What am I missing from my income statement?

What am I missing from my income statement?

Screenshots below for reference

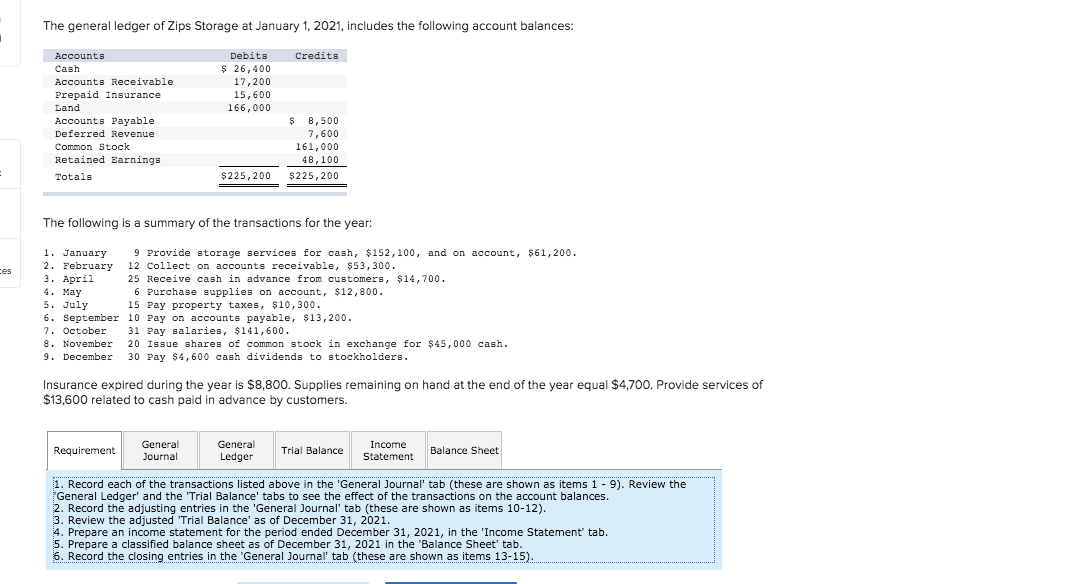

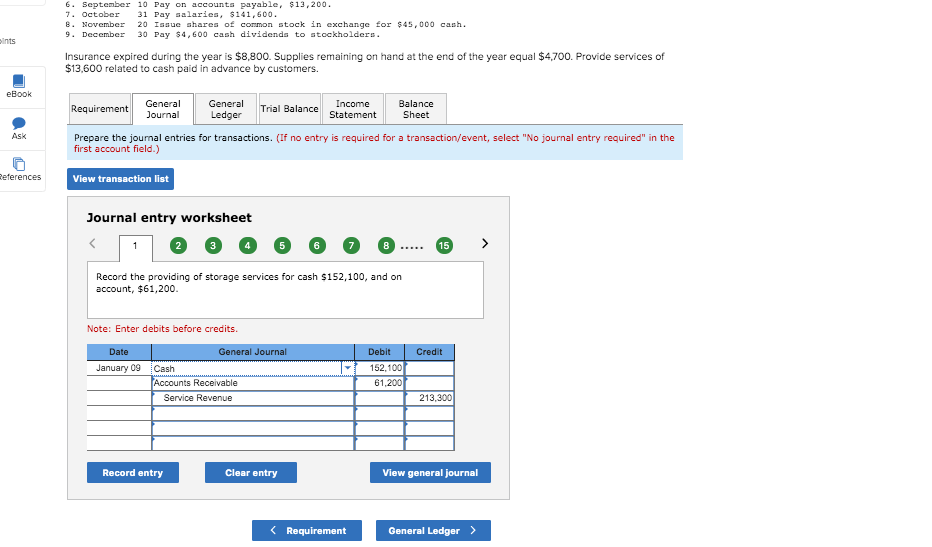

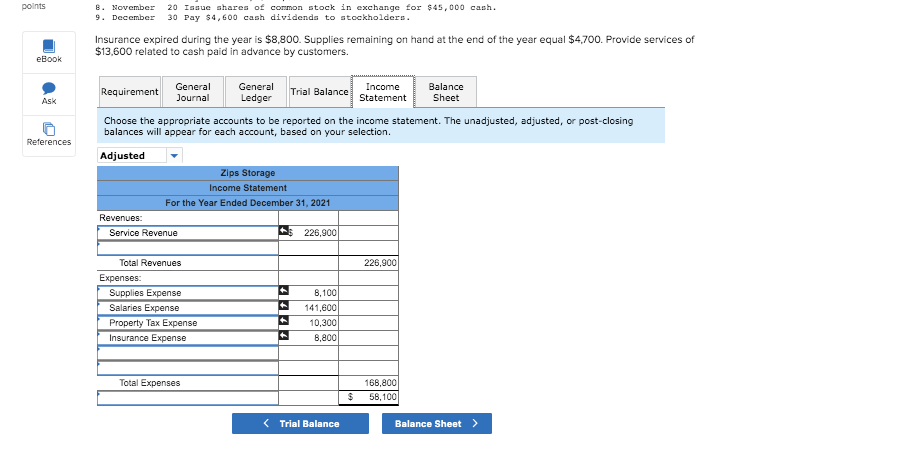

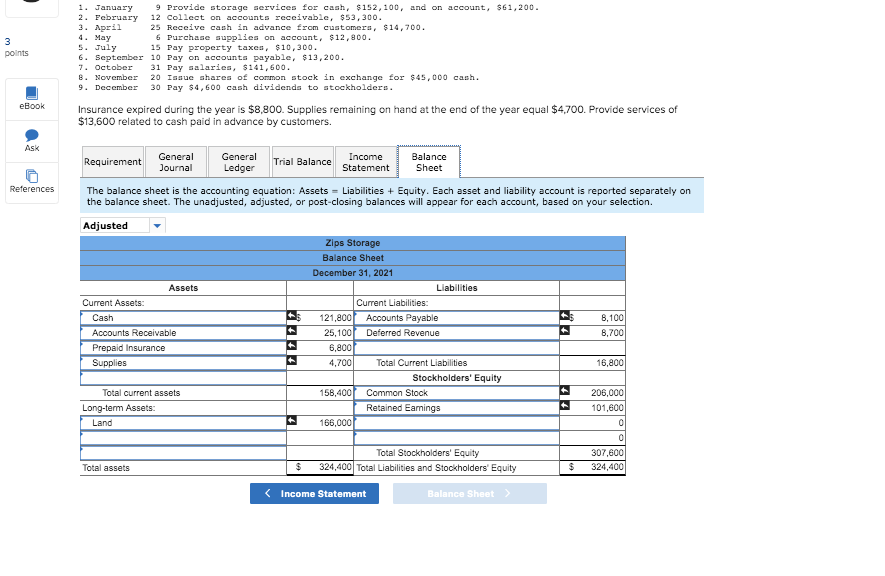

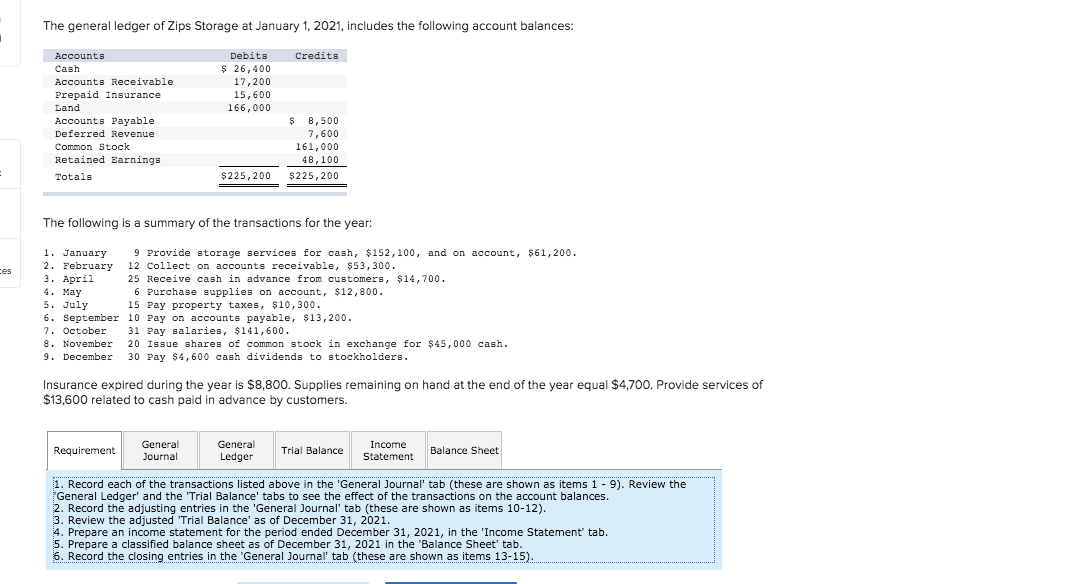

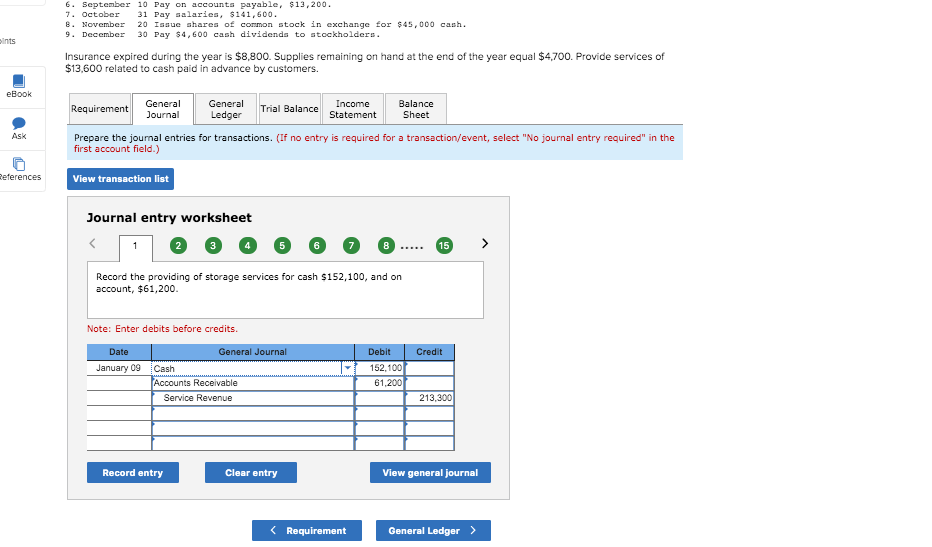

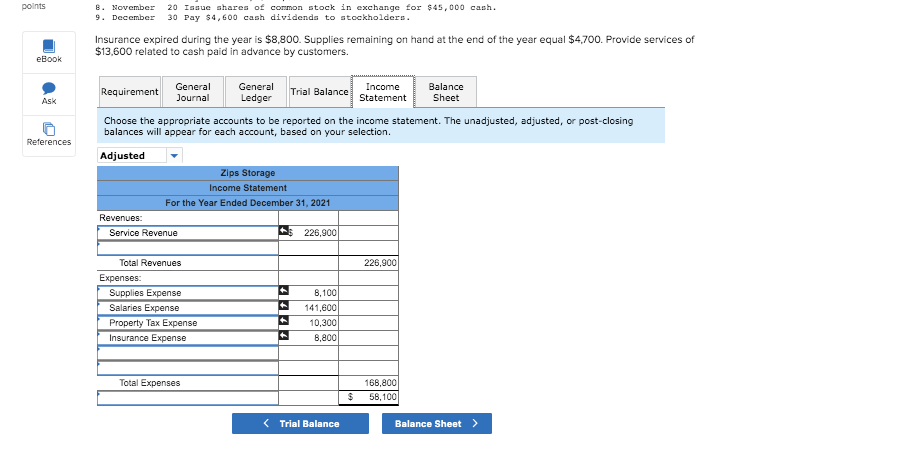

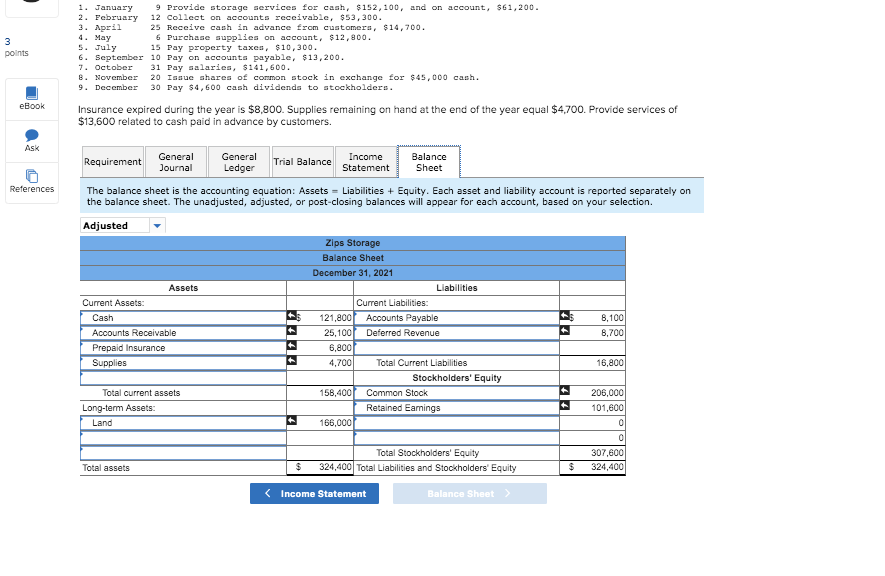

6. September 10 Day on accounts payable, $13,200. 7. October 31 Pay salaries, $141,600. 8. November 20 Issue shares of common stock in exchange for $45,000 cash. 9. December 30 Pay $4,600 cash dividends to stockholders. ints Insurance expired during the year is $8,800. Supplies remaining on hand at the end of the year equal $4,700. Provide services of $13.600 related to cash paid in advance by customers. eBook Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Ask Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) References View transaction list Journal entry worksheet points 8. November 9. December 20 Issue shares of common stock in exchange for $45,000 cash. 30 Pay $4,600 cash dividends to stockholders. Insurance expired during the year is $8,800. Supplies remaining on hand at the end of the year equal $4,700. Provide services of $13.600 related to cash paid in advance by customers. eBook Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Ask Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. References Adjusted - Zips Storage Income Statement For the Year Ended December 31, 2021 Revenues Service Revenue *$ 226,900 226.900 Total Revenues Expenses Supplies Expense Salaries Expense Property Tax Expense Insurance Expense 8.100 141,600 10,300 8.800 * Total Expenses 168.800 58,100 $ (Trial Balance Balance Sheet > 1. January 9 Provide storage services for cash, $152, 100, and on account, $61,200. 2. February 12 Collect on accounts receivable, $53,300. 3. April 25 Receive cash in advance from customers, $14,700. 4. May 6 Purchase supplies on account, $12,800. 5. July 15 Pay property taxes, $10,300. 6. September 10 Pay on accounts payable, $13,200. 7. October 31 Pay salaries, $141,600. 8. November 20 Issue shares of common stock in exchange for $45,000 cash. 9. December 30 Pay $4,600 cash dividends to stockholders. points eBook Insurance expired during the year is $8,800. Supplies remaining on hand at the end of the year equal $4,700. Provide services of $13.600 related to cash paid in advance by customers. Ask Requirement ant General Journal General Ledger Trial Balance Income Statement Balance Sheet References The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Adjusted - Assets Current Assets: Cash Zips Storage Balance Sheet December 31, 2021 Liabilities Current Liabilities: * $ 121,8001 Accounts Payable $ 25,1007 Deferred Revenue 6,800 4,700 Total Current Liabilities Stockholders' Equity 158,400 Common Stock Retained Eamings 166, 000 * $ * 8,100 8.700 Accounts Receivable Prepaid Insurance Supplies 16,800 Total current assets Long-term Assets: Land 206,000 101,600 0 307,600 324,400 Total assets Total Stockholders' Equity 324,400 Total Liabilities and Stockholders' Equity $ $ Income Statement Balance Sheet) The general ledger of Zips Storage at January 1, 2021, includes the following account balances: Credits Debits $ 26,400 17,200 15,600 166,000 Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totals $ 8,500 7,600 161,000 48, 100 $225,200 $225,200 The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $152,100, and on account, $61,200. 2. February 12 Collect on accounts receivable, $53,300. 3. April 25 Receive cash in advance from customers, $14,700. 4. May 6 Purchase supplies on account, $12,800. 5. July 15 Pay property taxes, $10,300. 6. September 10 Pay on accounts payable, $13,200. 7. October 31 Pay salaries, $141,600. 8. November 20 Issue shares of common stock in exchange for $45,000 cash. 9. December 30 Pay $4,600 cash dividends to stockholders. Insurance expired during the year is $8,800. Supplies remaining on hand at the end of the year equal $4,700. Provide services of $13,600 related to cash paid in advance by customers. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1-9). Review the General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 10-12). 3. Review the adjusted 'Trial Balance' as of December 31, 2021. 4. Prepare an income statement for the period ended December 31, 2021, in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of December 31, 2021 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 13-15)

What am I missing from my income statement?

What am I missing from my income statement?