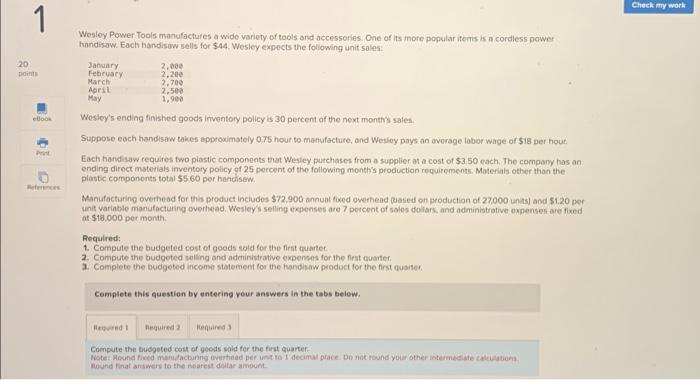

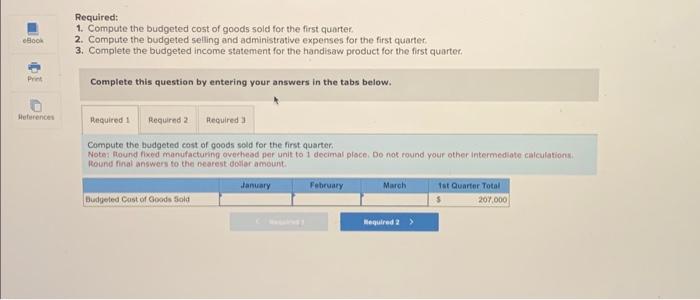

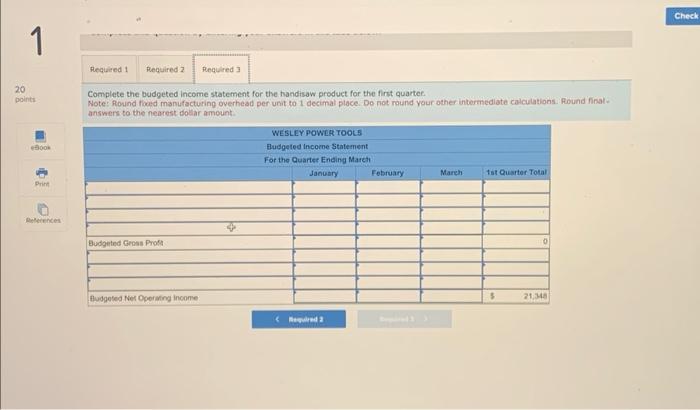

Wesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular itenis is a cordless power handisaw. Each handistw sells for $44. Wesley expects the foliowing unit sales: Wesley's ending finished goods inventory policy is 30 percent of the next manth's sales. Suppose each handisaw takes approximately 075 hour to mantufacture, and Wesley pays an average labor wage of $18 per hour Each handisaw requires two plastic components that Wesley purchases from a supplier at a cost of $3.50 each. The company has an ending direct materiais inventory policy of 25 percent of the following month's production roquirements. Materials other than the plastic components total 55.60 per handisew. Manufacturing overtead for this product includes $72,900 annuat foxed overnead (dased on production of 27,000 units) and 51.20 per unit variable manufacturing overhead. Wesley's selling exenenses are 7 percent of sales dolars, and administrative expenses are fixed at $18.000 pec month. Aequired: 1. Compute the budgeted cost of goods sold for the fint quarter 2. Compute the budgeted seling and administrative expenses for the first euanter. 2. Complete the budgeted income statement for the fandisaw prodoct for the first quarter. Complete this question by entering your answers in the tabs below. Compute the tuidgoted coit of goods sald for the first quarter. Tlound final answers to the neareit doltar amoont. Required: 1. Compute the budgeted cost of goods sold for the first quortet. 2. Compute the budgeted selling and administratlve expenses for the first quarter. 3. Complete the budgeted income statement for the handisaw product for the first quartec. Complete this question by entering your answers in the tabs below. Compute the budgeted cost of goods sold for the first quarter. Notes flound fixed manufacturing overhead per unit to 1 decimal ploce, Do not round your other intermediate calculations. Round final answers to the nearest doliar amount. Complete the budgeted income statement for the handisaw product for the first quarter. Note: Round foad manufacturing overhead per unit to 1 decimal place. Do not round your other intermediate calculations: Round final. answers to the nearest dollar amount. Wesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular itenis is a cordless power handisaw. Each handistw sells for $44. Wesley expects the foliowing unit sales: Wesley's ending finished goods inventory policy is 30 percent of the next manth's sales. Suppose each handisaw takes approximately 075 hour to mantufacture, and Wesley pays an average labor wage of $18 per hour Each handisaw requires two plastic components that Wesley purchases from a supplier at a cost of $3.50 each. The company has an ending direct materiais inventory policy of 25 percent of the following month's production roquirements. Materials other than the plastic components total 55.60 per handisew. Manufacturing overtead for this product includes $72,900 annuat foxed overnead (dased on production of 27,000 units) and 51.20 per unit variable manufacturing overhead. Wesley's selling exenenses are 7 percent of sales dolars, and administrative expenses are fixed at $18.000 pec month. Aequired: 1. Compute the budgeted cost of goods sold for the fint quarter 2. Compute the budgeted seling and administrative expenses for the first euanter. 2. Complete the budgeted income statement for the fandisaw prodoct for the first quarter. Complete this question by entering your answers in the tabs below. Compute the tuidgoted coit of goods sald for the first quarter. Tlound final answers to the neareit doltar amoont. Required: 1. Compute the budgeted cost of goods sold for the first quortet. 2. Compute the budgeted selling and administratlve expenses for the first quarter. 3. Complete the budgeted income statement for the handisaw product for the first quartec. Complete this question by entering your answers in the tabs below. Compute the budgeted cost of goods sold for the first quarter. Notes flound fixed manufacturing overhead per unit to 1 decimal ploce, Do not round your other intermediate calculations. Round final answers to the nearest doliar amount. Complete the budgeted income statement for the handisaw product for the first quarter. Note: Round foad manufacturing overhead per unit to 1 decimal place. Do not round your other intermediate calculations: Round final. answers to the nearest dollar amount