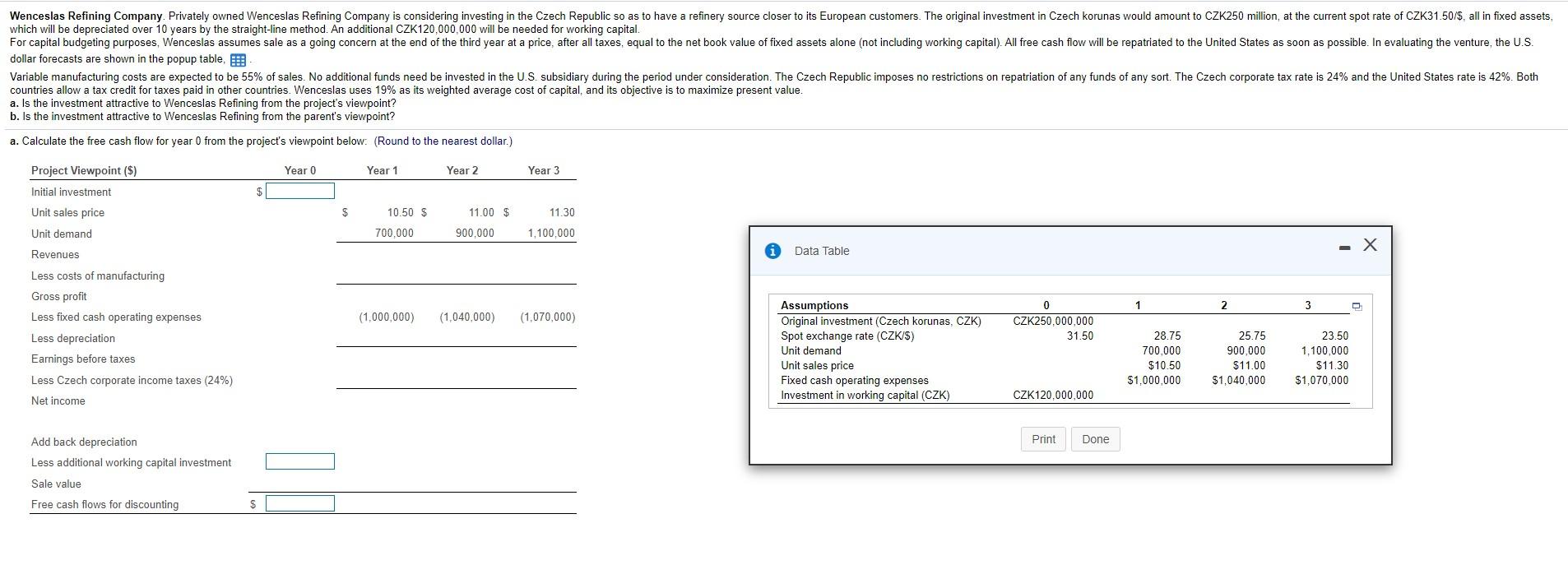

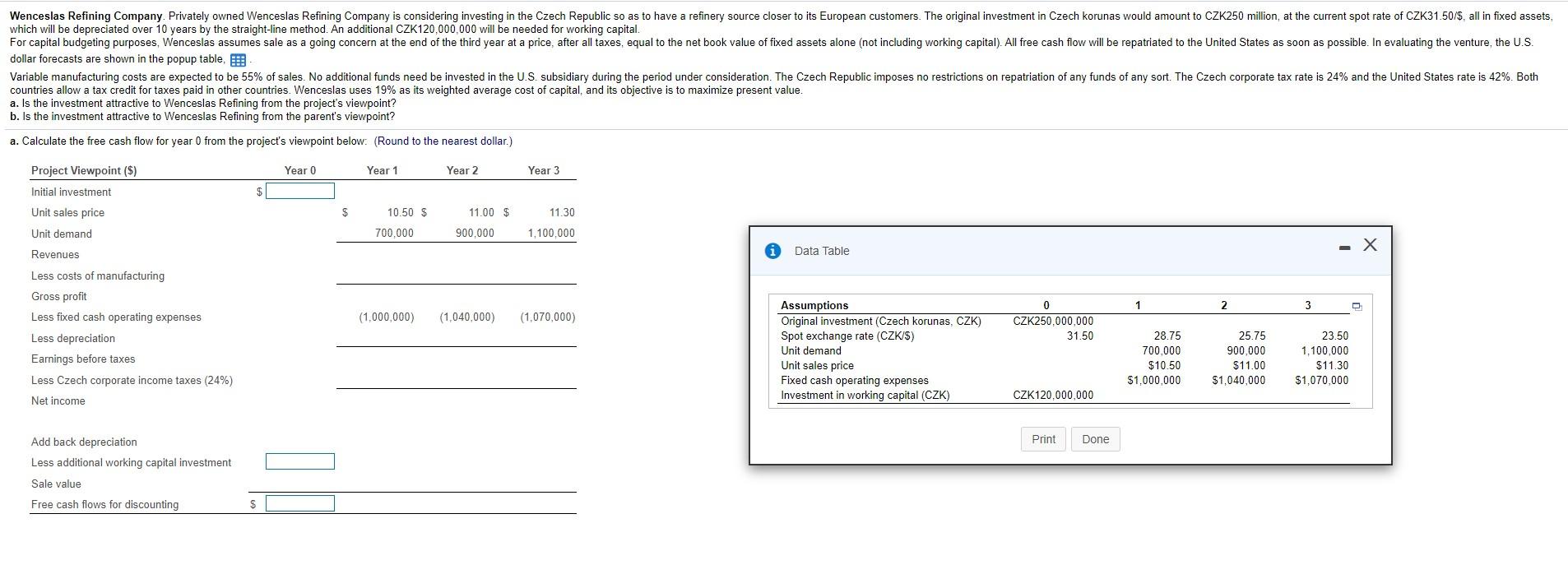

Wenceslas Refining Company. Privately owned Wenceslas Refining Company is considering investing in the Czech Republic so as to have a refinery source closer to its European customers. The original investment in Czech korunas would amount to CZK250 million, at the current spot rate of CZK31.50/$, all in fixed assets, which will be depreciated over 10 years by the straight-line method. An additional CZK120,000,000 will be needed for working capital. For capital budgeting purposes, Wenceslas assumes sale as a going concern at the end of the third year at a price, after all taxes, equal to the net book value of fixed assets alone (not including working capital). All free cash flow will be repatriated to the United States as soon as possible. In evaluating the venture, the U.S. dollar forecasts are shown in the popup table, Variable manufacturing costs are expected to be 55% of sales. No additional funds need be invested in the U.S. subsidiary during the period under consideration. The Czech Republic imposes no restrictions on repatriation of any funds of any sort. The Czech corporate tax rate is 24% and the United States rate is 42%. Both countries allow a tax credit for taxes paid in other countries. Wenceslas uses 19% as its weighted average cost of capital, and its objective is to maximize present value. a. Is the investment attractive to Wenceslas Refining from the project's viewpoint? b. Is the investment attractive to Wenceslas Refining from the parent's viewpoint? a. Calculate the free cash flow for year from the project's viewpoint below. (Round to the nearest dollar.) Year 0 Year 1 Year 2 Year 3 Project Viewpoint ($) Initial investment Unit sales price Unit demand $ 10.50 $ 11.00 $ 11.30 700,000 900.000 1,100,000 - X Revenues Data Table 1 2 3 O (1,000,000) (1,040,000) (1,070,000) Less costs of manufacturing Gross profit Less fixed cash operating expenses Less depreciation Earnings before taxes Less Czech corporate income taxes (24%) Net income 0 CZK250,000,000 31.50 23.50 Assumptions Original investment (Czech korunas, CZK) Spot exchange rate (CZK/S) Unit demand Unit sales price Fixed cash operating expenses Investment in working capital (CZK) 28.75 700.000 $10.50 $1,000,000 25.75 900,000 $11.00 $1,040,000 1,100,000 $11.30 $1,070,000 CZK120,000,000 Print Done Add back depreciation Less additional working capital investment Sale value Free cash flows for discounting $