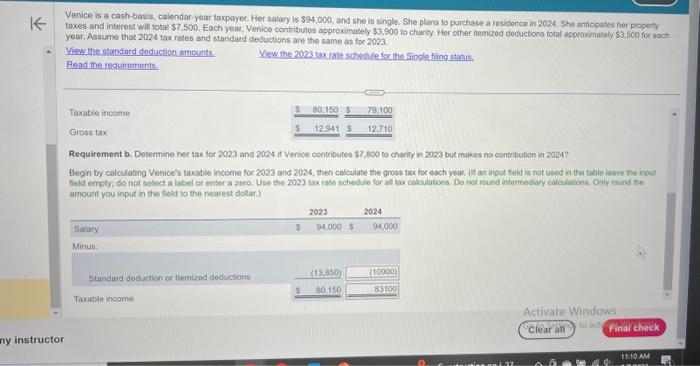

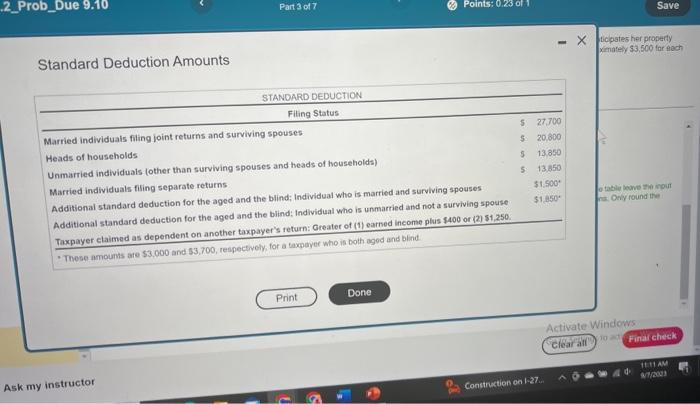

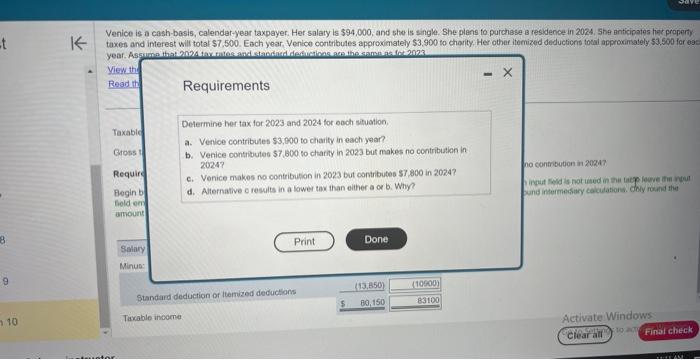

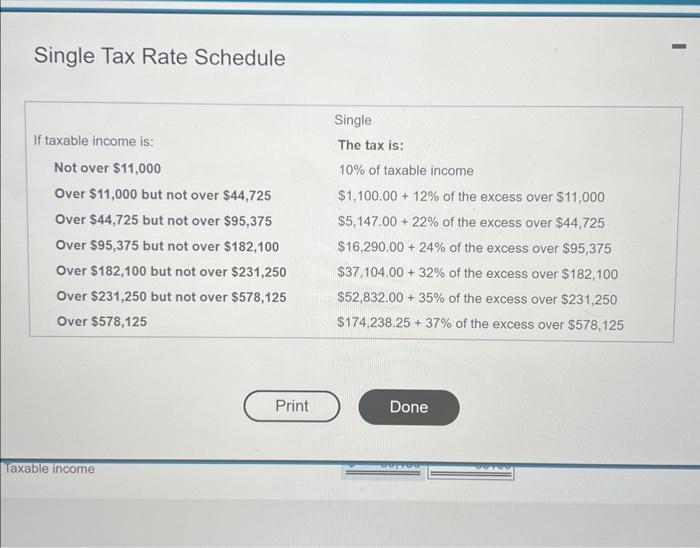

wet and interest will total $7,500. Each year, Venice contributes approximately $3,900 to charity. Her other itemized deductions focal approximstely 53,500 for e9: Requirements Delermine her tax for 2023 and 2024 for each situation. a. Venice contribules $3,000 to charity in each year? b. Venice contributes $7,800 to charity in 2023 but makes no contribution in 2024? c. Venice makes no contribusion in 2023 but contributes 57,800 in 2024 ? d. Alternative c results in a lower tax than elther a o b. Why? ho contribution in 20247 Wund intermessary catculations. Only round the Standard Deduction Amounts Ask my instructor Single Tax Rate Schedule 1 Venice is a cash-basis, calondar-year taxpayer. Het salary is $94,000, and she is single. She plans to purchase a fesidence in 2024 , 5 he anticipotos her propery year. Assume that 2024 tax rates and standard deductions are the same as for 2023 Yiow the standard doduction amounts. View the 2023 tax rate schedule foc the Siople fin Read the requitements. Requirement b. Desermine her tax for 2023 and 2024 if Venice contributes 57,800 to charity in 2023 but makes no contributon in 2024 ? Begin by calculating Venice's taxatie income for 2023 and 2024 , then calculate the gross tax for each year, cf an ingut fold is not used in the table leuwe the hiput amount you inpus in the field to the nearest dollar;) wet and interest will total $7,500. Each year, Venice contributes approximately $3,900 to charity. Her other itemized deductions focal approximstely 53,500 for e9: Requirements Delermine her tax for 2023 and 2024 for each situation. a. Venice contribules $3,000 to charity in each year? b. Venice contributes $7,800 to charity in 2023 but makes no contribution in 2024? c. Venice makes no contribusion in 2023 but contributes 57,800 in 2024 ? d. Alternative c results in a lower tax than elther a o b. Why? ho contribution in 20247 Wund intermessary catculations. Only round the Standard Deduction Amounts Ask my instructor Single Tax Rate Schedule 1 Venice is a cash-basis, calondar-year taxpayer. Het salary is $94,000, and she is single. She plans to purchase a fesidence in 2024 , 5 he anticipotos her propery year. Assume that 2024 tax rates and standard deductions are the same as for 2023 Yiow the standard doduction amounts. View the 2023 tax rate schedule foc the Siople fin Read the requitements. Requirement b. Desermine her tax for 2023 and 2024 if Venice contributes 57,800 to charity in 2023 but makes no contributon in 2024 ? Begin by calculating Venice's taxatie income for 2023 and 2024 , then calculate the gross tax for each year, cf an ingut fold is not used in the table leuwe the hiput amount you inpus in the field to the nearest dollar;)