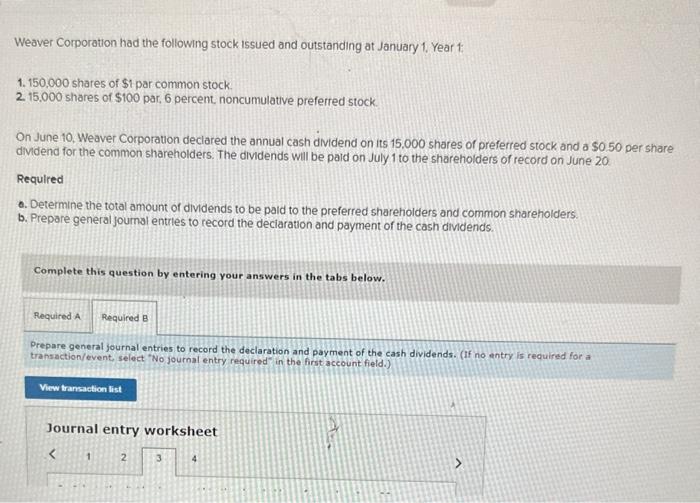

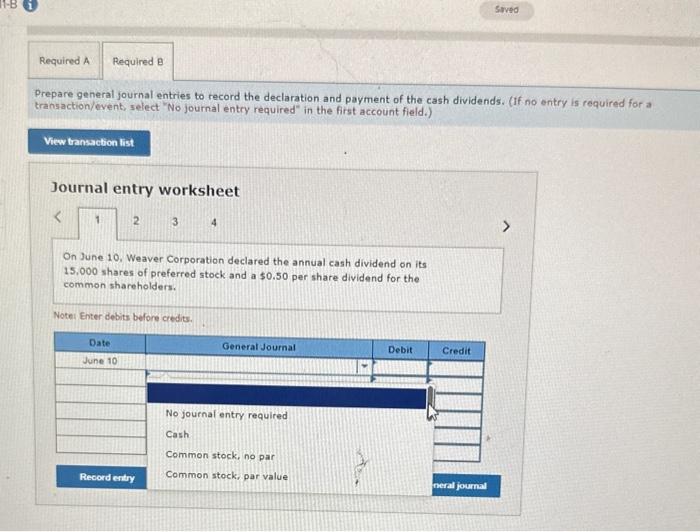

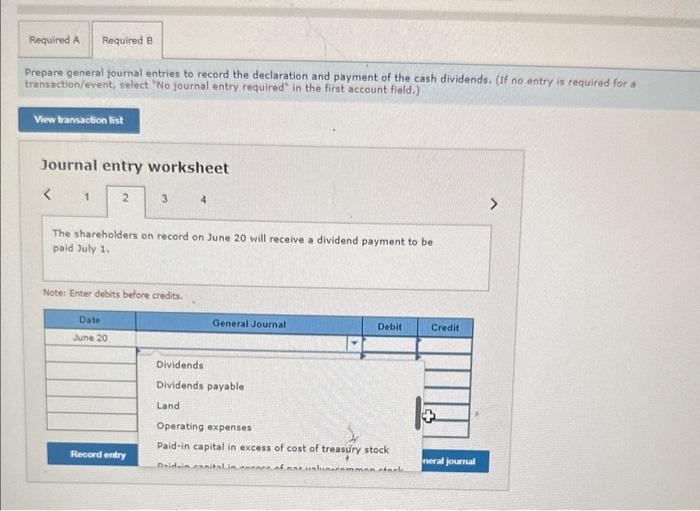

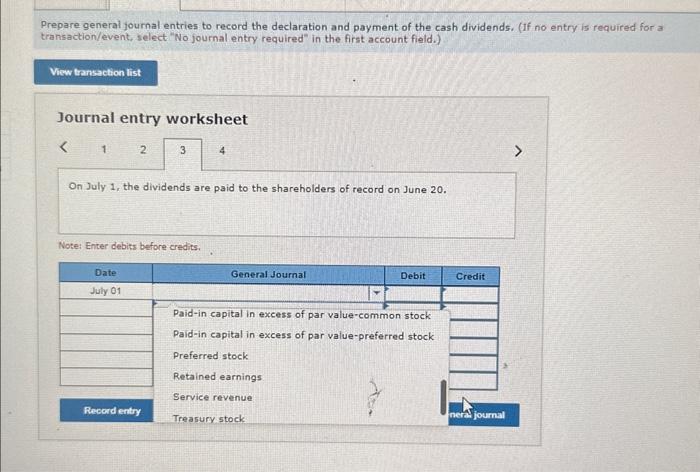

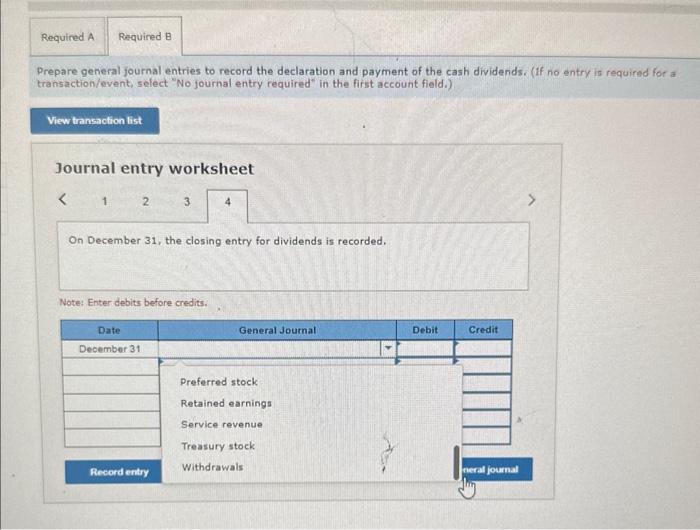

Weaver Corporation had the following stock Issued and outstanding at January 1, Year 1 : 1. 150,000 shares of \$1 par common stock. 2. 15,000 shares of $100 par, 6 percent noncumulative preferred stock. On June 10, Weaver Corporation deciared the annual cash dividend on its 15.000 shares of preferted stock and a $0.50 per share dividend for the common shareholders. The dividends will be paid on July 1 to the shareholders of record on June 20 Requlred 0. Determine the total amount of dividends to be pald to the preferred shareholders and common shareholders. b. Prepare general joumal entrles to record the deciaration and payment of the cash dividends. Complete this question by entering your answers in the tabs below. Prepare general journal entries to record the declaration and payment of the cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Prepare general journal entries to record the declaration and payment of the cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet On June 10. Weaver Corporation declared the annual cash dividend on its 15,000 shares of preferred stock and a $0.50 per share dividend for the common shareholders. Notei Enter debits before credits. Prepare general journal entries to record the declaration and payment of the cash dividends. (if no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) Journal entry worksheet The shareholders on record on June 20 will receive a dividend payment to be paid July 1. Noter Enter debits before credits. Prepare general joumal entries to record the declaration and payment of the cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2 On July 1 , the dividends are paid to the shareholders of record on June 20 . Note: Enter debits before credits. Prepare general journal entries to record the declaration and payment of the cash dividends. (If no entry in required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet