Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Week 2 - Homework Recording Financial Movements & Identifying Assets Name: Submission Deadline: 2 5 Sep 2 0 2 4 While preparing for his new

Week Homework Recording Financial Movements & Identifying Assets Name: Submission Deadline: Sep While preparing for his new business in Geneva, Larry thought he hasn't enough funds to run the activity he wants. He therefore started a small local business as a photographer to make the money he needs. Larry is a former student of the course Fundamentals of Accounting but does not remember how record financial movements. Help him to do so by: Identifying for each transaction if the account impacted is an assets account Recording the below transactions in the right account and under the right account side Preparing the simplified income statement based on the template below Preparing the simplified statement of cash flow based on the template below Preparing the simplified statement of financial position balance sheet based on the template below Period August : To start his business: A Larry brought to his photographer activity his cash savings of CHF B He bought a camera and memory for CHF C He ran a Google Ads campaign to get his first client for a cost of CHF D His first client hired him for a graduation ceremony for a lump sum payment of CHF E To get to the graduation ceremony location, Larry spent CHF for a train ticket and this was the only cost he incurred for this event. Period September : Larry worked so well at the graduation ceremony that several students and parents called him for their events to be their photographer. Larry's agenda showed the following for period : F Semester's launch dinner September single down payment of CHF G Sergio Ramotti's birthday September initial installment of CHF on September and CHF subsequent payment on September H Karin Swifter's ladies party September payment by picture at CHF per picture and a maximum of pictures. Assume that all pictures were done. I. To get to the three events at optimal cost, Larry limited his availability to Geneva and subscribed a monthly TPG package at CHF No other costs were incurred by larry. Period October : As Lary's semester was quickly progressing and his activities started taking him too much time, he decided to stop his photography business. The following transactions were done: J Larry sold his camera and its memory for CHF K Larry didn't renew his TPG subscription Period August Step identify movements and analyze them: Step T Accounts, indicate the name of the account and record the movements: Step Reporting information in financial statements at the end of the period Relevant calculations for income statement reporting: Relevant calculations for statement of cash flow reporting: Relevant calculations for balance sheet reporting: Step identify movements and analyze them: Step T Accounts, indicate the name of the account and record the movements: Step Reporting information in financial statements at the end of the period Relevant calculations for income statement reporting: Relevant calculations for statement of cash flow reporting: Relevant calculations for balance sheet reporting: Period August Step identify movements and analyze them: Step T Accounts, indicate the name of the account and record the movements: Period October Step identify movements and analyze them: Step T Accounts, indicate the name of the account and record the movements: Step Reporting information in financial statements at the end of the period Relevant calculations for income statement reporting: Relevant calculations for statement of cash flow reporting: Relevant calculations for balance sheet reporting: Step Reporting information in financial statements at the end of the period Relevant calculations for income statement reporting: Relevant calculations for statement of cash flow reporting: Relevant calculations for balance sheet reporting:

Week Homework

Recording Financial Movements & Identifying Assets

Name:

Submission Deadline: Sep

While preparing for his new business in Geneva, Larry thought he hasn't enough funds to run the

activity he wants. He therefore started a small local business as a photographer to make the

money he needs. Larry is a former student of the course Fundamentals of Accounting but does

not remember how record financial movements. Help him to do so by:

Identifying for each transaction if the account impacted is an assets account

Recording the below transactions in the right account and under the right account side

Preparing the simplified income statement based on the template below

Preparing the simplified statement of cash flow based on the template below

Preparing the simplified statement of financial position balance sheet based on the

template below

Period August :

To start his business:

A Larry brought to his photographer activity his cash savings of CHF

B He bought a camera and memory for CHF

C He ran a Google Ads campaign to get his first client for a cost of CHF

D His first client hired him for a graduation ceremony for a lump sum payment of CHF

E To get to the graduation ceremony location, Larry spent CHF for a train ticket and this

was the only cost he incurred for this event.

Period September :

Larry worked so well at the graduation ceremony that several students and parents called him for

their events to be their photographer. Larry's agenda showed the following for period :

F Semester's launch dinner September single down payment of CHF

G Sergio Ramotti's birthday September initial installment of CHF on September

and CHF subsequent payment on September

H Karin Swifter's ladies party September payment by picture at CHF per picture

and a maximum of pictures. Assume that all pictures were done.

I. To get to the three events at optimal cost, Larry limited his availability to Geneva and

subscribed a monthly TPG package at CHF No other costs were incurred by larry.

Period October :

As Lary's semester was quickly progressing and his activities started taking him too much time,

he decided to stop his photography business. The following transactions were done:

J Larry sold his camera and its memory for CHF

K Larry didn't renew his TPG subscription

Period August

Step identify movements and analyze them:

Step T Accounts, indicate the name of the account and record the movements:

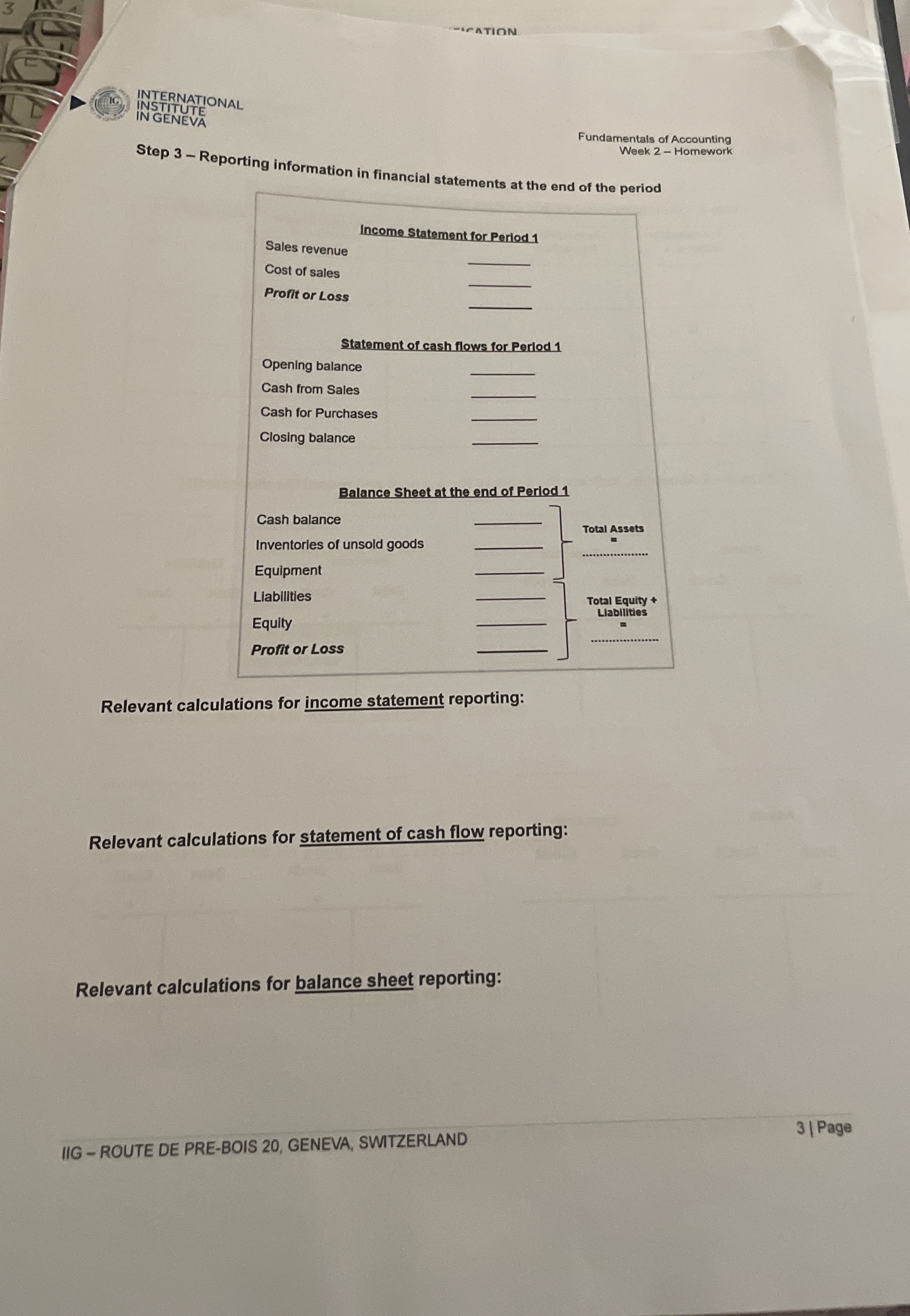

Step Reporting information in financial statements at the end of the period

Relevant calculations for income statement reporting:

Relevant calculations for statement of cash flow reporting:

Relevant calculations for balance sheet reporting:

Step identify movements and analyze them:

Step T Accounts, indicate the name of the account and record the movements:

Step Reporting information in financial statements at the end of the period

Relevant calculations for income statement reporting:

Relevant calculations for statement of cash flow reporting:

Relevant calculations for balance sheet reporting:

Period August

Step identify movements and analyze them:

Step T Accounts, indicate the name of the account and record the movements:

Period October

Step identify movements and analyze them:

Step T Accounts, indicate the name of the account and record the movements:

Step Reporting information in financial statements at the end of the period

Relevant calculations for income statement reporting:

Relevant calculations for statement of cash flow reporting:

Relevant calculations for balance sheet reporting:

Step Reporting information in financial statements at the end of the period

Relevant calculations for income statement reporting:

Relevant calculations for statement of cash flow reporting:

Relevant calculations for balance sheet reporting:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started