Answered step by step

Verified Expert Solution

Question

1 Approved Answer

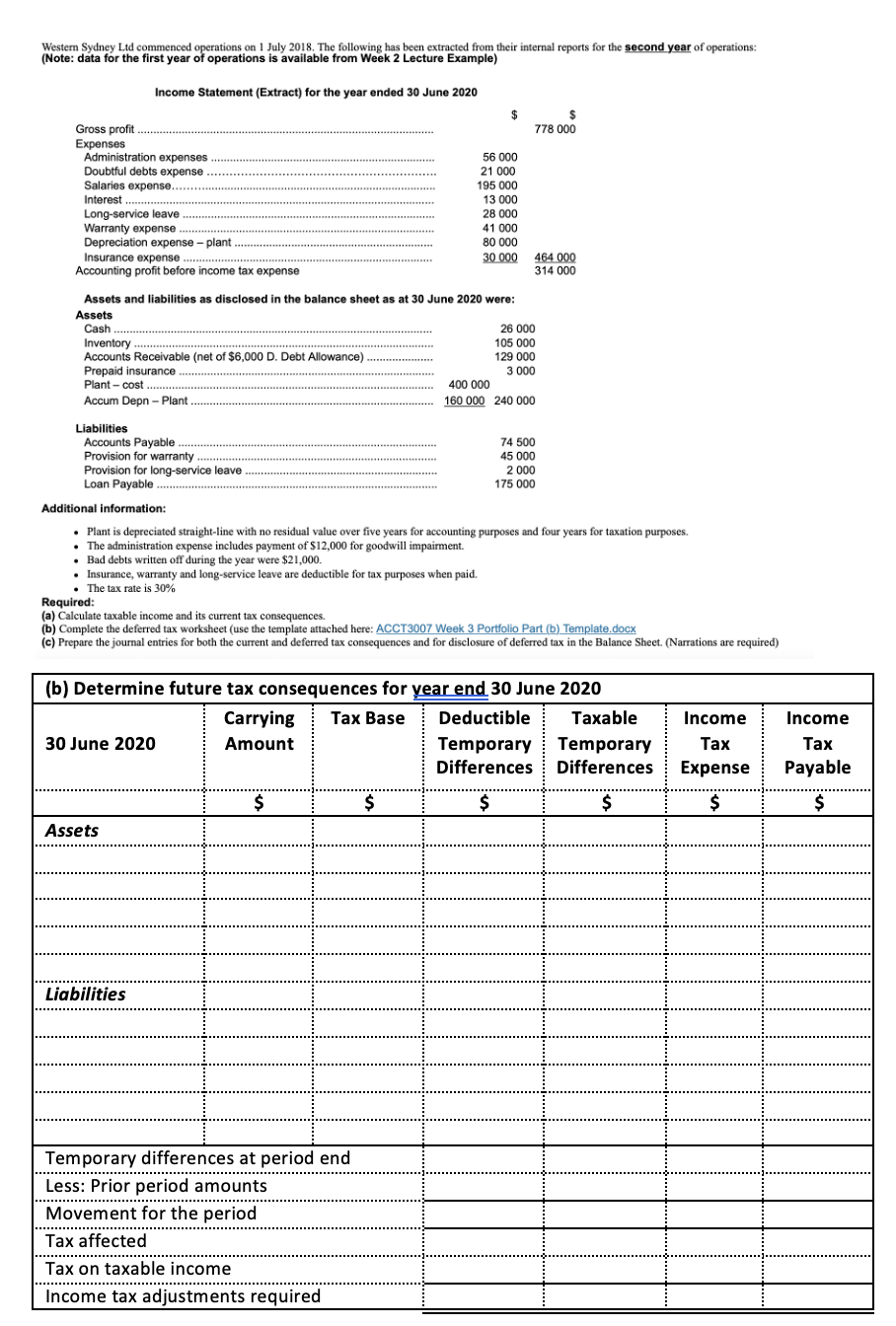

Western Sydney Ltd commenced operations on 1 July 2 0 1 8 . The following has been extracted from their internal reports for the second

Western Sydney Ltd commenced operations on July The following has been extracted from their internal reports for the second year of operations:

Note: data for the first year of operations is available from Week Lecture Example

Income Statement Extract for the year ended June

Gross profit

Expenses

Administration expenses

Doubtful debts expense

Salaries expense.

Interest

Longservice leave

Warranty expense

Depreciation expense plant

Insurance expense

Accounting profit before income tax expense

$$

Assets and liabilities as disclosed in the balance sheet as at June were:

Assets

Cash

Inventory

Accounts Receivable net of $ D Debt Allowance

Prepaid insurance

Plant cost

Accum Depn Plant

Liabilities

Accounts Payable

Provision for warranty

Provision for longservice leave

Loan Payable

Additional information:

Plant is depreciated straightline with no residual value over five years for accounting purposes and four years for taxation purposes.

The administration expense includes payment of $ for goodwill impairment.

Bad debts written off during the year were $

Insurance, warranty and longservice leave are deductible for tax purposes when paid.

The tax rate is

Required:

a Calculate taxable income and its current tax consequences.

b Complete the deferred tax worksheet use the template attached here: ACCT Week Portfolio Part b Template.docx

c Prepare the journal entries for both the current and deferred tax consequences and for disclosure of deferred tax in the Balance Sheet. Narrations are required

b Determine future tax consequences for year end June

table June tableCarryingAmountTax Base,tableDeductibleTemporaryDifferencestableTaxableTemporaryDifferencestableIncomeTaxExpensetableIncomeTaxPayable$$$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started