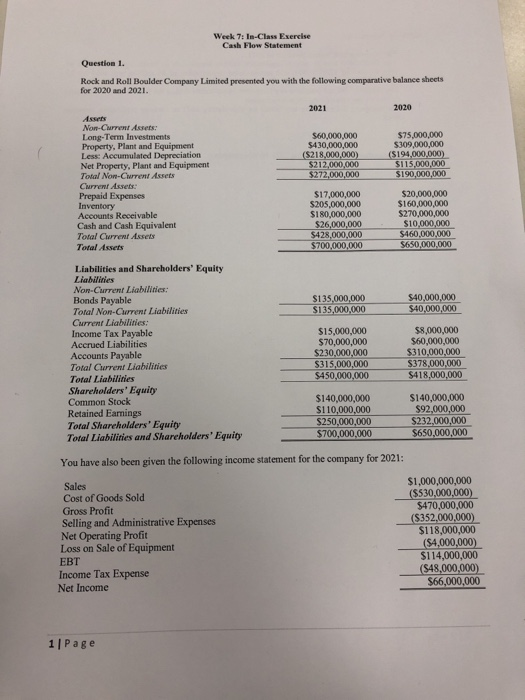

Week 7: In-Class Exercise Cash Flow Statement Question 1. Rock and Roll Boulder Company Limited presented you with the following comparative balance sheets for 2020 and 2021. 2021 2020 $60,000,000 $430,000.000 (S218,000,000) $212,000,000 $272,000,000 $75,000,000 S309,000,000 (S194,000,000) $115,000,000 $190,000,000 Assets Nor-Cher Assets Long-Term Investments Property, Plant and Equipment Less: Accumulated Depreciation Net Property, Plant and Equipment Total Non- C em Assets Current Assets Prepaid Expenses Inventory Accounts Receivable Cash and Cash Equivalent Total Current Assets Total Assets $17,000,000 S205,000,000 S180.000.000 $26,000,000 S428.000.000 $700,000,000 $20.000.000 $160,000,000 $270,000,000 $10,000,000 $460.000.000 $650,000,000 $135,000,000 S135,000,000 $40,000,000 $40,000,000 Liabilities and Shareholders' Equity Liabilities Nor-Current Liabilities: Bonds Payable Total Non-Current Liabilities Current Liabilities: Income Tax Payable Accrued Liabilities Accounts Payable Total Current Liabilities Total Liabilities Shareholders' Equity Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $15,000,000 $70,000,000 $230,000,000 $315,000,000 $450,000,000 $8,000,000 $60,000,000 $310,000,000 $378.000.000 $418,000,000 $140,000,000 $110,000,000 $250,000,000 $700,000,000 $140,000,000 $92,000,000 $232,000,000 $650,000,000 You have also been given the following income statement for the company for 2021: Sales Cost of Goods Sold Gross Profit Selling and Administrative Expenses Net Operating Profit Loss on Sale of Equipment EBT Income Tax Expense Net Income $1,000,000,000 ($530,000,000) $470,000,000 ($352,000,000) $118,000,000 ($4,000,000) S114,000,000 ($48,000,000 $66,000,000 1 Page Additional Information 1. The company paid a cash dividend in 2011. 2. The $4,000,000 loss on sale of equipment reflects transaction in which equipment with an original cost of $12,000,000, and accumulated depreciation of $5 million was sold for $3 million in cash 3. The company did not purchase any long-term investments during the year. There was no gain or loss on the sale of long-term investments. 4. The company did not retire any bonds payable during 2021 or issue or repurchase common stock Required: Construct a statement of cash flows for 2021 for the company. 21 Page