Answered step by step

Verified Expert Solution

Question

1 Approved Answer

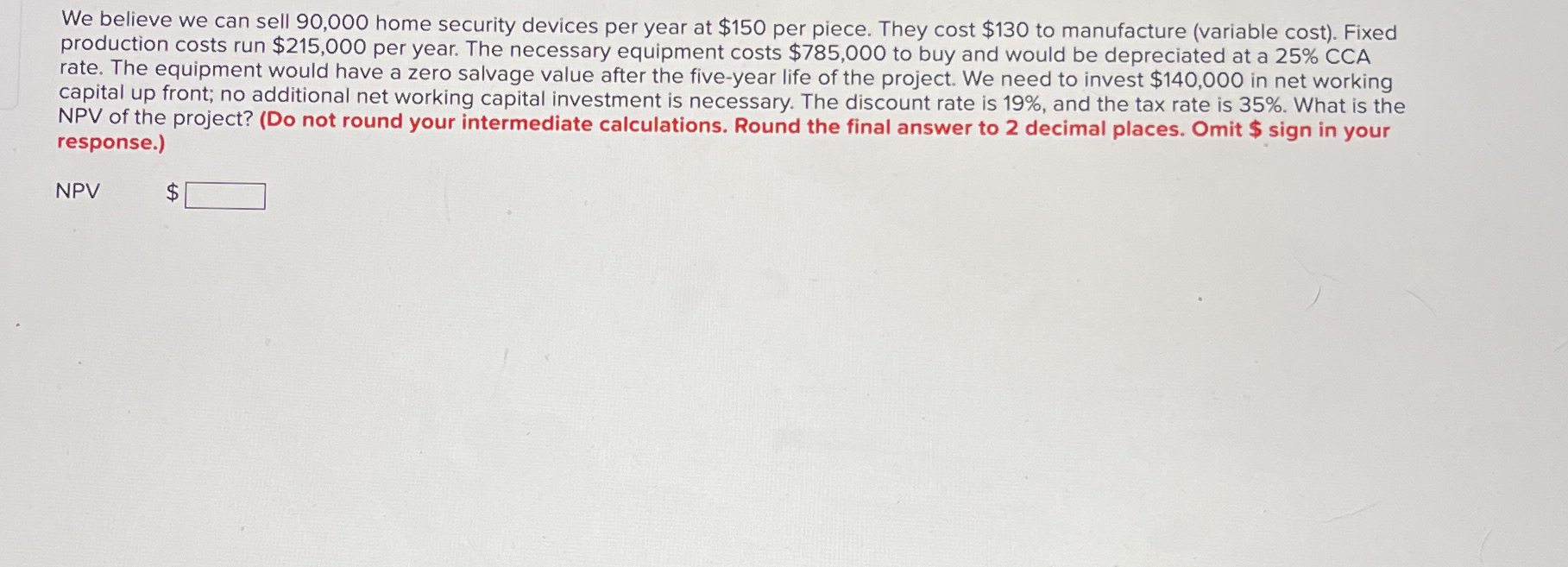

We believe we can sell 9 0 , 0 0 0 home security devices per year at $ 1 5 0 per piece. They cost

We believe we can sell home security devices per year at $ per piece. They cost $ to manufacture variable cost Fixed production costs run $ per year. The necessary equipment costs $ to buy and would be depreciated at a CCA rate. The equipment would have a zero salvage value after the fiveyear life of the project. We need to invest $ in net working capital up front; no additional net working capital investment is necessary. The discount rate is and the tax rate is What is the NPV of the project? Do not round your intermediate calculations. Round the final answer to decimal places. Omit $ sign in your response.

NPV

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started