Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Week 3 Consider a U.S.-based company that exports goods to Switzerland. The U.S. company expects to receive payment on a shipment of goods in three

Week 3

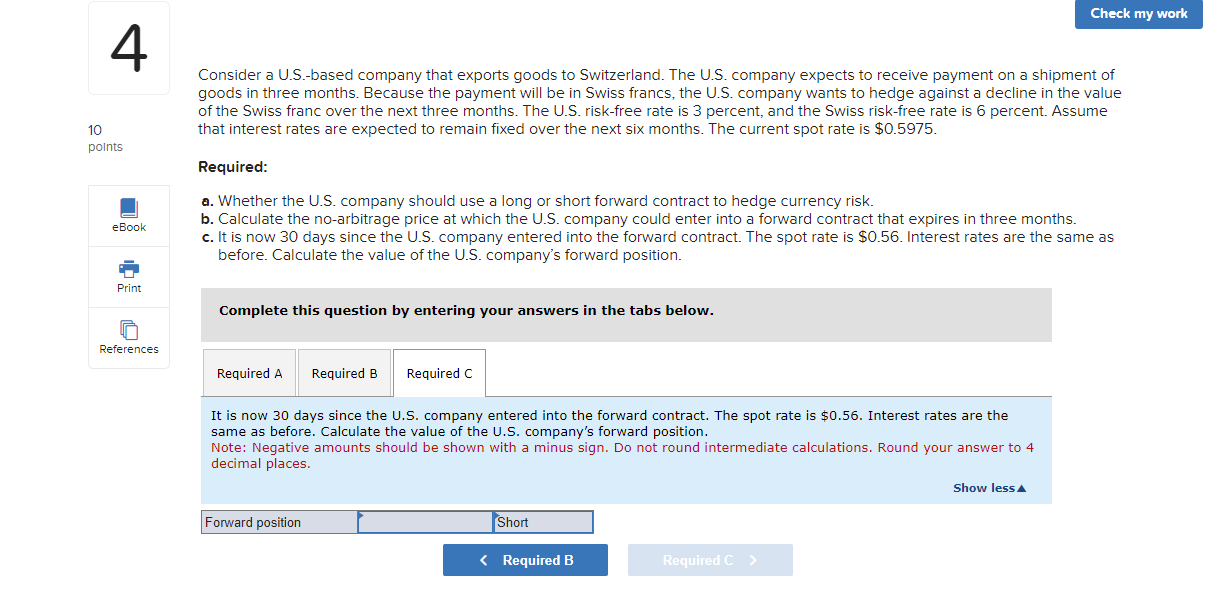

Consider a U.S.-based company that exports goods to Switzerland. The U.S. company expects to receive payment on a shipment of goods in three months. Because the payment will be in Swiss francs, the U.S. company wants to hedge against a decline in the value of the Swiss franc over the next three months. The U.S. risk-free rate is 3 percent, and the Swiss risk-free rate is 6 percent. Assume that interest rates are expected to remain fixed over the next six months. The current spot rate is $0.5975. Required: a. Whether the U.S. company should use a long or short forward contract to hedge currency risk. b. Calculate the no-arbitrage price at which the U.S. company could enter into a forward contract that expires in three months. c. It is now 30 days since the U.S. company entered into the forward contract. The spot rate is $0.56. Interest rates are the same as before. Calculate the value of the U.S. company's forward position. Complete this question by entering your answers in the tabs below. It is now 30 days since the U.S. company entered into the forward contract. The spot rate is $0.56. Interest rates are the same as before. Calculate the value of the U.S. company's forward position. Note: Negative amounts should be shown with a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places

Consider a U.S.-based company that exports goods to Switzerland. The U.S. company expects to receive payment on a shipment of goods in three months. Because the payment will be in Swiss francs, the U.S. company wants to hedge against a decline in the value of the Swiss franc over the next three months. The U.S. risk-free rate is 3 percent, and the Swiss risk-free rate is 6 percent. Assume that interest rates are expected to remain fixed over the next six months. The current spot rate is $0.5975. Required: a. Whether the U.S. company should use a long or short forward contract to hedge currency risk. b. Calculate the no-arbitrage price at which the U.S. company could enter into a forward contract that expires in three months. c. It is now 30 days since the U.S. company entered into the forward contract. The spot rate is $0.56. Interest rates are the same as before. Calculate the value of the U.S. company's forward position. Complete this question by entering your answers in the tabs below. It is now 30 days since the U.S. company entered into the forward contract. The spot rate is $0.56. Interest rates are the same as before. Calculate the value of the U.S. company's forward position. Note: Negative amounts should be shown with a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started