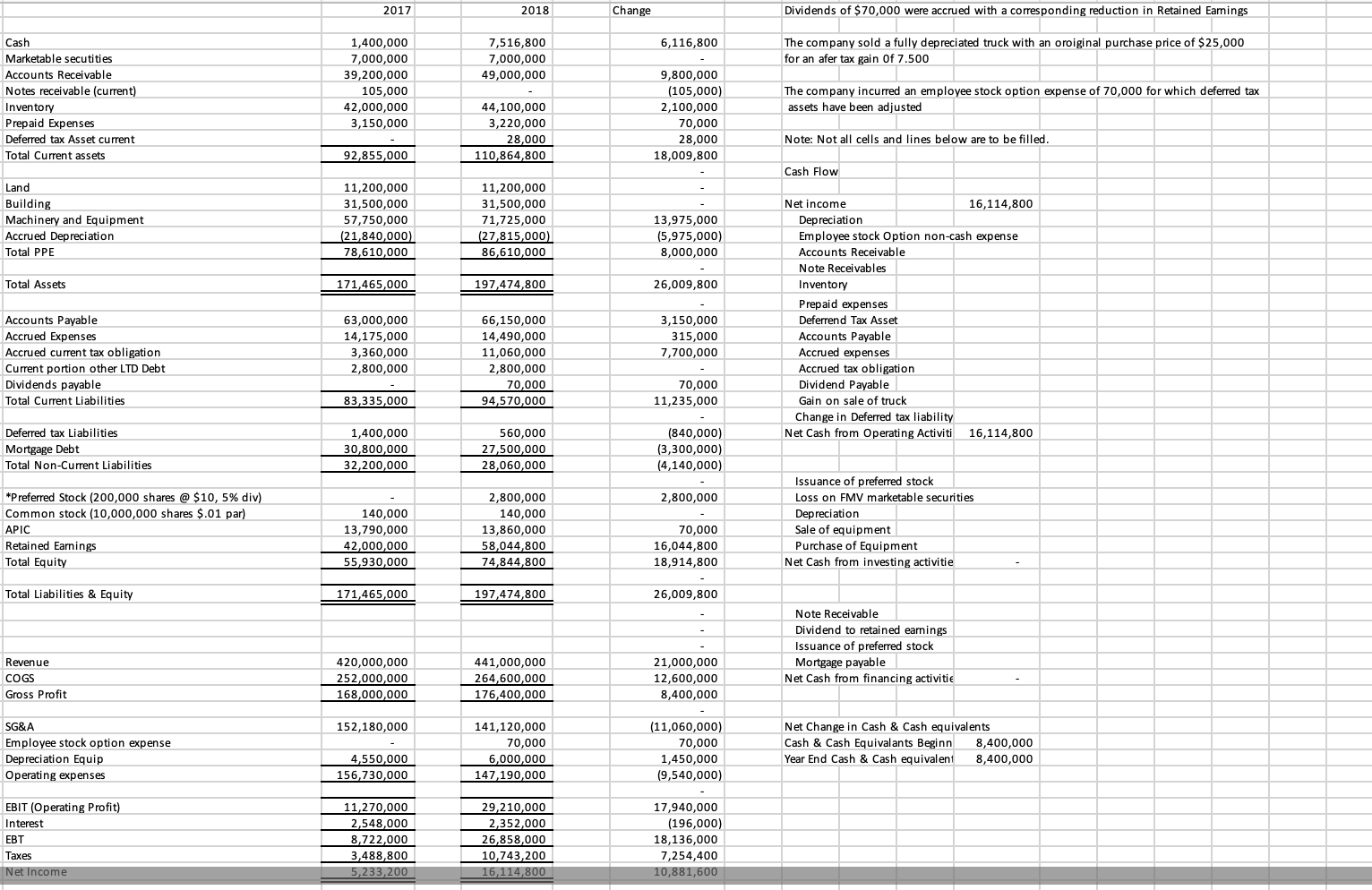

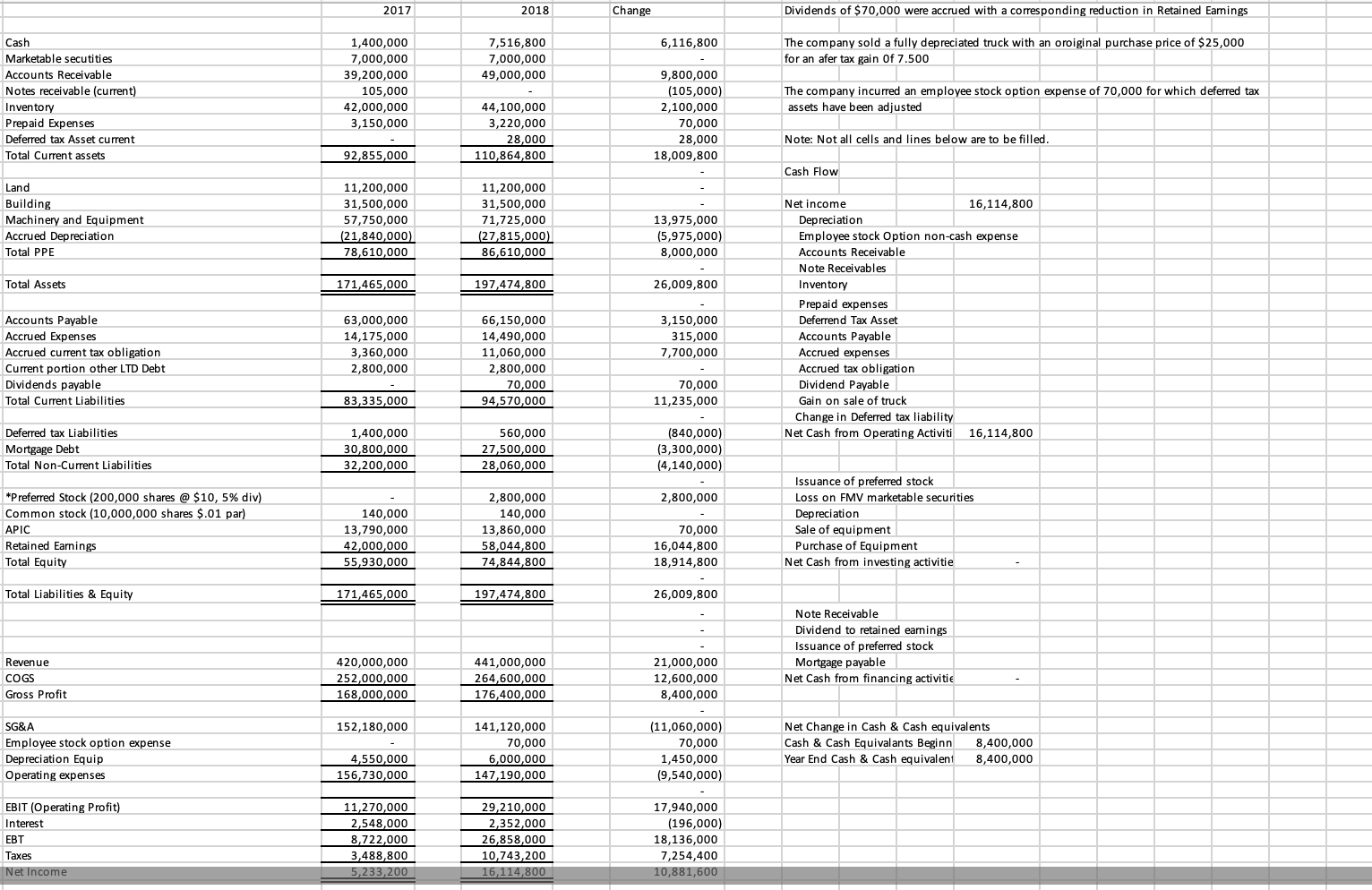

We are given information from the Income statement and Balance Sheet (both given on the left side of the image), we are asked to solve the cash flow statement. Please help me solve the line items for this Cash Flow Statement. We only need values for the Cash flow Statement for the year 2018. The area where I need your help is under the Area titled "Cash Flow" starting with the operating activities, then etc. This is located on the right side of the image. So, based upon the information on the left side of the graphic (Balance sheet and Income statement) Please solve the Cash Flow statement line items, for the year 2018, on the right side of this graphic. Net income is already given. Also, above the cash flow statement, you will see some additional information that will help solve this problem. Also, the after-tax gain on the sale of the truck is $2500 not 7500.

2017 2018 Change Dividends of $70,000 were accrued with a corresponding reduction in Retained Earnings 6,116,800 7,516,800 7,000,000 49,000,000 The company sold a fully depreciated truck with an original purchase price of $25,000 for an afer tax gain Of 7.500 Cash Marketable secutities Accounts Receivable Notes receivable (current) Inventory Prepaid Expenses Deferred tax Asset current Total Current assets 1,400,000 7,000,000 39,200,000 105,000 42,000,000 3,150,000 The company incurred an employee stock option expense of 70,000 for which deferred tax assets have been adjusted 44,100,000 3,220,000 28,000 110,864,800 9,800,000 (105,000) 2,100,000 70,000 28,000 18,009,800 Note: Not all cells and lines below are to be filled. 92,855,000 Cash Flow Land Building Machinery and Equipment Accrued Depreciation Total PPE 11,200,000 31,500,000 57,750,000 (21,840,000) 78,610,000 11,200,000 31,500,000 71,725,000 (27,815,000) 86,610,000 13,975,000 (5,975,000) 8,000,000 Total Assets 171,465,000 197,474,800 26,009,800 Accounts Payable Accrued Expenses Accrued current tax obligation Current portion other LTD Debt Dividends payable Total Current Liabilities 63,000,000 14,175,000 3,360,000 2,800,000 3,150,000 315,000 7,700,000 66,150,000 14,490,000 11,060,000 2,800,000 70,000 94,570,000 Net income 16,114,800 Depreciation Employee stock Option non-cash expense Accounts Receivable Note Receivables Inventory Prepaid expenses Deferrend Tax Asset Accounts Payable Accrued expenses Accrued tax obligation Dividend Payable Gain on sale of truck Change in Deferred tax liability Net Cash from Operating Activiti 16,114,800 70,000 11,235,000 83,335,000 Deferred tax Liabilities Mortgage Debt Total Non-Current Liabilities 1,400,000 30,800,000 32,200,000 560,000 27,500,000 28,060,000 (840,000) (3,300,000) (4,140,000) 2,800,000 *Preferred Stock (200,000 shares @ $10,5% div) Common stock (10,000,000 shares $.01 par) APIC Retained Earnings Total Equity 140,000 13,790,000 42,000,000 55,930,000 2,800,000 140,000 13,860,000 58,044,800 74,844,800 Issuance of preferred stock Loss on FMV marketable securities Depreciation Sale of equipment Purchase of Equipment Net Cash from investing activitie 70,000 16,044,800 18,914,800 Total Liabilities & Equity 171,465,000 197,474,800 26,009,800 Note Receivable Dividend to retained earnings Issuance of preferred stock Mortgage payable Net Cash from financing activitie Revenue COGS Gross Profit 420,000,000 252,000,000 168,000,000 441,000,000 264,600,000 176,400,000 21,000,000 12,600,000 8,400,000 152,180,000 SG&A Employee stock option expense Depreciation Equip Operating expenses 141,120,000 70,000 6,000,000 147,190,000 (11,060,000) 70,000 1,450,000 (9,540,000) Net Change in Cash & Cash equivalents Cash & Cash Equivalants Beginn 8,400,000 Year End Cash & Cash equivalent 8,400,000 4,550,000 156,730,000 EBIT (Operating Profit) Interest EBT Taxes Net Income 11,270,000 2,548,000 8,722,000 3,488,800 5,233,200 29,210,000 2,352,000 26,858,000 10,743,200 16,114,800 17,940,000 (196,000) 18,136,000 7,254,400 10,881,600