Answered step by step

Verified Expert Solution

Question

1 Approved Answer

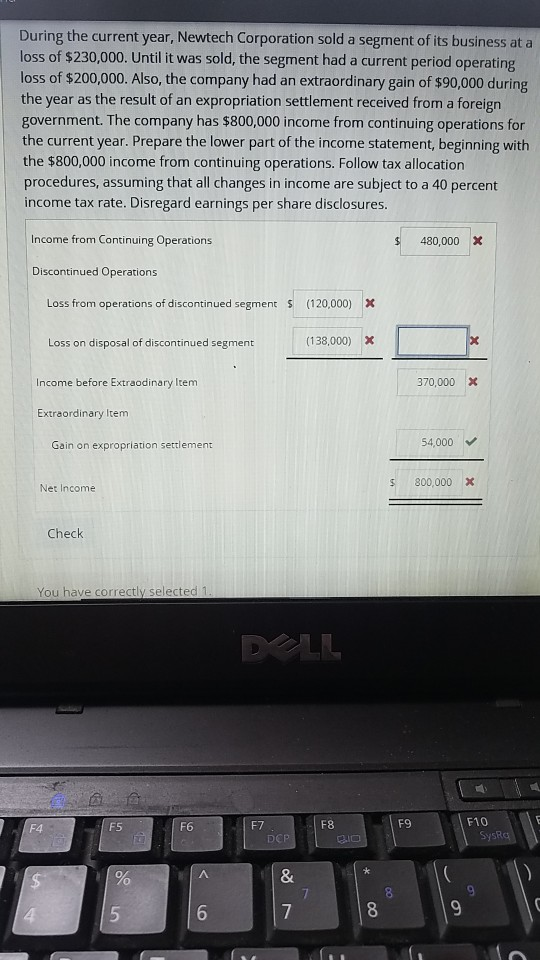

what am I doing wrong? Thought the 800000x40% would give income from continuing operations, and following losses from sale of segment and operating loss would

what am I doing wrong? Thought the 800000x40% would give income from continuing operations, and following losses from sale of segment and operating loss would be x60%....I am confused! Help and an explanation so I understand would be great.

During the current year, Newtech Corporation sold a segment of its business at a loss of $230,000. Until it was sold, the segment had a current period operating loss of $200,000. Also, the company had an extraordinary gain of $90,000 during the year as the result of an expropriation settlement received from a foreign government. The company has $800,000 income from continuing operations for the current year. Prepare the lower part of the income statement, beginning with the $800,000 income from continuing operations. Follow tax allocation procedures, assuming that all changes in income are subject to a 40 percent income tax rate. Disregard earnings per share disclosures. Income from Continuing Operations 480,000x Discontinued Operations Loss from operations of discontinued segment S (120,000 x Loss on disposal of discontinued segment (138,000)x Income before Extraodinary Item 370,000 x Extraordinary ltem Gain on expropriation settlement 54,000 s 800,000 x Net Income Check You have correctly selected 1 F9 F10 F4 F5 F6 F7 F8 5 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started