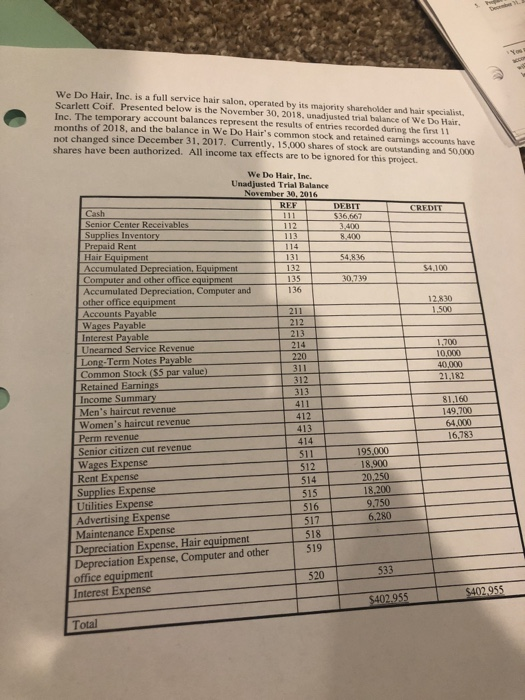

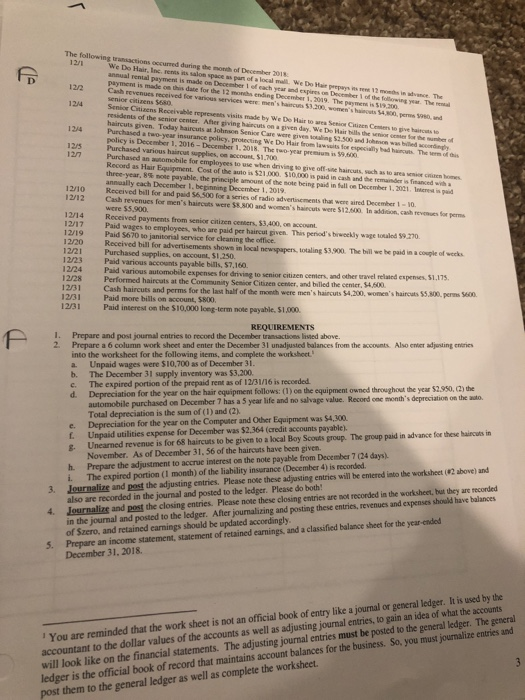

We Do Hair, Inc. is a full service hair salon, operated by its majority shareholder and hair specialist Scarlett Coif. Presented below is the November 30. 2018, unadjusted trial balance of We Do Hair. Inc. The temporary account balances represent the results of entries recorded during the first 11 months of 2018, and the balance in We Do Hair's common stock and retained earnings accounts have not changed since December 31, 2017. Currently, 15,000 shares of stock are outstanding and 50,000 shares have been authorized. All income tax effects are to be ignored for this project. We Do Hair, Inc. Unadjusted Trial Balance November 30. 2016 RF DEBIT 536.66 CREDI Senior Center Receivables Rent 54.836 0,739 Co Accumulated Depreciation, Computer and other office equipment Accounts Payable Wages Payable Interest Payable Unearned Service Revenue 136 12,830 211 1.700 220 311 Retained Earnin Income Summary 313 411 Women's haircut revenue Perm revenue Senior citizen cut revenue 49.700 64,000 16,783 195,000 18,900 20,250 18,200 9.750 6,280 511 Rent Expense 514 515 516 517 518 Depreciation Expense. Hair equipment Depreciation Expense, Computer and other 519 533 520 Total The following transactions occurred during the month of December 2018 12/1 We Do Hair, Inc. renes its salon space as pan of a local mall We Do Hair prepays ins rene 12 mondhs in advance. The annual rental payment is made on December I of each year and expires on December 1 of the follorwing year. The rena paymen is made e date for the i2 mrths endng December 1, 2019 . The paymers is swan. Cash revenues 12/2 received for various services were men's haircuts $3,.200, women's hainouts 54,800, perme 5980, und 1244 Senior Citizens Receivable represeets visits made by We De Hair to area Senion Citieen Cemmers to pive haircuts residents of the senior center. Afher giving haircuts on a given haircuts given. Today haircuts at Johnson Senioe Purchased a two-year insurance policy, protecting We Do Hair from lawsuits for Care were given soaling$2.500 and Johenon was billed ccodingly especially bad hits The term of y is December 1, 2016- December 1. 2018. The two-yer premium is $9,600 Purchased various haircut supplies, on accoust, $1.700 Purchased an automobile for employoes to use when driving so give off-uine haircuts, such as to area senior cRinen Record as Hair Equipment. Cost of the auto is $21,000. S10,000 is paid in cash and the remainder is financed wi three-year, 8%ncee payable, the pr teple a oun of te note being paid in full on December 1, 202. Increas pad annually each December 1, beginning December 1, 2019 12/10 Received bill for and paid 56,500 for a series of radio advertinements thas were aired December 1 10. 12/12 Cash revenues for men's haircuts were $8,800 and women's haircuts were $12.00 In addision, cash revnues for perma 12/14 12/17 Paid wages to employees, who are paid per haircut given. This period's brweekly wage toraled $9.270 12/19 Paid $670 so janitorial service for cleaning the office. 12/20 Received bill for advertisements shown in local newspapers, totaling 53,900. The bill we be paid in a couple of wecks 12/21 12/23 Paid various accounts payable bills, $7,160. 1224 Paid variou 12/28 Performed 12/31 12/31 Paid more bills on account, $800. 12/31 Received payments from senicer citizen centers,53,400,oaccount Purchased supplies, on account 51.250. s automobile haircuts at the Community Senice Citizen center, and billed the center, $4,600 expenses for driving to senior citizen ceniers, and other eravel related expenses, S1,175. Cash haircuts and perms for the last half of the month were men's haircuts $4,200, women's haircuts $5,800 perms 5600. Paid interest on the $10,000 loeg-term note payable, $1,000 REQUIREMENTS 1. Prepare and post journal entries to record the December transactions lised above. 2 Prepare a 6 column work shoet and enter the December 31 unadjusted balances from the accounts Also enter adjosting entries into the worksheet for the following items, and complete the worksheet a. Unpaid wages were $10,700 as of December 31. b. The December 31 supply inventory was $3,200 c. The expired portion of the prepaid rent as of 12/31/16 is recoeded the year on the hair equipment follows: (1) on the equipment owned throughout the year $2950, (2) the automobile purchased on December 7 has a 5 year life and no salvage value. Recond onc month's depreciation on the adto. Total depreciation is the sum of (1) and (2). e. Depreciation for the year on the Computer and Other Equipment was $4,300 . Unpaid utilities expense for December was $2.364 (credit accounts payable). g. Unearned revenue is for 68 haircuts to be given to a local Boy Scouts group. The group paid in advance for these haircuts in h. Prepare the adjustment to accrue interest on the note payable from December 7 (24 days) i. The expired portion (1 month) of the liability insurance (December 4) is recorded Lournalize and post the adjusting entries, please note these adjusting entries will be entered into the worksheet (#2 above) and also are recorded in the journal and posted to the ledger. Please do both November. As of December 31, 56 of the haircuts have been given. 3. in the journal and posted to the ledger. After journalizing and posting these entries, revenues and expenses should have balances of Szero, and retained earnings should be updated accordingly Prepare an income statement, statement of retained earnings, and a classified balance sheet for the year ended 4. Journalize and post the closing entries. Please note these closing entries are not recorded in the worksheet, but they are recorded 5. December 31. 2018. I You are reminded that the work sheet is not an official book of entry like a journal or general ledger. It is used by the accountant to the dollar values of the accounts as well as adjusting journal entries, to gain an idea of what the accounts will look like on the financial statements. The adjusting journal entries must be posted to the general ledger. The general ledger is the official book of record that maintains account balances for the business. So, you must jourmalize entries and post them to the general ledger as well as complete the worksheet GENERAL JOURNAL-WE DO HAIR, INC. DATE ACCOUNT REFDEBIT CREDIT