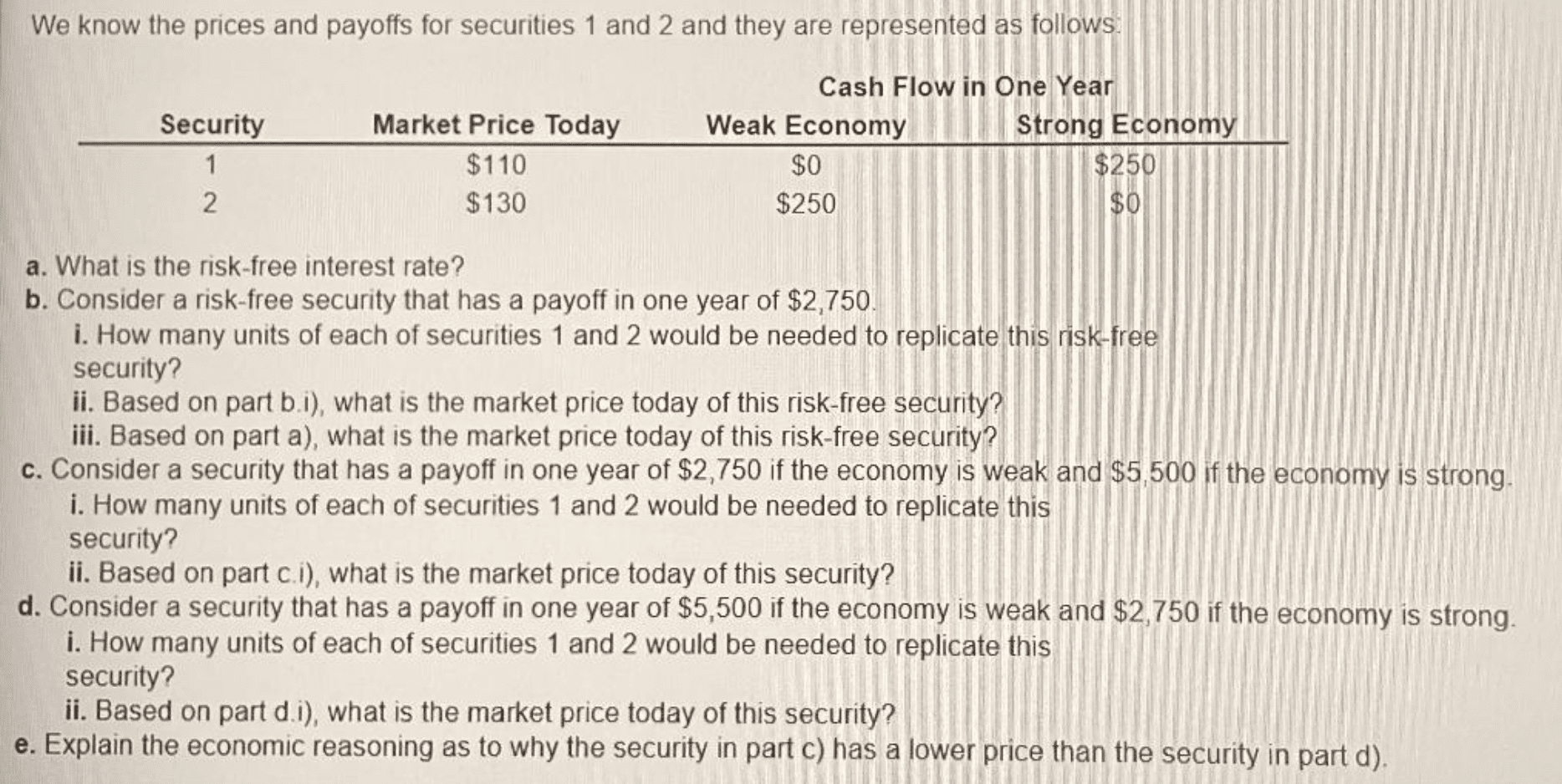

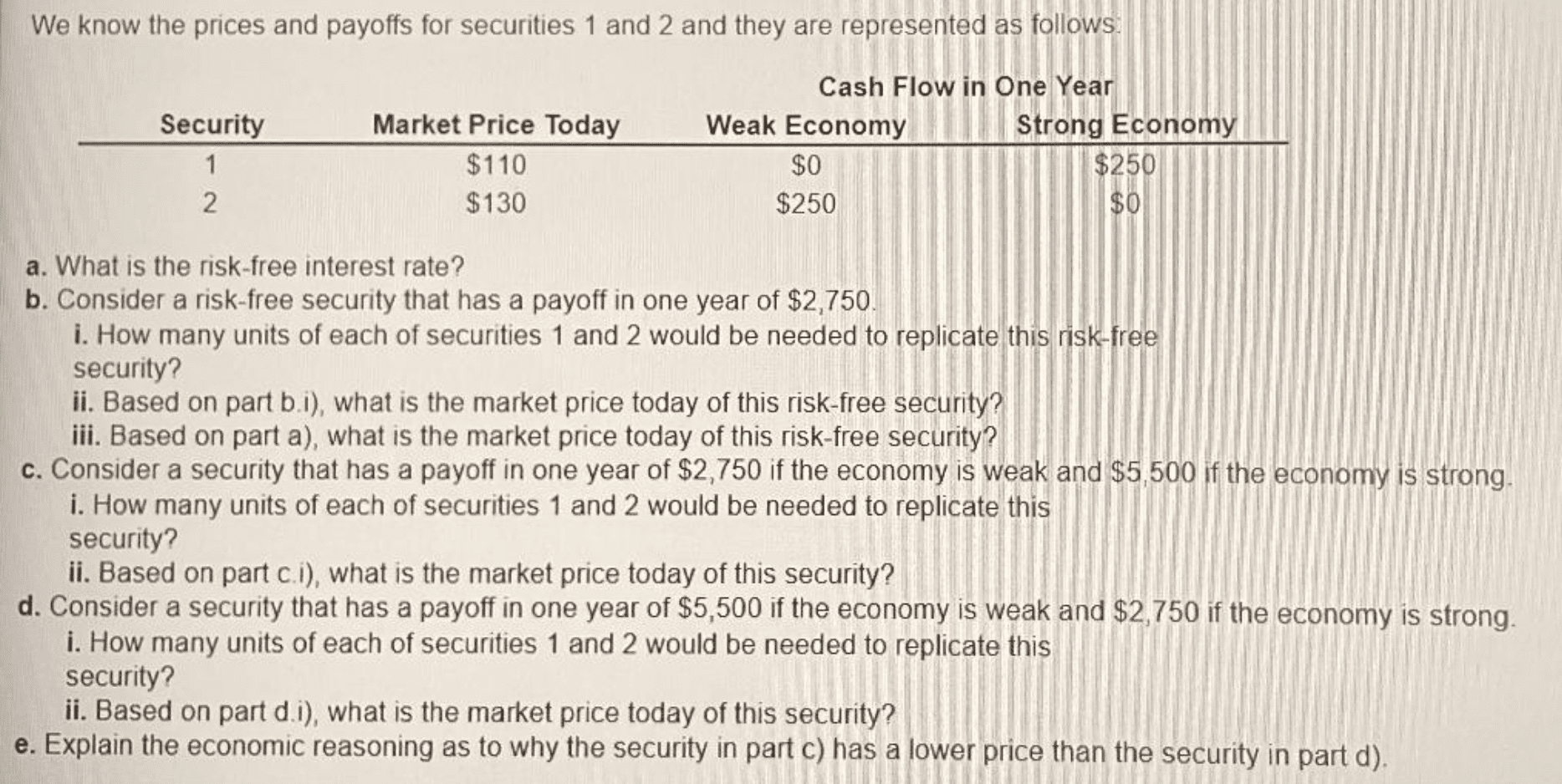

We know the prices and payoffs for securities 1 and 2 and they are represented as follows. Security 1 2 Market Price Today $110 $130 Cash Flow in One Year Weak Economy Strong Economy $0 $250 $250 $0 a. What is the risk-free interest rate? b. Consider a risk-free security that has a payoff in one year of $2,750 i. How many units of each of securities 1 and 2 would be needed to replicate this risk-free security? ii. Based on part bi), what is the market price today of this risk-free security? iii. Based on part a), what is the market price today of this risk-free security? c. Consider a security that has a payoff in one year of $2,750 if the economy is weak and $5,500 if the economy is strong. i. How many units of each of securities 1 and 2 would be needed to replicate this security? ii. Based on part ci), what is the market price today of this security? d. Consider a security that has a payoff in one year of $5,500 if the economy is weak and $2,750 if the economy is strong. i. How many units of each of securities 1 and 2 would be needed to replicate this security ? ii. Based on part di), what is the market price today of this security? e. Explain the economic reasoning as to why the security in part c) has a lower price than the security in part d). We know the prices and payoffs for securities 1 and 2 and they are represented as follows. Security 1 2 Market Price Today $110 $130 Cash Flow in One Year Weak Economy Strong Economy $0 $250 $250 $0 a. What is the risk-free interest rate? b. Consider a risk-free security that has a payoff in one year of $2,750 i. How many units of each of securities 1 and 2 would be needed to replicate this risk-free security? ii. Based on part bi), what is the market price today of this risk-free security? iii. Based on part a), what is the market price today of this risk-free security? c. Consider a security that has a payoff in one year of $2,750 if the economy is weak and $5,500 if the economy is strong. i. How many units of each of securities 1 and 2 would be needed to replicate this security? ii. Based on part ci), what is the market price today of this security? d. Consider a security that has a payoff in one year of $5,500 if the economy is weak and $2,750 if the economy is strong. i. How many units of each of securities 1 and 2 would be needed to replicate this security ? ii. Based on part di), what is the market price today of this security? e. Explain the economic reasoning as to why the security in part c) has a lower price than the security in part d)