Question

West Coast Electronics (WCE) is a publicly traded Canadian company with 40,000 common shares that are lightly traded with a current market value of $30.00

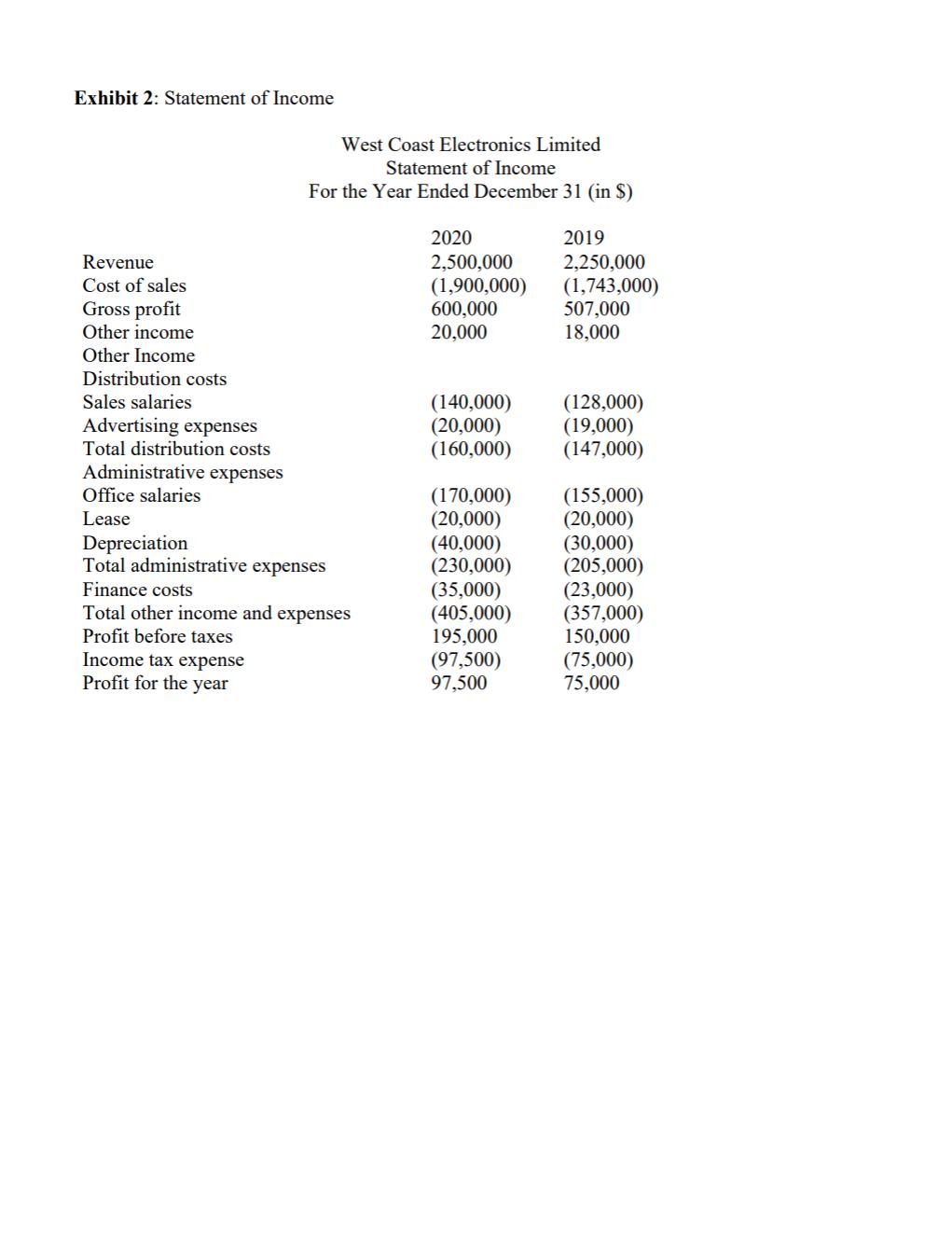

West Coast Electronics (WCE) is a publicly traded Canadian company with 40,000 common shares that are lightly traded with a current market value of $30.00 per share. The company has been in business since 1985 and has two main sources of income: the major one is the revenue from the sale of its products and services; the second source is (income not from sales) interest from investments. The company offers a broad portfolio of tested and certified IT accessories. The company’s head office is located on the west coast of the province of Ontario, in Port Stanley, Ontario, Canada. Anna Yu Sinclair, the Founder and CEO asks you for some advice. She has provided two exhibits of information (found at the end of this document). She would like to improve the quality, usefulness and readability of the financial reports.

The CEO is a very busy person, she would like a briefing note, not a novel. The length of your submission should be no more than two written pages (single spaced) and no more than two pages of exhibits. That is, a maximum of two pages of exhibits (normally exhibits are included at the end of the report); for a maximum of four pages (two written + two exhibits = four) total.

Include background, key considerations, current situation, and conclusions if possible. Please format according to GAAP (Canadian generally accepted accounting principles). Can do ratio analysis, as long as it helps answer the main question “she would like to improve the quality, usefulness and readability of the financial reports.” Jot/point notes are fine as long as they summarize possible solutions and describe the work being done. Lastly, please include the exhibits and reworks of the statements, but a full two pages of written response isnt necessary if everything can be condensed.

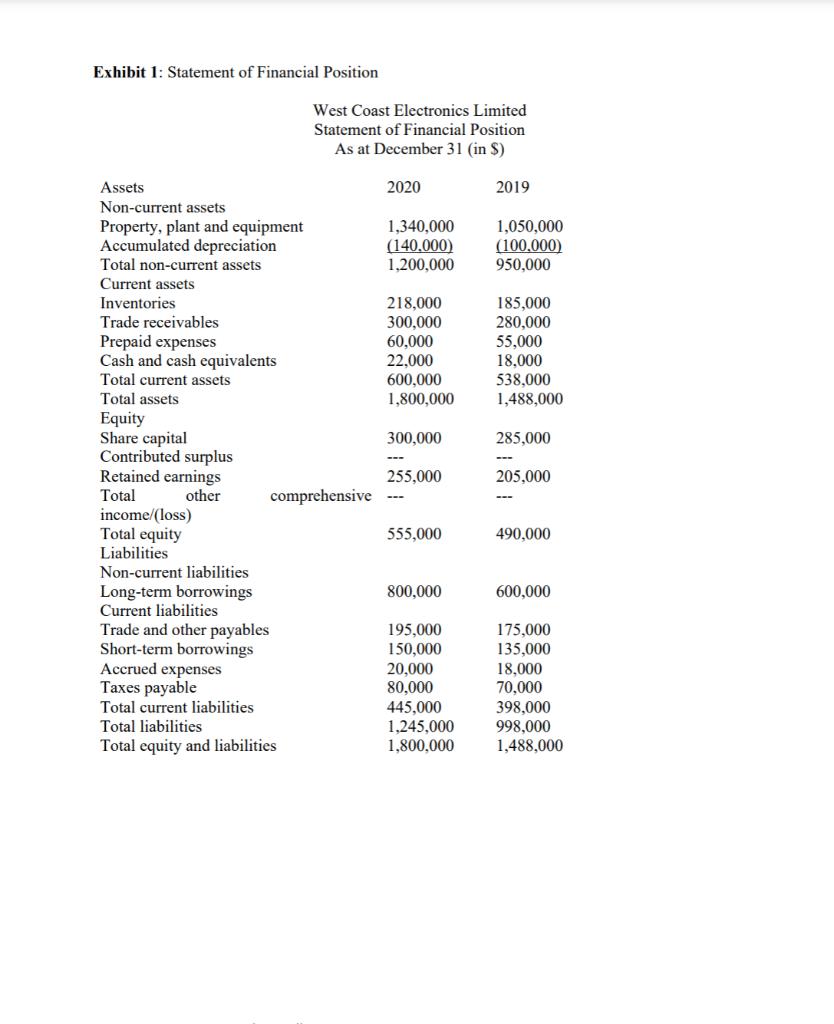

Exhibit 1: Statement of Financial Position Assets Non-current assets Property, plant and equipment Accumulated depreciation Total non-current assets Current assets Inventories Trade receivables Prepaid expenses Cash and cash equivalents Total current assets Total assets Equity Share capital Contributed surplus Retained earnings Total income/(loss) other Total equity Liabilities Non-current liabilities Long-term borrowings Current liabilities Trade and other payables West Coast Electronics Limited Statement of Financial Position As at December 31 (in $) comprehensive Short-term borrowings Accrued expenses Taxes payable Total current liabilities Total liabilities Total equity and liabilities 2020 1,340,000 (140,000) 1,200,000 218,000 300,000 60,000 22,000 600,000 1,800,000 300,000 255,000 555,000 800,000 195,000 150,000 20,000 80,000 445,000 1,245,000 1,800,000 2019 1,050,000 (100,000) 950,000 185,000 280,000 55,000 18,000 538,000 1,488,000 285,000 205,000 490,000 600,000 175,000 135,000 18,000 70,000 398,000 998,000 1,488,000

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Report for the Business Background Routine Maintance helps one to get millage out of ones vehicles V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started