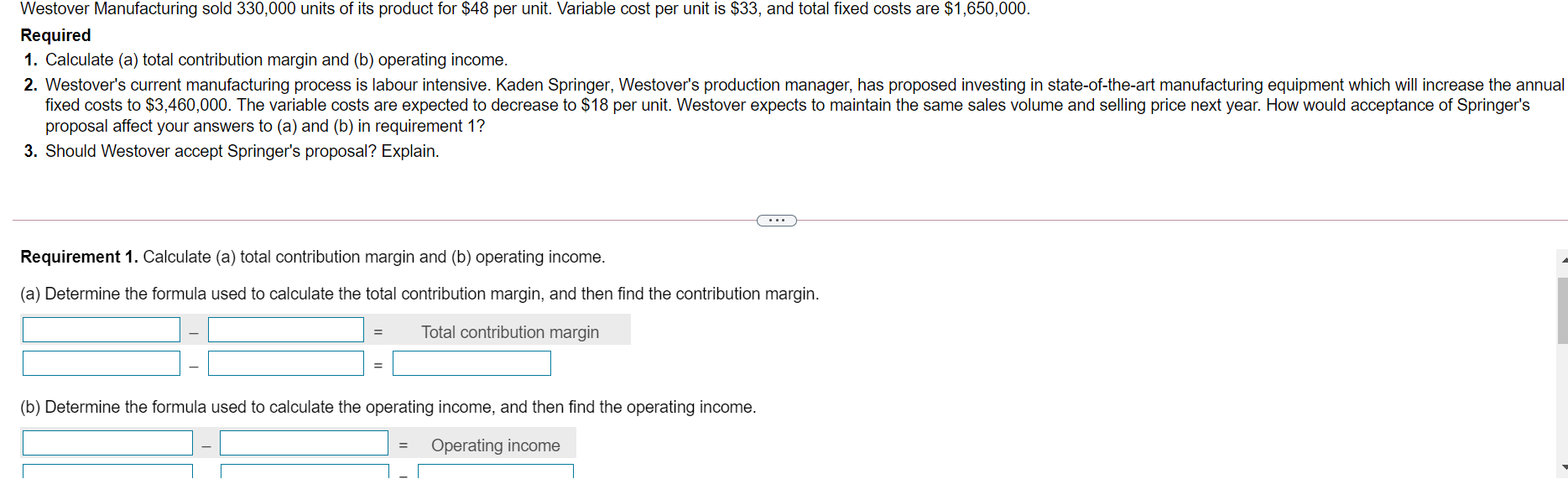

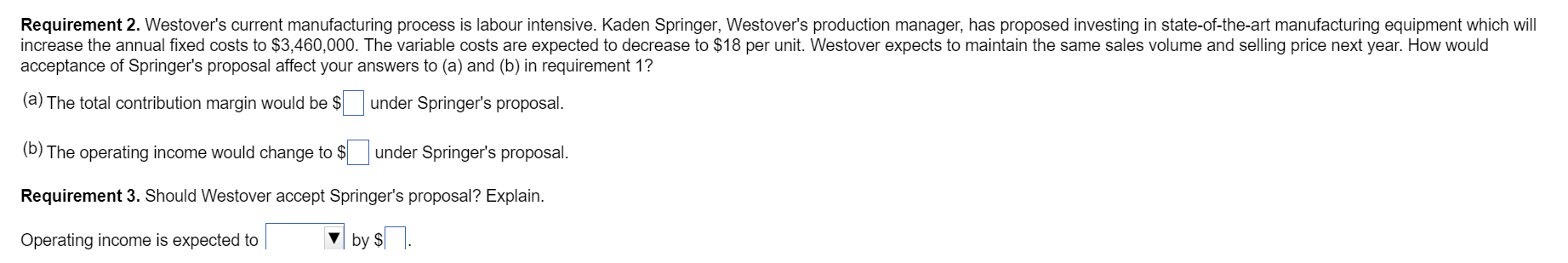

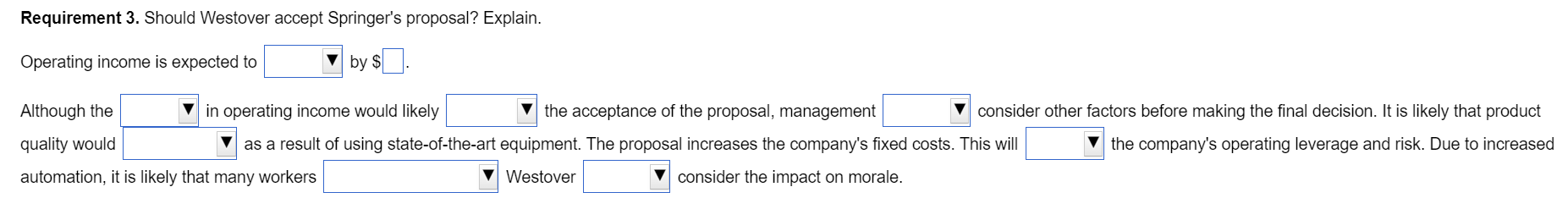

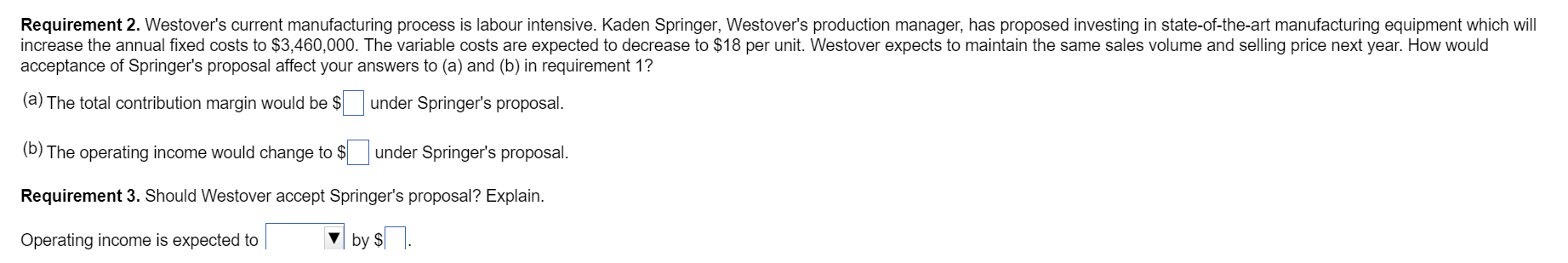

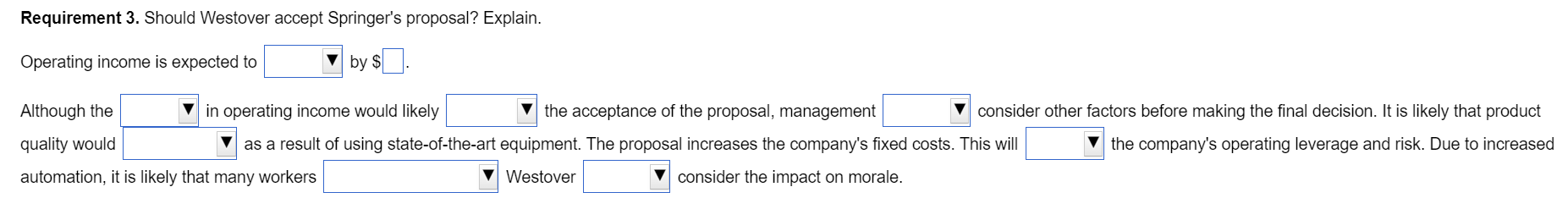

Westover Manufacturing sold 330,000 units of its product for $48 per unit. Variable cost per unit is $33, and total fixed costs are $1,650,000. Required 1. Calculate (a) total contribution margin and (b) operating income. 2. Westover's current manufacturing process is labour intensive. Kaden Springer, Westover's production manager, has proposed investing in state-of-the-art manufacturing equipment which will increase the annual fixed costs to $3,460,000. The variable costs are expected to decrease to $18 per unit. Westover expects to maintain the same sales volume and selling price next year. How would acceptance of Springer's proposal affect your answers to (a) and (b) in requirement 1? 3. Should Westover accept Springer's proposal? Explain. ... Requirement 1. Calculate (a) total contribution margin and (b) operating income. (a) Determine the formula used to calculate the total contribution margin, and then find the contribution margin. = Total contribution margin = (b) Determine the formula used to calculate the operating income, and then find the operating income. Operating income Requirement 2. Westover's current manufacturing process is labour intensive. Kaden Springer, Westover's production manager, has proposed investing in state-of-the-art manufacturing equipment which will increase the annual fixed costs to $3,460,000. The variable costs are expected to decrease to $18 per unit. Westover expects to maintain the same sales volume and selling price next year. How would acceptance of Springer's proposal affect your answers to (a) and (b) in requirement 1? (a) The total contribution margin would be $ under Springer's proposal. (b) The operating income would change to $ under Springer's proposal. Requirement 3. Should Westover accept Springer's proposal? Explain. Operating income is expected to by $17. Requirement 3. Should Westover accept Springer's proposal? Explain. Operating income is expected to by $0. Although the in operating income would likely the acceptance of the proposal, management consider other factors before making the final decision. It is likely that product quality would as a result of using state-of-the-art equipment. The proposal increases the company's fixed costs. This will the company's operating leverage and risk. Due to increased automation, it is likely that many workers V Westover consider the impact on morale