Question

Weldon Corporations fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2024: March 17Accounts receivable of $3,400

Weldon Corporations fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2024:

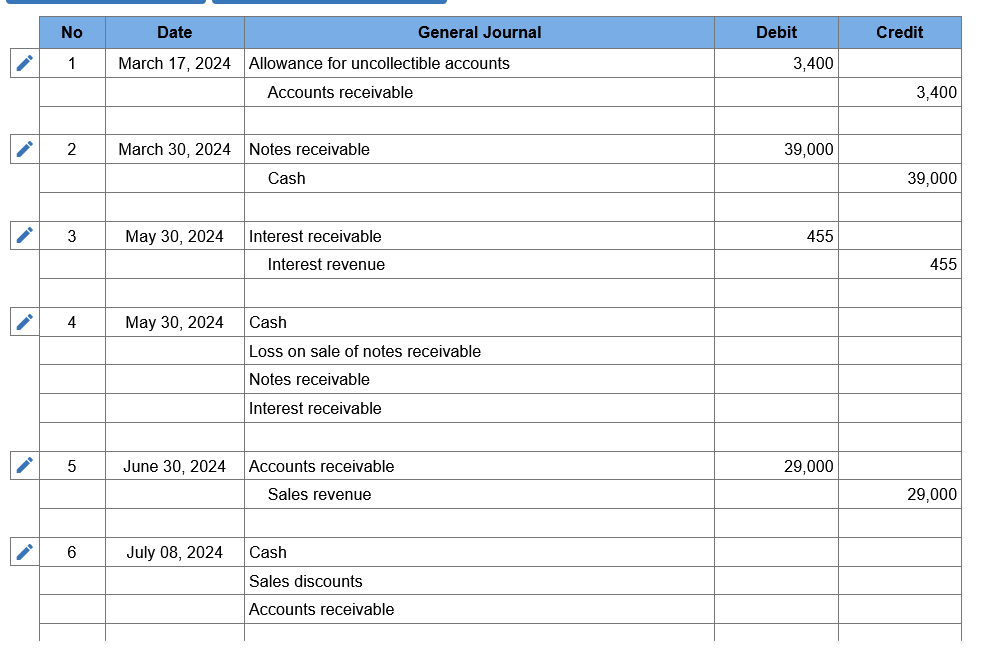

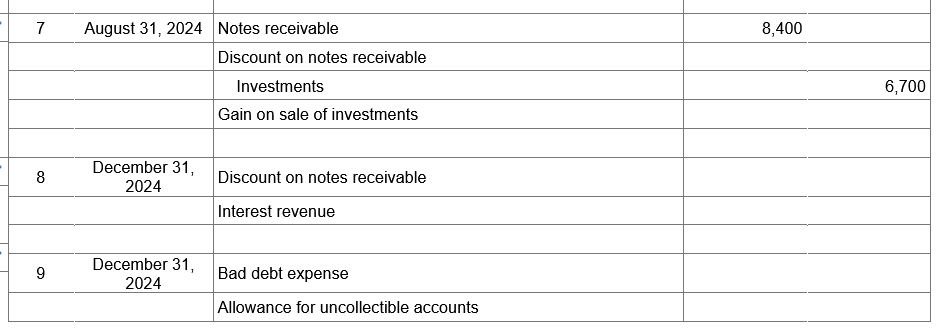

March 17Accounts receivable of $3,400 were written off as uncollectible. The company uses the allowance method.March 30Loaned an officer of the company $39,000 and received a note requiring principal and interest at 7% to be paid on March 30, 2025.May 30Discounted the $39,000 note at a local bank. The banks discount rate is 8%. The note was discounted without recourse and the sale criteria are met.June 30Sold merchandise to the Blankenship Company for $29,000. Terms of the sale are 210/, n30/

. Weldon uses the gross method to account for cash discounts. July 8The Blankenship Company paid its account in full.August 31Sold stock in a nonpublic company with a book value of $6,700 and accepted a $8,400 noninterest-bearing note with a discount rate of 8%. The $8,400 payment is due on February 28, 2025. The stock has no ready market value.December 31Weldon estimates that the allowance for uncollectible accounts should have a balance in it at year-end equal to 3% of the gross accounts receivable balance of $960,000. The allowance had a balance of $29,000 at the start of 2024.Required:

1 & 2. Prepare journal entries for each of the above transactions and additional year-end adjusting entries indicated.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to nearest whole dollar.

Weldon Corporations fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2024:

March 17Accounts receivable of $3,400 were written off as uncollectible. The company uses the allowance method.March 30Loaned an officer of the company $39,000 and received a note requiring principal and interest at 7% to be paid on March 30, 2025.May 30Discounted the $39,000 note at a local bank. The banks discount rate is 8%. The note was discounted without recourse and the sale criteria are met.June 30Sold merchandise to the Blankenship Company for $29,000. Terms of the sale are 210/, n30/

. Weldon uses the gross method to account for cash discounts. July 8The Blankenship Company paid its account in full.August 31Sold stock in a nonpublic company with a book value of $6,700 and accepted a $8,400 noninterest-bearing note with a discount rate of 8%. The $8,400 payment is due on February 28, 2025. The stock has no ready market value.December 31Weldon estimates that the allowance for uncollectible accounts should have a balance in it at year-end equal to 3% of the gross accounts receivable balance of $960,000. The allowance had a balance of $29,000 at the start of 2024.Required:

1 & 2. Prepare journal entries for each of the above transactions and additional year-end adjusting entries indicated.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started