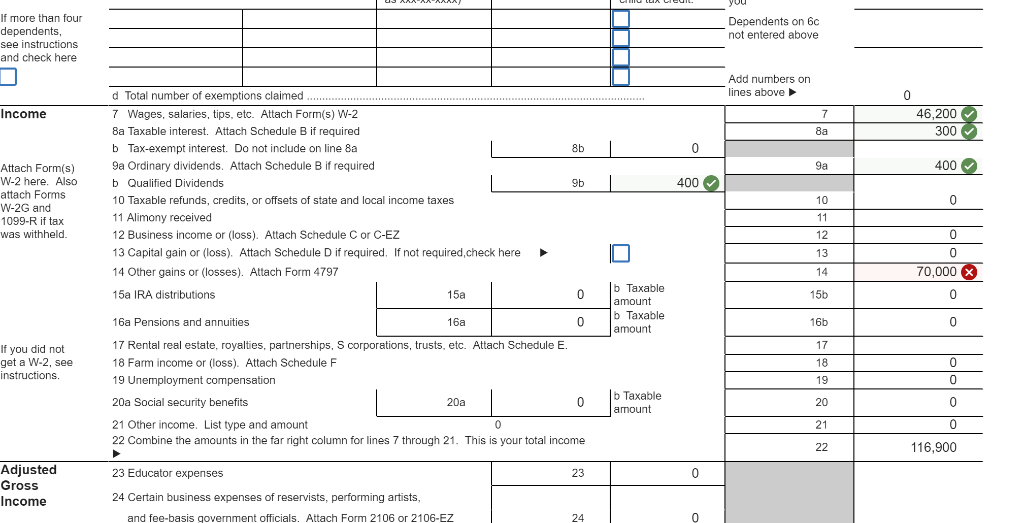

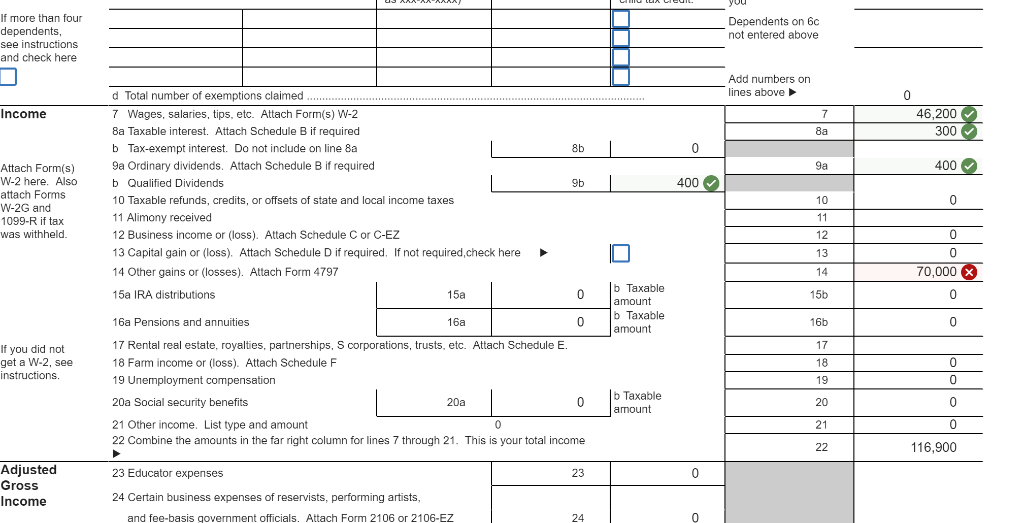

Wendy ONeil (SSN 412-34-5670), who is single, worked full-time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 85711. For the year, she had the following reported on her W-2:

| |

| Wages | $ | 46,200 |

| Federal withholding | | 6,930 |

| Social security wages | | 46,200 |

| Social security withholding | | 2,864 |

| Medicare withholding | | 670 |

| State withholding | | 2,310 |

| |

Other information follows:

| |

| 1099-INT New Bank | $ | 300 |

| 1099-DIV Freeze, Inc. Ordinary dividends | | 400 |

| Qualified dividends | | 400 |

| |

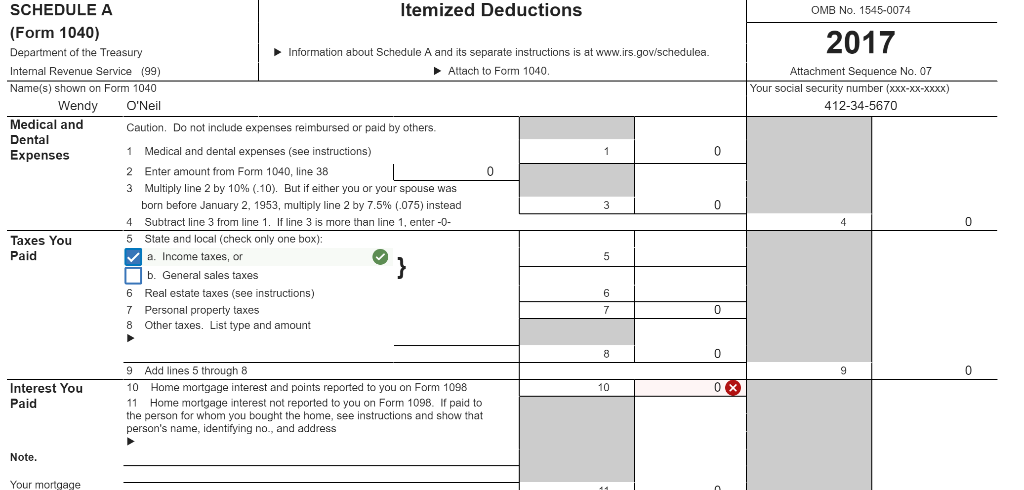

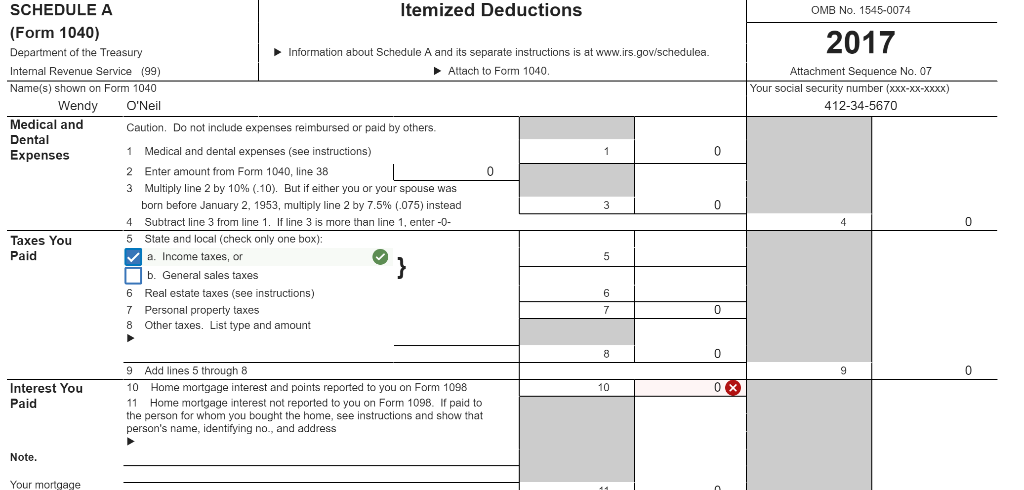

Wendy had the following itemized deductions:

| |

| State income tax withholding | $ | 2,310 |

| State income tax paid with the 2016 return | | 100 |

| Real estate tax | | 2,600 |

| Mortgage interest | | 8,060 |

| |

Wendy inherited a beach house in North Carolina (rental only) on January 2, 2017, from her father. The FMV at the fathers death was $850,000. He had purchased the house 20 years earlier for $100,000.

| |

| Summer rental income | | $ | 45,000 |

| Repairs | | | 2,500 |

| Real estate taxes | | | 6,500 |

| Utilities | | | 2,400 |

| Depreciation | (Calculate - ignore land value) |

| |

On December 29, 2017, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, AZ. She received rental property with an FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2018.

Prepare Form 1040 for Wendy for 2017. The taxpayer had qualifying health care coverage at all times during the tax year. You will also need Schedule A, Schedule B, Schedule E, Form 4562, and Form 8824.

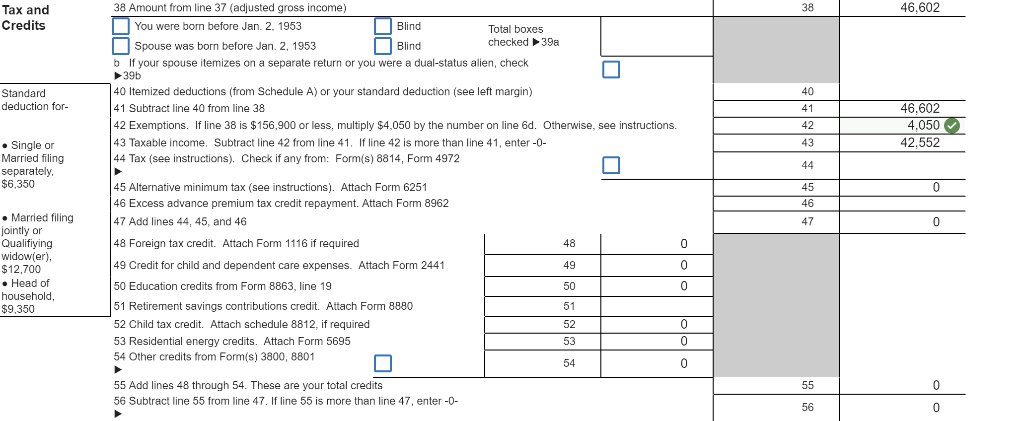

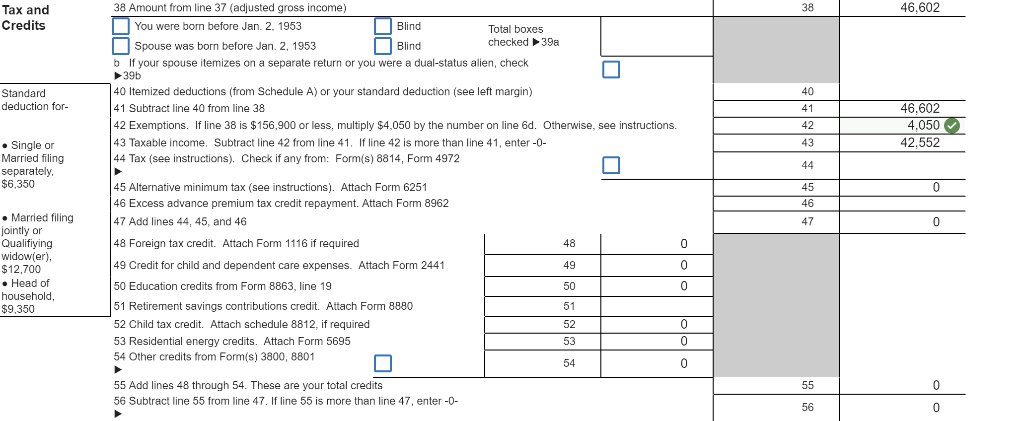

four Dependents on 6c not entered above danendents see instructions and check here Add numbers on lines above Total number of exemptions claimed 46,200 Income 7 Wages, salaries, tips, etc. Attach Form(s) W-2 7 300 8a Taxable interest. Attach Schedule B if required 8a 0 b Tax-exempt interest. Do not include on line 8a 8h 9a Ordinary dividends. Attach Schedule B if required 400 9a Attach Form(s) W-2 here. Also 400 b Qualified Dividends Gh attach Forms 10 Taxable refunds, credits, or offsets of state and local income taxes 10 11 Alimony received 1 1099-R if tax 0 was withheld. 12 Business income or (loss). Attach Schedule C or C-EZ 12 (loss) Attach Schedule D if required. If not required,check here 13 Capital gain 13 70,000 x 14 Other gains or (losses). Attach Form 4797 b Taxable amount C 15a IRA distributions 15a 15b b Taxable 16a Pensions and annuities 16a 16b amount 17 Rental real estate, royalties, partnerships, corporations, trusts, etc. Attach Schedule E 17 you did not get a W-2, see instructions. 0 18 Farm income or (loss). Attach Schedule F 18 19 Unemployment compensation 0 19 b Taxable 20a Social security benefits 20a 20 amount 21 Other income. List type and amount 0 21 22 Combine the amounts the far right column for lines 7 through 21. This is your total income 116,900 22 Adjusted 0 23 Educator expenses 23 Gross 24 Certain business expenses of reservists, performing artists, Income 0 and fee-basis government officials, Attach Form 2106 2106-EZ 24 46,602 38 Amount from line 37 (adjusted gross income) 38 Tax and Credits You were born before Jan. 2, 1953 Blind Total boxes checked 39a Spouse was born before Jan. 2, 1953 Blind b If your spouse itemizes on a separate return or you were a dual-status alien, check 39b 40 40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) Standard deduction for- 46,602 41 Subtract line 40 from line 38 4* 4,050 42 Exemptions. If line 38 is $156,900 or less, multiply $4,050 by the number on line 6d. Ottherwise, see instructions. 42 42.552 43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0 Single c Married filing separately $6.350 43 44 Tax (see instructions). Check if any from: Form(s) 8814, Form 4972 44 45 Alternative minimum tax (see instructions). Attach Form 6251 46 Excess advance premium tax credit repayment. Attach Form 8962 47 Add lines 44, 45, and 46 C 45 46 Married filing jointly or 47 0 48 Foreign tax credit. Attach Form 1116 if required Qualifiying ). $12.700 Head of 48 0 49 Credit for child and dependent care expenses. Attach Form 2441 0 4C 0 50 Education credits from Form 8863, line 19 50 household. 51 Retirement savings contributions credit. Attach Form 8880 51 $9.350 52 Child tax credit. Attach schedule 8812, if required 0 52 C 53 Residential energy credits. Attach Form 5695 54 Other credits from Form(s) 3800, 8801 53 0 54 55 Add lines 48 through 54. These are your total credits 55 ubtract line 55 from line 47. If line 55 is more than line 47, enter -0- 5e 0 56 lele Itemized Deductions SCHEDULE A OMB No. 1545-0074 (Form 1040) 2017 Information about Schedule A and its separate instructions Department of the Treasury at www.irs.gov/schedulea. Intemal Revenue Service (99) Attach to Form 1040. Attachment Sequence No. 07 Name(s) shown on Form 1040 Your social security number (xxx-xx-xXxxx) 412-34-5670 Wendy O'Neil Medical and Caution. Do not include expenses reimbursed or paid by others. Dental Medical and dental expenses (see instructions) 1 1 Expenses Enter amount from Form 1040, line 38 0 2 Multiply line 2 by 10 % ( .10). But if either you or your spouse was 3 0 born before January 2, 1953, multiply line 2 by 7.5% (075 ) instead 3 0 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- 4 Taxes You State and local (check only one box) 5 Paid a. Income taxes, or b. General sales taxes 6 Real estate taxes (see instructions) Personal property taxes 0 7 7 8 Other taxes. List type and amount 8 0 Add lines 5 through 8 0 9 9 0x Interest You Paid 10 Home mortqage interest and points reported 10 you on Form 1098 Home mortgage ierest o instouctions and show the person's name, identifying no., and address Note Your mortgage four Dependents on 6c not entered above danendents see instructions and check here Add numbers on lines above Total number of exemptions claimed 46,200 Income 7 Wages, salaries, tips, etc. Attach Form(s) W-2 7 300 8a Taxable interest. Attach Schedule B if required 8a 0 b Tax-exempt interest. Do not include on line 8a 8h 9a Ordinary dividends. Attach Schedule B if required 400 9a Attach Form(s) W-2 here. Also 400 b Qualified Dividends Gh attach Forms 10 Taxable refunds, credits, or offsets of state and local income taxes 10 11 Alimony received 1 1099-R if tax 0 was withheld. 12 Business income or (loss). Attach Schedule C or C-EZ 12 (loss) Attach Schedule D if required. If not required,check here 13 Capital gain 13 70,000 x 14 Other gains or (losses). Attach Form 4797 b Taxable amount C 15a IRA distributions 15a 15b b Taxable 16a Pensions and annuities 16a 16b amount 17 Rental real estate, royalties, partnerships, corporations, trusts, etc. Attach Schedule E 17 you did not get a W-2, see instructions. 0 18 Farm income or (loss). Attach Schedule F 18 19 Unemployment compensation 0 19 b Taxable 20a Social security benefits 20a 20 amount 21 Other income. List type and amount 0 21 22 Combine the amounts the far right column for lines 7 through 21. This is your total income 116,900 22 Adjusted 0 23 Educator expenses 23 Gross 24 Certain business expenses of reservists, performing artists, Income 0 and fee-basis government officials, Attach Form 2106 2106-EZ 24 46,602 38 Amount from line 37 (adjusted gross income) 38 Tax and Credits You were born before Jan. 2, 1953 Blind Total boxes checked 39a Spouse was born before Jan. 2, 1953 Blind b If your spouse itemizes on a separate return or you were a dual-status alien, check 39b 40 40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) Standard deduction for- 46,602 41 Subtract line 40 from line 38 4* 4,050 42 Exemptions. If line 38 is $156,900 or less, multiply $4,050 by the number on line 6d. Ottherwise, see instructions. 42 42.552 43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0 Single c Married filing separately $6.350 43 44 Tax (see instructions). Check if any from: Form(s) 8814, Form 4972 44 45 Alternative minimum tax (see instructions). Attach Form 6251 46 Excess advance premium tax credit repayment. Attach Form 8962 47 Add lines 44, 45, and 46 C 45 46 Married filing jointly or 47 0 48 Foreign tax credit. Attach Form 1116 if required Qualifiying ). $12.700 Head of 48 0 49 Credit for child and dependent care expenses. Attach Form 2441 0 4C 0 50 Education credits from Form 8863, line 19 50 household. 51 Retirement savings contributions credit. Attach Form 8880 51 $9.350 52 Child tax credit. Attach schedule 8812, if required 0 52 C 53 Residential energy credits. Attach Form 5695 54 Other credits from Form(s) 3800, 8801 53 0 54 55 Add lines 48 through 54. These are your total credits 55 ubtract line 55 from line 47. If line 55 is more than line 47, enter -0- 5e 0 56 lele Itemized Deductions SCHEDULE A OMB No. 1545-0074 (Form 1040) 2017 Information about Schedule A and its separate instructions Department of the Treasury at www.irs.gov/schedulea. Intemal Revenue Service (99) Attach to Form 1040. Attachment Sequence No. 07 Name(s) shown on Form 1040 Your social security number (xxx-xx-xXxxx) 412-34-5670 Wendy O'Neil Medical and Caution. Do not include expenses reimbursed or paid by others. Dental Medical and dental expenses (see instructions) 1 1 Expenses Enter amount from Form 1040, line 38 0 2 Multiply line 2 by 10 % ( .10). But if either you or your spouse was 3 0 born before January 2, 1953, multiply line 2 by 7.5% (075 ) instead 3 0 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- 4 Taxes You State and local (check only one box) 5 Paid a. Income taxes, or b. General sales taxes 6 Real estate taxes (see instructions) Personal property taxes 0 7 7 8 Other taxes. List type and amount 8 0 Add lines 5 through 8 0 9 9 0x Interest You Paid 10 Home mortqage interest and points reported 10 you on Form 1098 Home mortgage ierest o instouctions and show the person's name, identifying no., and address Note Your mortgage