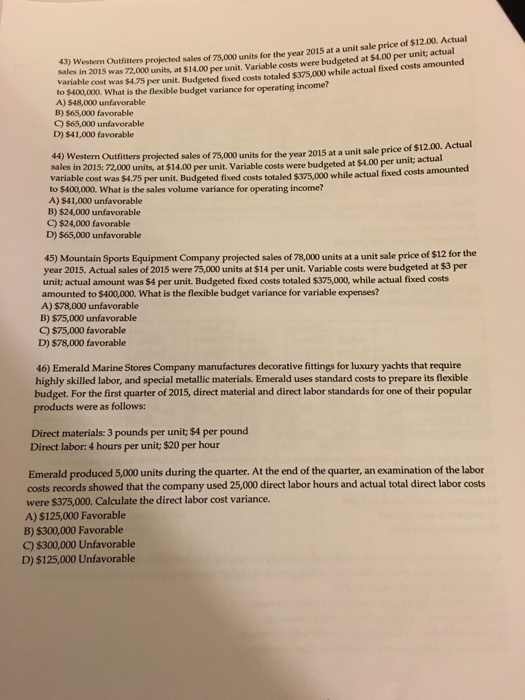

Western outfitters projected sales of 75,000 units for the year 2015 at a unit sale price of $12.00. Actual sales in 2015 was 72,000 units, at $14.00 per unit. Variable costs were budgeted at $4.00 per unit; actual variable cost was $4.75 per unit. Budgeted fixed costs totaled $375,000 while actual fixed costs amounted to $400,000. What is the flexible budget variance for operating income? $48,000 unfavourable $65,000 favourable $65,000 unfavourable $41,000 favourable Western Outfitter projected sale of 75,000 units for the year 2015 at a unit sale price of $12.00. Actual sales in 2015 : 72.000 units, at $14.00 per unit. Variable costs were budgeted at $4.00 per unit; actual variable cost was $4.75 per unit. Budgeted fixed costs totaled $375,000 while actual fixed costs amount to $400,000. What is the sales volume variance for operating income? $41,000 unfavorable $24,000 unfavorable $24.000 favorable $65,000 unfavorable Mountain Sports Equipment Company projected sales of 78,000 units at a unit sale price of $12 for the year 2015. Actual sales of 2015 were 75,000 units at $14 per unit. Variable costs were budgeted at $3 per unit; actual amount was $4 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $400,000. What is the flexible budget variance for variable expenses? $78,000 unfavorable $75,000 unfavorable $75,000 favorable 78,000 favorable Emerald Marine Stores Company manufactures decorative fittings for luxury yachts that require highly skilled labor, and special metallic materials. Emerald uses standard costs to prepare its flexible budget. For the first quarter of 2015, direct material and direct labor standards for one of their popular products were as follows: Direct materials: 3 pounds per unit; $4 per pound Direct labor: 4 hours per unit; $20 per hour Emerald produced 5,000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the company used 25,000 direct labor hours and actual total direct labor costs were $375,000. Calculate the direct labor cost variance. $125,000 Favourable $300,000 Favourable $300,000 Favourable $125,000 Favourable