Question

Westbrook owns and operates a variety of fast-food restaurants in 3 cities: New York, Boston, and Providence. Each location is considered a separate division and

Westbrook owns and operates a variety of fast-food restaurants in 3 cities: New York, Boston, and Providence. Each location is considered a separate division and the company finances the 3 restaurants raising equity and debt at company (not division) level. The cost of debt and equity are 2% and 10%, respectively. Debt and equity are not publicly traded on exchanges. Westbrook is subject to a 25% corporate tax rate.

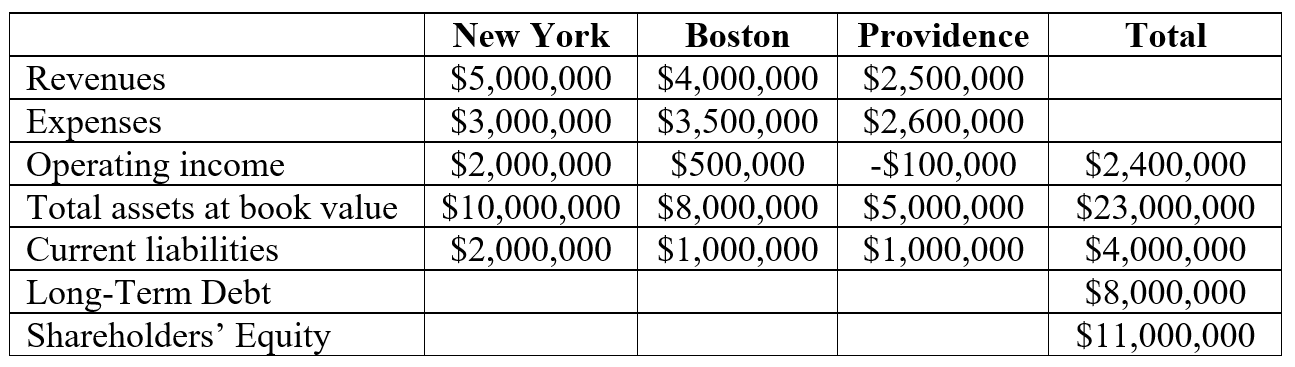

The following information refers to the 3 divisions at the end of 2020:

a. (1.5 points) Calculate the EVA of the company. Show your calculations.

b. (0.5 points) Please provide a couple of examples through which managers can improve EVA at this company.

Total Revenues Expenses Operating income Total assets at book value Current liabilities Long-Term Debt Shareholders' Equity New York Boston $5,000,000 $4,000,000 $3,000,000 $3,500,000 $2,000,000 $500,000 $10,000,000 $8,000,000 $2,000,000 $1,000,000 Providence $2,500,000 $2,600,000 $100,000 $5,000,000 $1,000,000 $2,400,000 $23,000,000 $4,000,000 $8,000,000 $11,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started