Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We were given this worksheet as extra practice, Problem 1 so far I completed on my own. I wanted feedback to see if my work

We were given this worksheet as extra practice, Problem 1 so far I completed on my own. I wanted feedback to see if my work is correct.

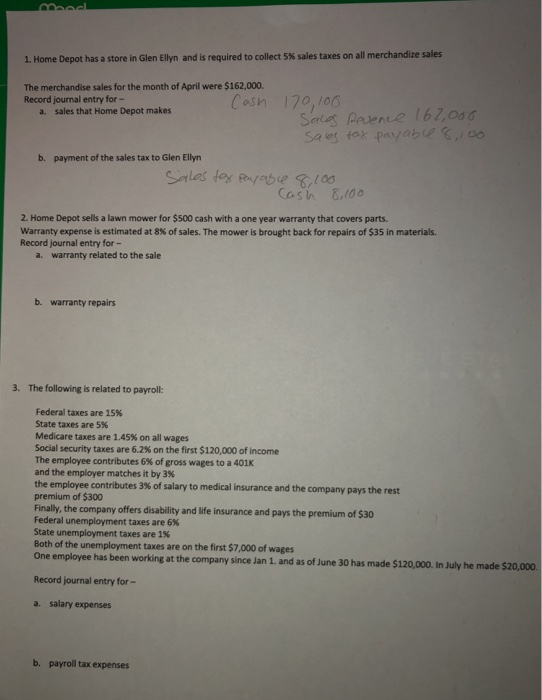

1. Home Depot has a store in Glen Ellyn and is required to collect 5% sales taxes on all merchandize sales The merchandise sales for the month of April were $162,000. Record journal entry for Cosh 170, o0 sales that Home Depot makes a. b. payment of the sales tax to Glen Ellyn Sales loy eyabe s00 Cash 8,10 2. Home Depot sells a lawn mower for $500 cash with a one year warranty that covers parts. Warranty expense is estimated at 8% of sales. The mower is brought back for repairs of $35 in materials. Record journal entry for- warranty related to the sale a. b. warranty repairs 3. The following is related to payroll: Federal taxes are 15% State taxes are 5% Medicare taxes are 1.45% on all wages Social security taxes are 6.2% on the first $120,000 of income The employee contributes 6% of gross wages to a 401K and the employer matches it by 3% the employee contributes 3% of salary to medical insurance and the premium of $300 Finally, the company offers disability and ife insurance and pays the premium of $30 Federal unemployment taxes are 6% State unemployment taxes are 1% Both of the unemployment taxes are on the first $7,000 of wages One employee has been working at the company since Jan 1. and as of June 30 has made $120,000. In July he made $20,000 company pays the rest Record journal entry for- a. salary expenses b. payroll tax expenses problems 2 and 3 have been a challenge for me, I got some answers on another piece of paper but I dont know if I did it correctly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started