Answered step by step

Verified Expert Solution

Question

1 Approved Answer

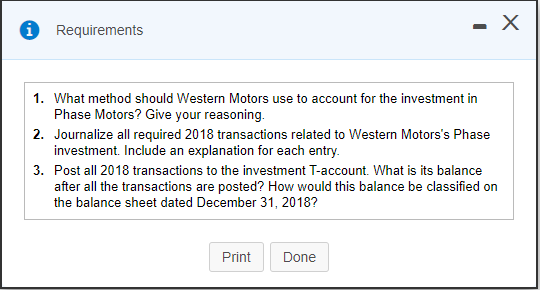

What about now? i - Requirements 1. What method should Western Motors use to account for the investment in Phase Motors? Give your reasoning. 2.

What about now?

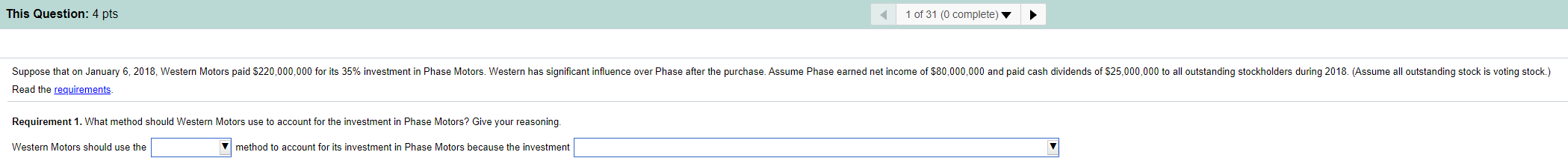

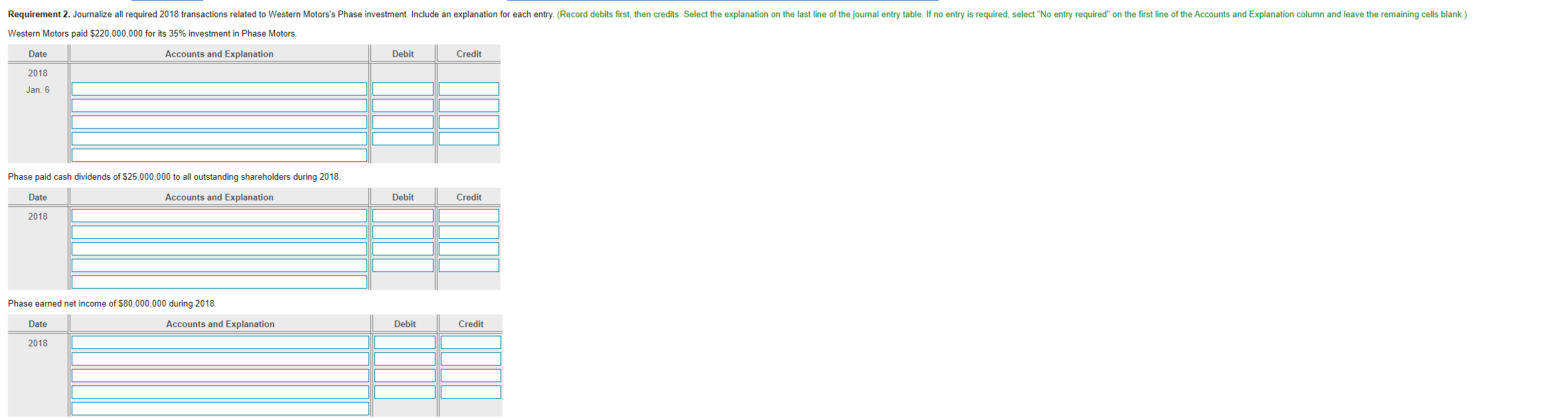

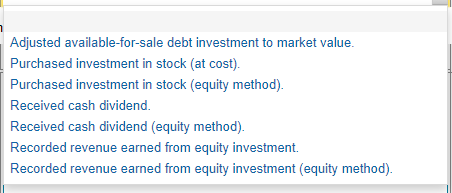

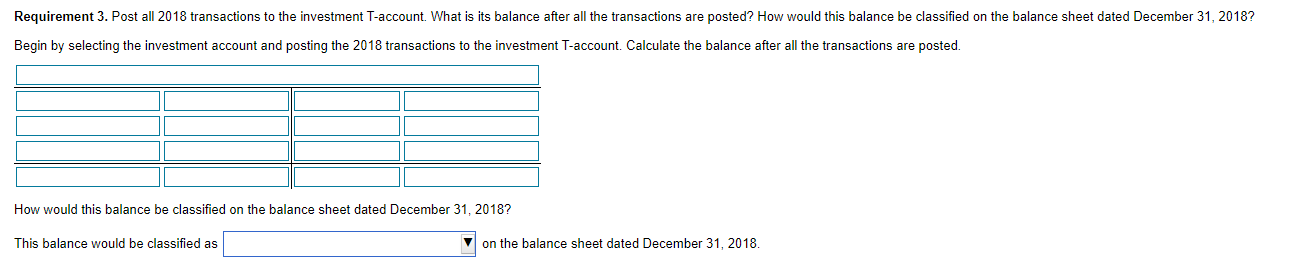

i - Requirements 1. What method should Western Motors use to account for the investment in Phase Motors? Give your reasoning. 2. Journalize all required 2018 transactions related to Western Motors's Phase investment. Include an explanation for each entry. 3. Post all 2018 transactions to the investment T-account. What is its balance after all the transactions are posted? How would this balance be classified on the balance sheet dated December 31, 2018? Print Done This Question: 4 pts 1 of 31 (0 complete) Suppose that on January 6, 2018, Western Motors paid $220,000,000 for its 35% investment in Phase Motors. Western has significant influence over Phase after the purchase. Assume Phase earned net income of $80,000,000 and paid cash dividends of $25,000,000 to all outstanding stockholders during 2018. (Assume all outstanding stock is voting stock.) Read the requirements Requirement 1. What method should Western Motors use to account for the investment in Phase Motors? Give your reasoning. Western Motors should use the method to account for its investment in Phase Motors because the investment Requirement 2. Journalize all required 2018 transactions related to Western Motors's Phase investment. Include an explanation for each entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Western Motors paid $220,000,000 for its 35% investment in Phase Motors Date Accounts and Explanation Debit Credit 2018 Jan. 6 Phase paid cash dividends of $25,000,000 to all outstanding shareholders during 2018 Date Accounts and Explanation Debit Credit 2018 Phase earned net income of $80,000,000 during 2018 Date Accounts and Explanation Debit Credit 2018 No entry required Available-for-Sale Debt Investment Cash Dividend Revenue Equity InvestmentsPhase Motors Fair Value Adjustment-Available-for-Sale Fair Value Adjustment-Equity Investments Fair Value AdjustmentHeld-to-Maturity Fair Value AdjustmentTrading Gain on Disposal Held-to-Matuirty Debt Investments Interest Revenue Loss on Disposal Revenue from Investments Trading Debt Investments Unrealized Holding GainAvailable-for-Sale Unrealized Holding Gain-Equity Investments Unrealized Holding GainHeld-to-Matuirty Unrealized Holding GainTrading Unrealized Holding LossAvailable-for-Sale Unrealized Holding Loss-Equity Investments Unrealized Holding Loss-Held-to-Matuirty Unrealized Holding Loss-Trading te Adjusted available-for-sale debt investment to market value. Purchased investment in stock (at cost). Purchased investment in stock (equity method). Received cash dividend. Received cash dividend (equity method). Recorded revenue earned from equity investment. Recorded revenue earned from equity investment (equity method). Requirement 3. Post all 2018 transactions to the investment T-account. What is its balance after all the transactions are posted? How would this balance be classified on the balance sheet dated December 31, 2018? Begin by selecting the investment account and posting the 2018 transactions to the investment T-account. Calculate the balance after all the transactions are posted. How would this balance be classified on the balance sheet dated December 31, 2018? This balance would be classified as on the balance sheet dated December 31, 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started