Answered step by step

Verified Expert Solution

Question

1 Approved Answer

we have to prpare - A)Income statement prepared using Gross margin format B)Income statement prepared using contribution margin ormat You have been provided the following

we have to prpare - A)Income statement prepared using Gross margin format B)Income statement prepared using contribution margin ormat

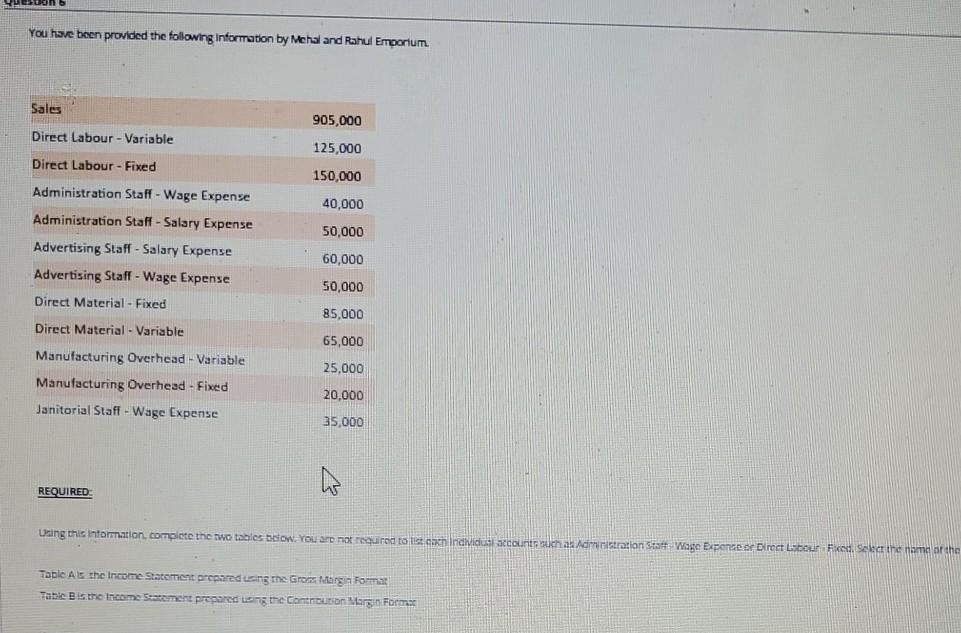

You have been provided the following information by Mchal and Rahul Emporium Sales 905,000 Direct Labour-Variable 125,000 Direct Labour - Fixed 150,000 40,000 Administration Staff - Wage Expense Administration Staff - Salary Expense Advertising Staff - Salary Expense Advertising Staff - Wage Expense 50,000 60,000 50,000 Direct Material - Fixed 85,000 Direct Material - Variable 65,000 Manufacturing Overhead - Variable Manufacturing Overhead - Fixed 25,000 20,000 Janitorial Staff - Wage Expense 35,000 REQUIRED Laing this information complete the two tables below. You are not required to thindviduscounts such as Administration Wage Exporter Direct Labour Fixed. Sekar the name arche Table As the Income Statement prepared using the Gro Morgan Format Table is the income Seatment prepared using the contin Margin FormStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started