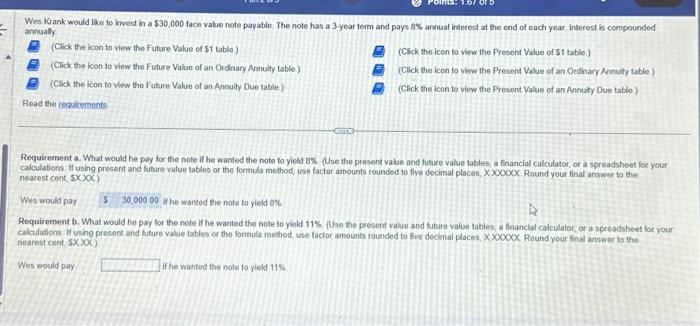

Wes Krank would like to invest in a $30,000 face value note payabio. The note has a 3 year term and pays 8% annual interest at the end of each year interest is compounded annualy (Click the icon to view the Future Value of $1 table.) (CFick the icon to view the Present Value of $1 table.) (Click the icon to view the Future Value of an Ordinary Annuity table) (Click the icon to view the Present Value of an Oruinary Annuity table) (Click the icon to view the Future Value of an Annvity Due table) (Click the icon to view the Present Value of an Annuty Due tablo) Road the tessitements. Requirement a. What would he pay for the note if he wanted the note to yield 8%. Use the present value and future value tables, a financial calculator, or a spreadsheet for your calculations If using prosent and future value tablos or the formula mothod, use factot amounts roundod to five decimal places, X XOCOCX Round your final answer to the nearest cent $0 ) Wes would pay If he wanted the note to yield a\% Requirement b. What would he pay for the note if he wanted the note to ylakd 11% (Use the present value and future value lables, a financlal calculator, or a spreadsheet for your calculations If using present and future value tables or the formula method, use factor amounts rounded to fivo decimal places, XXOCOCX. Round your final answar io the nearest cent, $ ) Wes would pay if he wanted the note to yiekd 11% Wes Krank would like to irvest in a $30,000 tace value note payable. The note has a 3 year tem and pays 8% annual interest at the end of each year Interest is compounded annualy. (Click the icon to viow the Future Value of $1 table) (Click the icon to view the Future Value of an Ordinary Annulty table) Read the reouir Requirement a calculations if nearest cent, 5 : Wos would pay Requirement b calculations. If Requirements a. What would he pay for the note it he wanted the note to yield 8% b. What would he pary for the note if he wanted the note to yield 11% c. What would he pay for the nole if he wanted the note to yleld 18% ? (Click the icon to view the Present Value of $1 table) (Click the icon to view the Present Value of an Ordinary Annuity table.) iclickthaisango view the Present Value of an Annuly Due table)