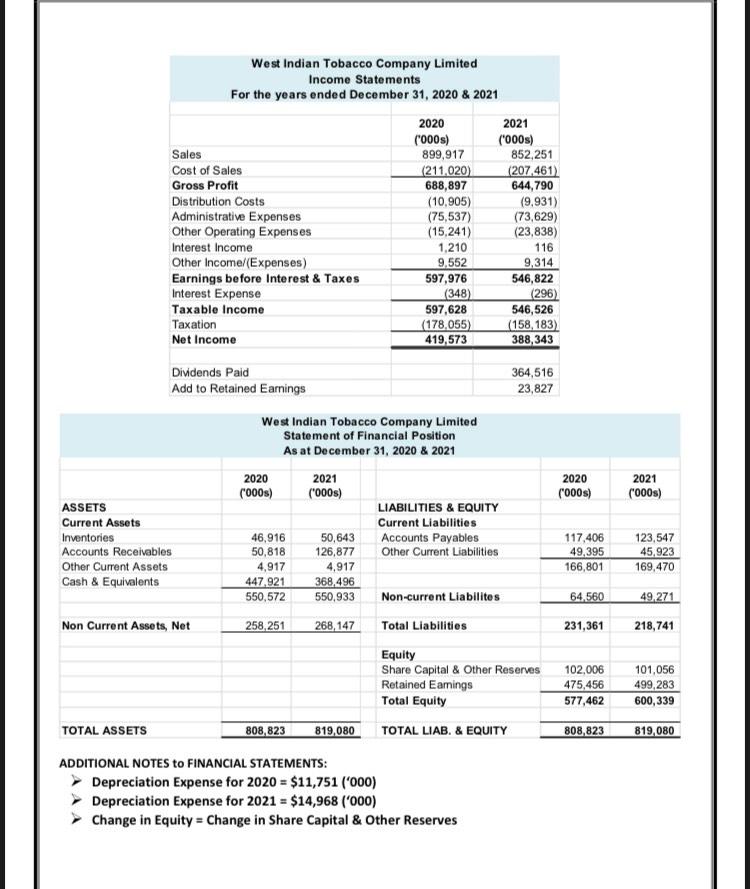

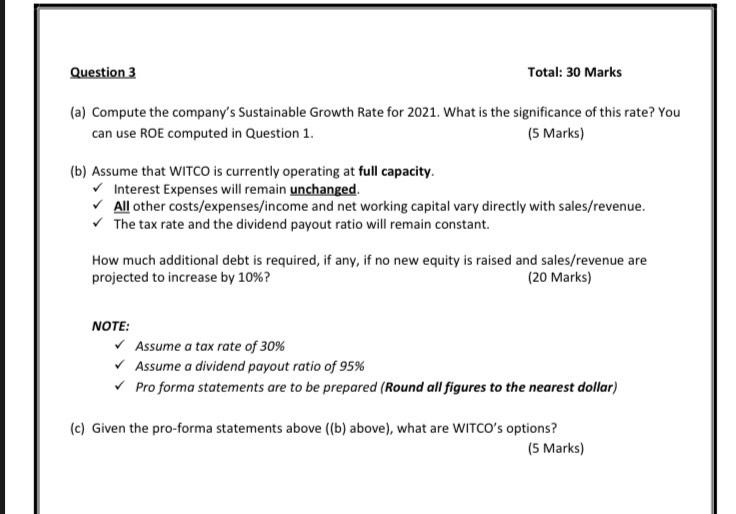

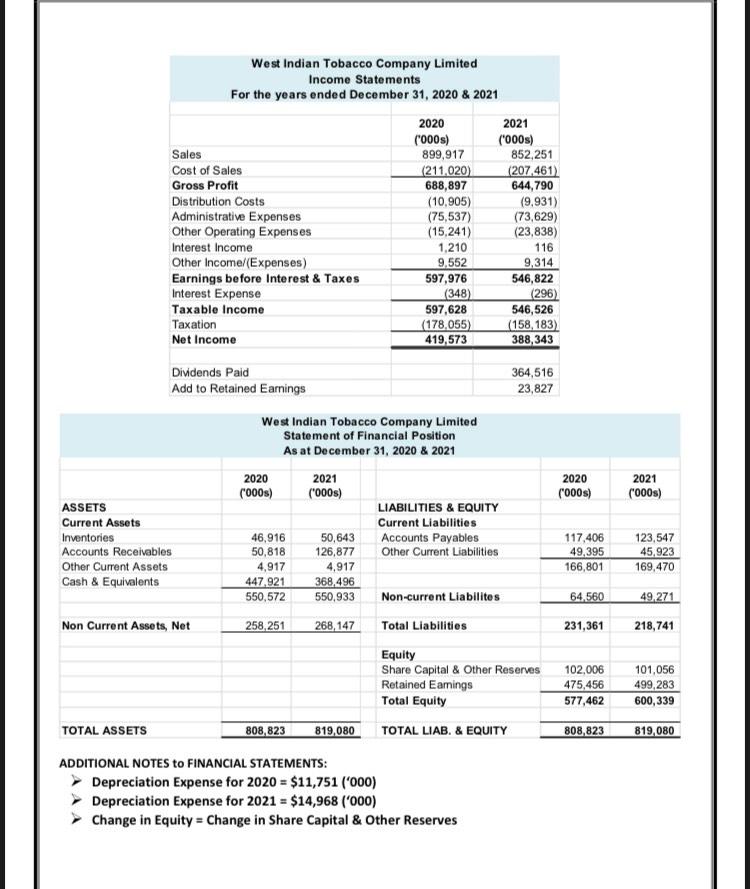

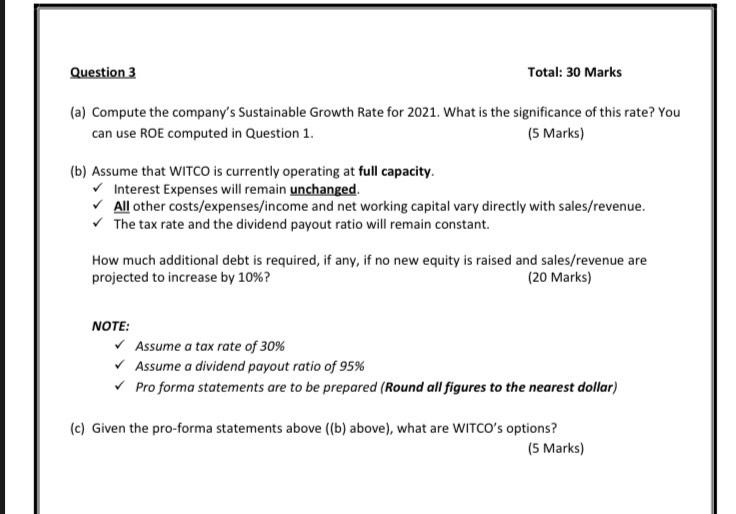

West Indian Tobacco Company Limited Income Statements For the years ended December 31, 2020 & 2021 2020 ('000s) Sales Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Interest Income Other Income/(Expenses) Earnings before Interest & Taxes Interest Expense Taxable income Taxation Net Income Dividends Paid Add to Retained Earnings 899,917 (211,020) 688,897 (10,905) (75,537) (15,241) 1,210 9,552 597,976 (348) 597,628 (178,055) 419,573 West Indian Tobacco Company Limited Statement of Financial Position As at December 31, 2020 & 2021 2020 2021 ('000s) ('000s) LIABILITIES & EQUITY Current Liabilities Accounts Payables Other Current Liabilities Non-current Liabilites Total Liabilities Equity Share Capital & Other Reserves Retained Earings Total Equity TOTAL LIAB. & EQUITY 2021 ('000s) ASSETS Current Assets Inventories 46,916 50,643 Accounts Receivables 50,818 126,877 Other Current Assets 4,917 4,917 Cash & Equivalents 447,921 368,496 550,572 550,933 Non Current Assets, Net 258,251 268,147 TOTAL ASSETS 808,823 819,080 ADDITIONAL NOTES to FINANCIAL STATEMENTS: Depreciation Expense for 2020 = $11,751 ('000) Depreciation Expense for 2021 = $14,968 ('000) Change in Equity = Change in Share Capital & Other Reserves 852,251 (207,461) 644,790 (9,931) (73,629) (23,838) 116 9,314 546,822 (296) 546,526 (158,183) 388,343 364,516 23,827 2020 ('000s) 117,406 49,395 166,801 64,560 231,361 102,006 475,456 577,462 808,823 2021 ('000s) 123,547 45,923 169,470 49,271 218,741 101,056 499,283 600,339 819,080 Question 3 Total: 30 Marks (a) Compute the company's Sustainable Growth Rate for 2021. What is the significance of this rate? You can use ROE computed in Question 1. (5 Marks) (b) Assume that WITCO is currently operating at full capacity. Interest Expenses will remain unchanged. All other costs/expenses/income and net working capital vary directly with sales/revenue. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required, if any, if no new equity is raised and sales/revenue are projected to increase by 10%? (20 Marks) NOTE: Assume a tax rate of 30% Assume a dividend payout ratio of 95% Pro forma statements are to be prepared (Round all figures to the nearest dollar) (c) Given the pro-forma statements above ((b) above), what are WITCO's options? (5 Marks) West Indian Tobacco Company Limited Income Statements For the years ended December 31, 2020 & 2021 2020 ('000s) Sales Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Interest Income Other Income/(Expenses) Earnings before Interest & Taxes Interest Expense Taxable income Taxation Net Income Dividends Paid Add to Retained Earnings 899,917 (211,020) 688,897 (10,905) (75,537) (15,241) 1,210 9,552 597,976 (348) 597,628 (178,055) 419,573 West Indian Tobacco Company Limited Statement of Financial Position As at December 31, 2020 & 2021 2020 2021 ('000s) ('000s) LIABILITIES & EQUITY Current Liabilities Accounts Payables Other Current Liabilities Non-current Liabilites Total Liabilities Equity Share Capital & Other Reserves Retained Earings Total Equity TOTAL LIAB. & EQUITY 2021 ('000s) ASSETS Current Assets Inventories 46,916 50,643 Accounts Receivables 50,818 126,877 Other Current Assets 4,917 4,917 Cash & Equivalents 447,921 368,496 550,572 550,933 Non Current Assets, Net 258,251 268,147 TOTAL ASSETS 808,823 819,080 ADDITIONAL NOTES to FINANCIAL STATEMENTS: Depreciation Expense for 2020 = $11,751 ('000) Depreciation Expense for 2021 = $14,968 ('000) Change in Equity = Change in Share Capital & Other Reserves 852,251 (207,461) 644,790 (9,931) (73,629) (23,838) 116 9,314 546,822 (296) 546,526 (158,183) 388,343 364,516 23,827 2020 ('000s) 117,406 49,395 166,801 64,560 231,361 102,006 475,456 577,462 808,823 2021 ('000s) 123,547 45,923 169,470 49,271 218,741 101,056 499,283 600,339 819,080 Question 3 Total: 30 Marks (a) Compute the company's Sustainable Growth Rate for 2021. What is the significance of this rate? You can use ROE computed in Question 1. (5 Marks) (b) Assume that WITCO is currently operating at full capacity. Interest Expenses will remain unchanged. All other costs/expenses/income and net working capital vary directly with sales/revenue. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required, if any, if no new equity is raised and sales/revenue are projected to increase by 10%? (20 Marks) NOTE: Assume a tax rate of 30% Assume a dividend payout ratio of 95% Pro forma statements are to be prepared (Round all figures to the nearest dollar) (c) Given the pro-forma statements above ((b) above), what are WITCO's options