Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Week 4 Lecture Illustrative Example 2 Problem 10.14 LO 5 Cash budget *** Prickly Pear Ltd wishes to prepare a cash budget for the

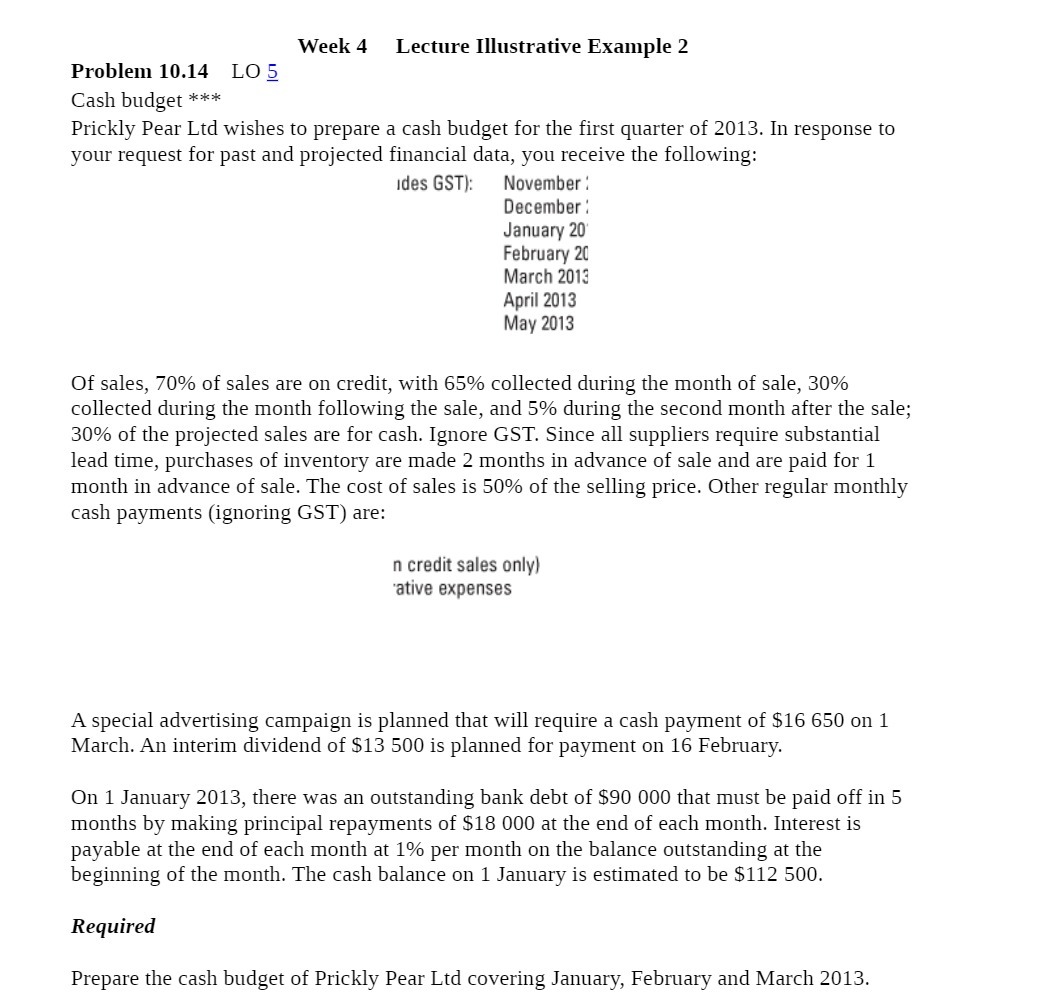

Week 4 Lecture Illustrative Example 2 Problem 10.14 LO 5 Cash budget *** Prickly Pear Ltd wishes to prepare a cash budget for the first quarter of 2013. In response to your request for past and projected financial data, you receive the following: ides GST): November: December January 20 February 20 March 2013 April 2013 May 2013 Of sales, 70% of sales are on credit, with 65% collected during the month of sale, 30% collected during the month following the sale, and 5% during the second month after the sale; 30% of the projected sales are for cash. Ignore GST. Since all suppliers require substantial lead time, purchases of inventory are made 2 months in advance of sale and are paid for 1 month in advance of sale. The cost of sales is 50% of the selling price. Other regular monthly cash payments (ignoring GST) are: In credit sales only) ative expenses A special advertising campaign is planned that will require a cash payment of $16 650 on 1 March. An interim dividend of $13 500 is planned for payment on 16 February. On 1 January 2013, there was an outstanding bank debt of $90 000 that must be paid off in 5 months by making principal repayments of $18 000 at the end of each month. Interest is payable at the end of each month at 1% per month on the balance outstanding at the beginning of the month. The cash balance on 1 January is estimated to be $112 500. Required Prepare the cash budget of Prickly Pear Ltd covering January, February and March 2013.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Prickly Pear Ltd Cash Budget January March 2013 January Inflows Sales 100000 x 30 30000 cash 30000 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started