Answered step by step

Verified Expert Solution

Question

1 Approved Answer

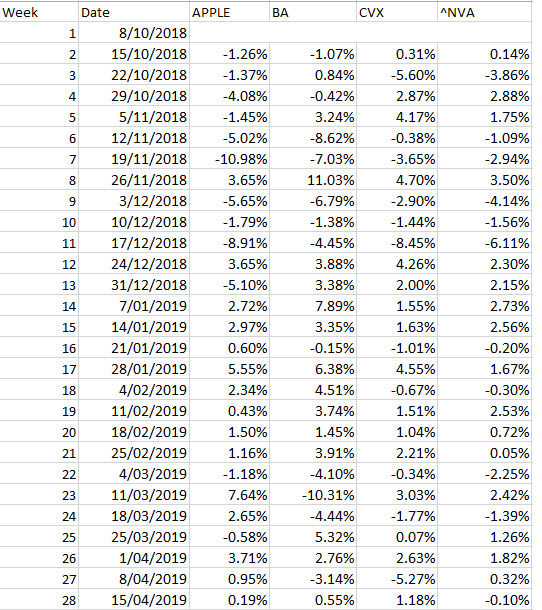

Weekly Discrete rate of returns: Estimate the Security Characteristic Line (SCL) for each of your stocks and the equal weighted portfolio, based on the Market

Weekly Discrete rate of returns:

Estimate the Security Characteristic Line (SCL) for each of your stocks and the equal weighted portfolio, based on the Market Model, using excess returns (discrete returns less the risk free rate), using Excel regression analysis functions. Show your results graphically. From your results, compute the Beta and the Jensens Alpha of each stock and the portfolio.

APPLE ANVA 8/10/2018 15/10/2018-1.26% -1.07% 0.31% 0.14% 2 3 2 22/10/2018-1.37% -3.86% 3 29/10/2018-4.08% -0.42% 2.88% 5/11/2018-1.45% 3.24% 1.75% -8.62% -0.38% 6 12/11/2018 5.02% -3.65% -2.94% 19/11/2018-10.98% 7 8 26/11/2018 3.65% 11.03% 3/12/2018 5.65% 4.14% 10/12/2018-1.79% -1.38% -1.44% 10 -1.56% 4.45% -8.45% 17/12/2018-8.91% -6.11% 11 12 24/12/2018 3.65% 3.88% 4.26% 13 31/12/2018 3.38% 7/01/2019 7.89% 2.73% 15 14/01/2019 3.35% 1.63% -0.15% 16 21/01/2019 17 28/01/2019 6.38% 4/02/2019 2.34% 4.51% 0.43% 19 11/02/2019 1.51% 20 18/02/2019 0.72% 1.45% 2125/02/2019 3.91% 0.05% 4/03/2019-1.18% -0.34% -2.25% 23 11/03/2019 -10.31% 24 18/03/2019 -1.77% -4.44% -1.39% 25/03/2019-0.58% 2 3 3 5.32% 25 1/04/2019 2.75% 2 8/04/2019 0.95% 0.32% 28 15/04/2019 1.18% APPLE ANVA 8/10/2018 15/10/2018-1.26% -1.07% 0.31% 0.14% 2 3 2 22/10/2018-1.37% -3.86% 3 29/10/2018-4.08% -0.42% 2.88% 5/11/2018-1.45% 3.24% 1.75% -8.62% -0.38% 6 12/11/2018 5.02% -3.65% -2.94% 19/11/2018-10.98% 7 8 26/11/2018 3.65% 11.03% 3/12/2018 5.65% 4.14% 10/12/2018-1.79% -1.38% -1.44% 10 -1.56% 4.45% -8.45% 17/12/2018-8.91% -6.11% 11 12 24/12/2018 3.65% 3.88% 4.26% 13 31/12/2018 3.38% 7/01/2019 7.89% 2.73% 15 14/01/2019 3.35% 1.63% -0.15% 16 21/01/2019 17 28/01/2019 6.38% 4/02/2019 2.34% 4.51% 0.43% 19 11/02/2019 1.51% 20 18/02/2019 0.72% 1.45% 2125/02/2019 3.91% 0.05% 4/03/2019-1.18% -0.34% -2.25% 23 11/03/2019 -10.31% 24 18/03/2019 -1.77% -4.44% -1.39% 25/03/2019-0.58% 2 3 3 5.32% 25 1/04/2019 2.75% 2 8/04/2019 0.95% 0.32% 28 15/04/2019 1.18%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started