Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We now turn to a financial asset called a bond. It is a security issued by a government or a corporation to finance their operations.

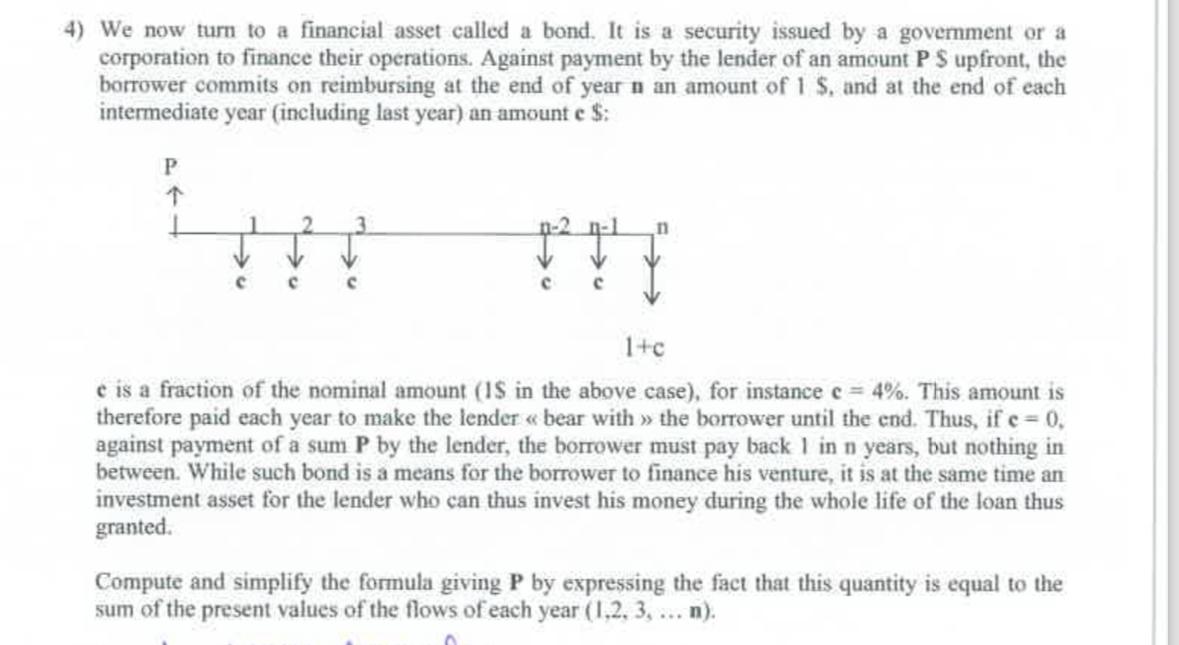

We now turn to a financial asset called a bond. It is a security issued by a government or a corporation to finance their operations. Against payment by the lender of an amount P $ upfront, the borrower commits on reimbursing at the end of year an amount of $ and at the end of each intermediate year including last year an amount $ :

is a fraction of the nominal amount in the above case for instance This amount is therefore paid each year to make the lender bear with the borrower until the end. Thus, if against payment of a sum by the lender, the borrower must pay back I in years, but nothing in between. While such bond is a means for the borrower to finance his venture, it is at the same time an investment asset for the lender who can thus invest his money during the whole life of the loan thus granted.

Compute and simplify the formula giving by expressing the fact that this quantity is equal to the sum of the present values of the flows of each year dotsn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started