Answered step by step

Verified Expert Solution

Question

1 Approved Answer

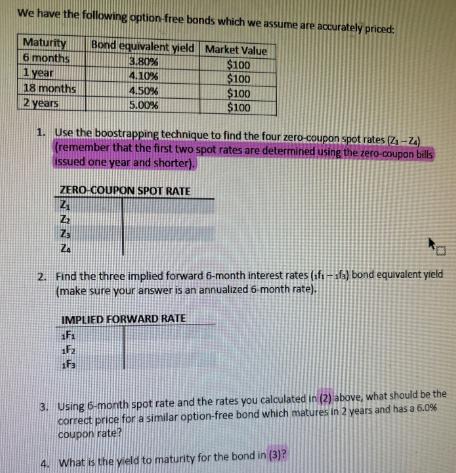

We have the following option-free bonds which we assume are accurately priced: Bond equivalent yield Market Value 3.80% 4.10% Maturity 6 months 1 year

We have the following option-free bonds which we assume are accurately priced: Bond equivalent yield Market Value 3.80% 4.10% Maturity 6 months 1 year 18 months 2 years 4.50% 5.00% Z Z Z Za $100 $100 1. Use the boostrapping technique to find the four zero-coupon spot rates (2-24) (remember that the first two spot rates are determined using the zero-coupon bills issued one year and shorter). ZERO-COUPON SPOT RATE $100 $100 IMPLIED FORWARD RATE 1F 1F 1F3 2. Find the three implied forward 6-month interest rates (ifi-fa) bond equivalent yield (make sure your answer is an annualized 6 month rate). 3. Using 6-month spot rate and the rates you calculated in (2) above, what should be the correct price for a similar option-free bond which matures in 2 years and has a 6.0% coupon rate? 4. What is the yield to maturity for the bond in (3)?

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations Zerocoupon spot rates Z1 380 given 6month rate Z2 1Z122 1 410 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started