werling Co. had 10,000 shares of $8 par common stock outstanding just prior to a spilt. The stock was spilt two-for-one and the par value was reduced to $3. which entry correctly records this stock spilt?

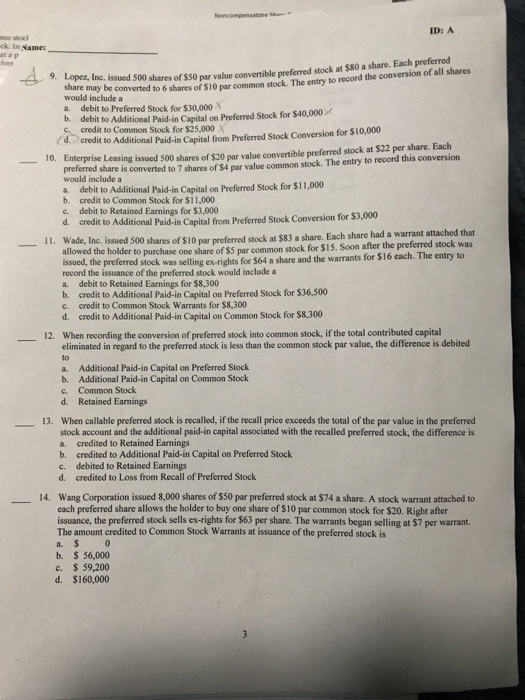

ck. In Name at a p ves 9 Lopez Inc. issued 500 shares of s0 par value comverible prerfered stock at s80 a share. Each preferred stock. The entry to record the conversion of all shares share may be converted to 6 shares of $10 par common would include a a. debit to Preferred Stock for $30,000 debit to Additional Paid-in Capital on Preferred Stock for $40,000 credit to Common Stock for $25,000X dcredit to Additional Paid-in Capital from Preferred Stock Conversion for $10,000 Enterprise Leasing issued 500 shares of $20 par value convertible preferred stock at $22 per share. Each preferred share is converted to 7 shares of $4 par value common stock. The entry to record this conversion would include a 10. a debit to Additional Paid-in Capital on Preferred Stock for $11,000 b. credit to Common Stock for $11,000 c. debit to Retained Earnings for $3,000 d. credit to Additional Paid-in Capital from Preferred Stock Conversion for S3 Wade, Inc, issued 500 for $3,000 II. Wade, Inc. issued 500 shares of S10 par preferred stock at $83 a share. Each share had a 11. to purchase one share of $5 par common stock for $15. Soon after the preferred stock was issued, the preferred stock was selling ex-ri ghts for $64 a share and the warrants for $16 each. The entry to record the issuance of the preferred stock would include a a. debit to Retained Earnings for $8,300 b. credit to Additional Paid-in Capital on Preferred Stock for $36,500 c. credit to Common Stock Warrants for $8,300 d. credit to Additional Paid-in Capital on Common Stock for $8,300 12. When recording the conversion of preferred stock into common stock, if the total contributed capital eliminated in regard to the preferred stock is less than the common stock par value, the difference is debited to a. Additional Paid-in Capital on Preferred Stock b. Additional Paid-in Capital on Common Stock Common Stock c. d. Retained Earnings 13. When callable prefered stock is recalled, if the recall price exceeds the total of the par value in the preferred stock account and the additional paid-in capital associated with the recalled preferred stock, the difference is a. credited to Retained Earnings b. credited to Additional Paid-in Capital on Preferred Stock c. debited to Retained Earnings d. credited to Loss from Recall of Preferred Stock Wang Corporation issued 8,000 shares of $50 par preferred stock at $74 a share. A stock warrant attached to each preferred share allows the holder to buy one share of S10 par common stock for $20. Right after issuance, the preferred stock sells ex-rights for $63 per share. The warrants began selling at $7 per warrant. The amount credited to Common Stock Warrants at issuance of the preferred stock is 14. b. $ 56,000 c. 59,200 d. $160,000 ck. In Name at a p ves 9 Lopez Inc. issued 500 shares of s0 par value comverible prerfered stock at s80 a share. Each preferred stock. The entry to record the conversion of all shares share may be converted to 6 shares of $10 par common would include a a. debit to Preferred Stock for $30,000 debit to Additional Paid-in Capital on Preferred Stock for $40,000 credit to Common Stock for $25,000X dcredit to Additional Paid-in Capital from Preferred Stock Conversion for $10,000 Enterprise Leasing issued 500 shares of $20 par value convertible preferred stock at $22 per share. Each preferred share is converted to 7 shares of $4 par value common stock. The entry to record this conversion would include a 10. a debit to Additional Paid-in Capital on Preferred Stock for $11,000 b. credit to Common Stock for $11,000 c. debit to Retained Earnings for $3,000 d. credit to Additional Paid-in Capital from Preferred Stock Conversion for S3 Wade, Inc, issued 500 for $3,000 II. Wade, Inc. issued 500 shares of S10 par preferred stock at $83 a share. Each share had a 11. to purchase one share of $5 par common stock for $15. Soon after the preferred stock was issued, the preferred stock was selling ex-ri ghts for $64 a share and the warrants for $16 each. The entry to record the issuance of the preferred stock would include a a. debit to Retained Earnings for $8,300 b. credit to Additional Paid-in Capital on Preferred Stock for $36,500 c. credit to Common Stock Warrants for $8,300 d. credit to Additional Paid-in Capital on Common Stock for $8,300 12. When recording the conversion of preferred stock into common stock, if the total contributed capital eliminated in regard to the preferred stock is less than the common stock par value, the difference is debited to a. Additional Paid-in Capital on Preferred Stock b. Additional Paid-in Capital on Common Stock Common Stock c. d. Retained Earnings 13. When callable prefered stock is recalled, if the recall price exceeds the total of the par value in the preferred stock account and the additional paid-in capital associated with the recalled preferred stock, the difference is a. credited to Retained Earnings b. credited to Additional Paid-in Capital on Preferred Stock c. debited to Retained Earnings d. credited to Loss from Recall of Preferred Stock Wang Corporation issued 8,000 shares of $50 par preferred stock at $74 a share. A stock warrant attached to each preferred share allows the holder to buy one share of S10 par common stock for $20. Right after issuance, the preferred stock sells ex-rights for $63 per share. The warrants began selling at $7 per warrant. The amount credited to Common Stock Warrants at issuance of the preferred stock is 14. b. $ 56,000 c. 59,200 d. $160,000