Answered step by step

Verified Expert Solution

Question

1 Approved Answer

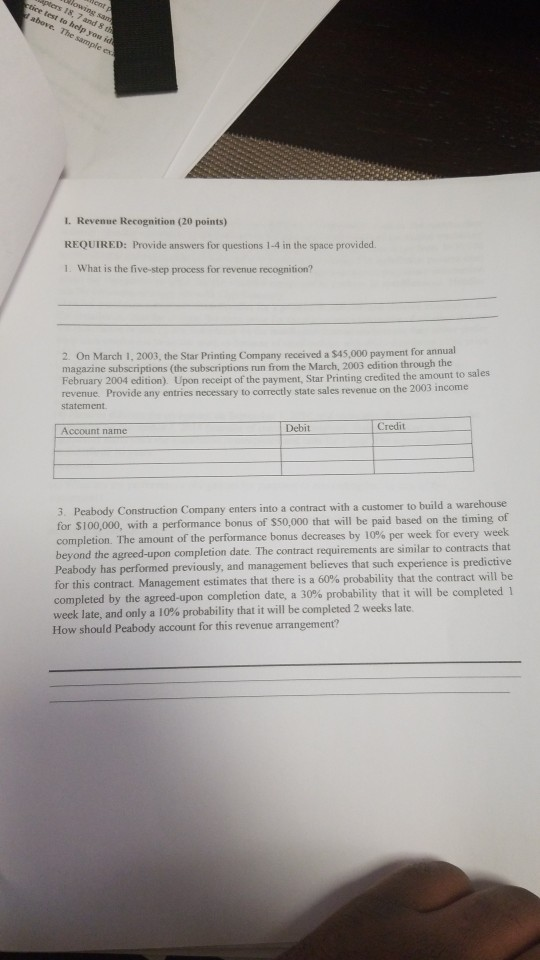

Went Wlowing samt apters 18, 7 and 8th stice test to help you id above. The sample ex 1. Revenue Recognition (20 points) REQUIRED: Provide

Went Wlowing samt apters 18, 7 and 8th stice test to help you id above. The sample ex 1. Revenue Recognition (20 points) REQUIRED: Provide answers for questions 1-4 in the space provided. 1. What is the five-step process for revenue recognition? 2. On March 1, 2003, the Star Printing Company received a $45.000 payment for annual magazine subscriptions (the subscriptions run from the March, 2003 edition through the February 2004 edition). Upon receipt of the payment, Star Printing credited the amount to sales revenue. Provide any entries necessary to correctly state sales revenue on the 2003 income statement Account name Debit Credit 3. Peabody Construction Company enters into a contract with a customer to build a warehouse for $100,000, with a performance bonus of $50,000 that will be paid based on the timing of completion. The amount of the performance bonus decreases by 10% per week for every week beyond the agreed-upon completion date. The contract requirements are similar to contracts that Peabody has performed previously, and management believes that such experience is predictive for this contract Management estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 30% probability that it will be completed! week late, and only a 10% probability that it will be completed 2 weeks late. How should Peabody account for this revenue arrangement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started