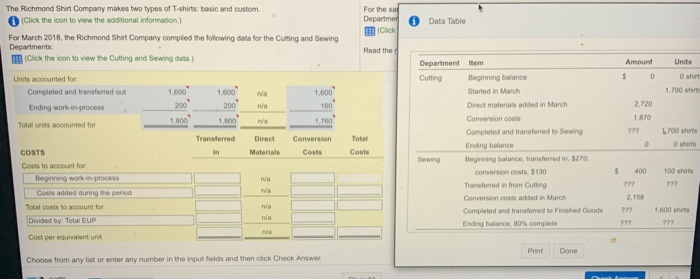

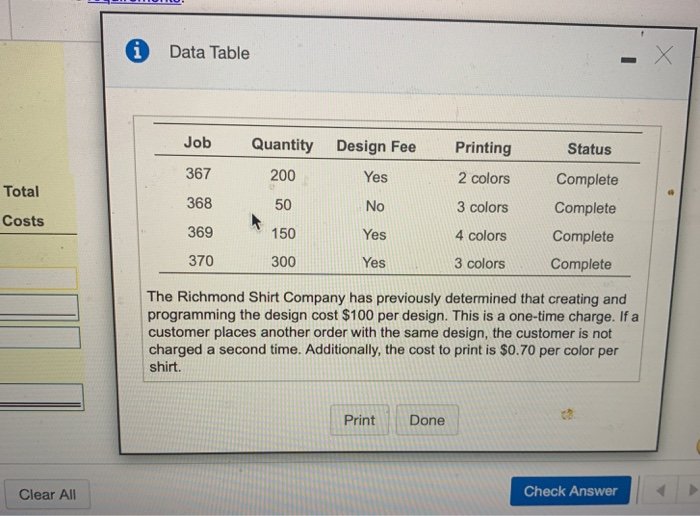

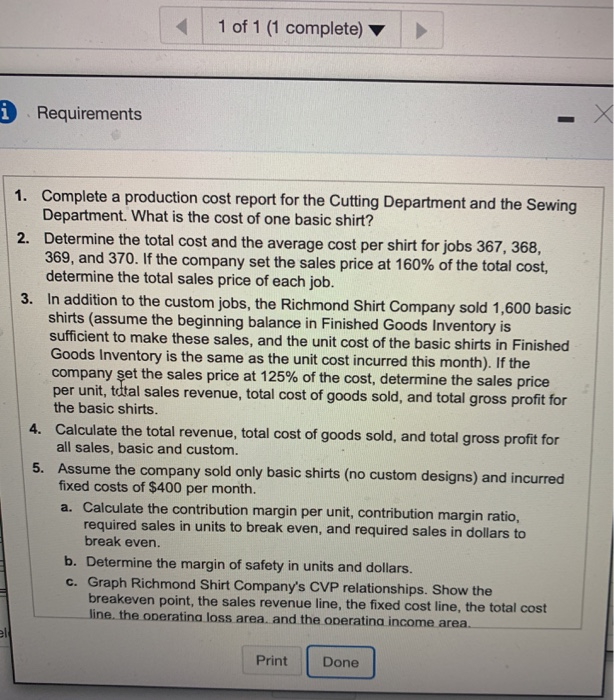

For the sa Departmer The Richmond Shirt Company makes two types of T-shirts: basic and custom (Click the icon to view the additional information.) Data Table m(Click For March 2018, the Richmond Shirt Company compled the following data for the Cuting and Sewing Departments: Read the m(Click the icon to view the Cutting and Sewing data.) Department Amount Units tem 0 0 shin Cutting Beginning balance Units accounted for 1,600 1.600 1,700 shirts Started in Marchs Completed and transferred out 1,600 n/a Direct materials added in March 2.720 200 200 160 Ending work-in-process nia 1,870 1,800 1,800 Conversion costs n'as 1.760 Total units accounted for Completed and transferred to Sewing L700 shirts Transferred Direct Conversion Total shirts Ending balance COSTS In Materials Costs Costs Beginning balance, transferred in, $270 Sewing Costs to account for 100 shirts 400 conversion oosts, $130 Beginning work-in-process n/a Transferred in from Cutting na Costs added during the period Conversion costs added in March 2,158 Total costs to account for n/a Completed and transfemed to Finished Goods 1,600 shirts nia Divided by Total EUP Ending balance, 80 % complete mm nVa Cost per equivalent unit Print Done Choose from any Ist or enter any number in the input fields and then cick Check Answer Data Table Job Quantity Design Fee Printing Status 367 200 Yes 2 colors Complete Total 368 50 No 3 colors Complete Costs 369 150 Yes 4 colors Complete 370 300 Yes 3 colors Complete The Richmond Shirt Company has previously determined that creating and programming the design cost $100 per design. This is a one-time charge. If a customer places another order with the same design, the customer is not charged a second time. Additionally, the cost to print is $0.70 per color per shirt. Print Done Check Answer Clear All 1 of 1 (1 complete) i Requirements 1. Complete a production cost report for the Cutting Department and the Sewing Department. What is the cost of one basic shirt? 2. Determine the total cost and the average cost per shirt for jobs 367, 368, 369, and 370. If the company set the sales price at 160% of the total cost, determine the total sales price of each job. 3. In addition to the custom jobs, the Richmond Shirt Company sold 1,600 basic shirts (assume the beginning balance in Finished Goods Inventory is sufficient to make these sales, and the unit cost of the basic shirts in Finished Goods Inventory is the same as the unit cost incurred this month). If the company et the sales price at 125% of the cost, determine the sales price per unit, total sales revenue, total cost of goods sold, and total gross profit for the basic shirts. 4. Calculate the total revenue, total cost of goods sold, and total gross profit for all sales, basic and custom. 5. Assume the company sold only basic shirts (no custom designs) and incurred fixed costs of $400 per month. a. Calculate the contribution margin per unit, contribution margin ratio, required sales in units to break even, and required sales in dollars to break even. b. Determine the margin of safety in units and dollars. c. Graph Richmond Shirt Company's CVP relationships. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operatina loss area, and the operatina income area el Print Done