Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auditors for the Internal Revenue Service (IRS) scrutinize income tax returns after they have been prescreened with the help of computer tests for normal ranges

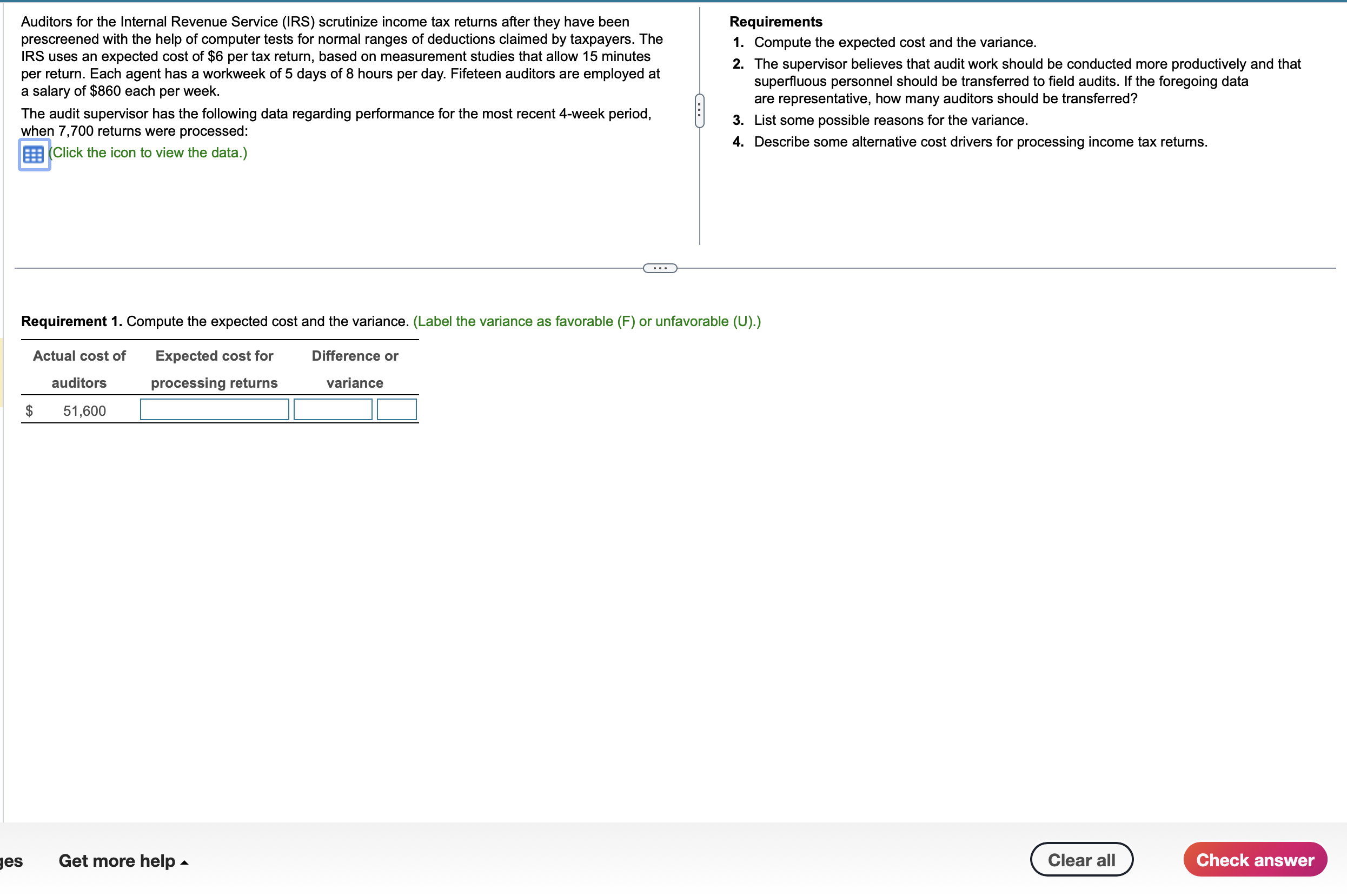

Auditors for the Internal Revenue Service (IRS) scrutinize income tax returns after they have been prescreened with the help of computer tests for normal ranges of deductions claimed by taxpayers. The IRS uses an expected cost of $6 per tax return, based on measurement studies that allow 15 minutes per return. Each agent has a workweek of 5 days of 8 hours per day. Fifeteen auditors are employed at a salary of $860 each per week. The audit supervisor has the following data regarding performance for the most recent 4-week period, when 7,700 returns were processed: (Click the icon to view the data.) Requirements 1. Compute the expected cost and the variance. 2. The supervisor believes that audit work should be conducted more productively and that superfluous personnel should be transferred to field audits. If the foregoing data are representative, how many auditors should be transferred? 3. List some possible reasons for the variance. 4. Describe some alternative cost drivers for processing income tax returns. Requirement 1. Compute the expected cost and the variance. (Label the variance as favorable (F) or unfavorable (U).)

Auditors for the Internal Revenue Service (IRS) scrutinize income tax returns after they have been prescreened with the help of computer tests for normal ranges of deductions claimed by taxpayers. The IRS uses an expected cost of $6 per tax return, based on measurement studies that allow 15 minutes per return. Each agent has a workweek of 5 days of 8 hours per day. Fifeteen auditors are employed at a salary of $860 each per week. The audit supervisor has the following data regarding performance for the most recent 4-week period, when 7,700 returns were processed: (Click the icon to view the data.) Requirements 1. Compute the expected cost and the variance. 2. The supervisor believes that audit work should be conducted more productively and that superfluous personnel should be transferred to field audits. If the foregoing data are representative, how many auditors should be transferred? 3. List some possible reasons for the variance. 4. Describe some alternative cost drivers for processing income tax returns. Requirement 1. Compute the expected cost and the variance. (Label the variance as favorable (F) or unfavorable (U).) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started