Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What amount is reported on the Form 1040 line: amount you overpaid? Federal Taxation I Module 8: Comprehensive Tax Return Project Jared and Ashley have

What amount is reported on the Form 1040 line: amount you overpaid?

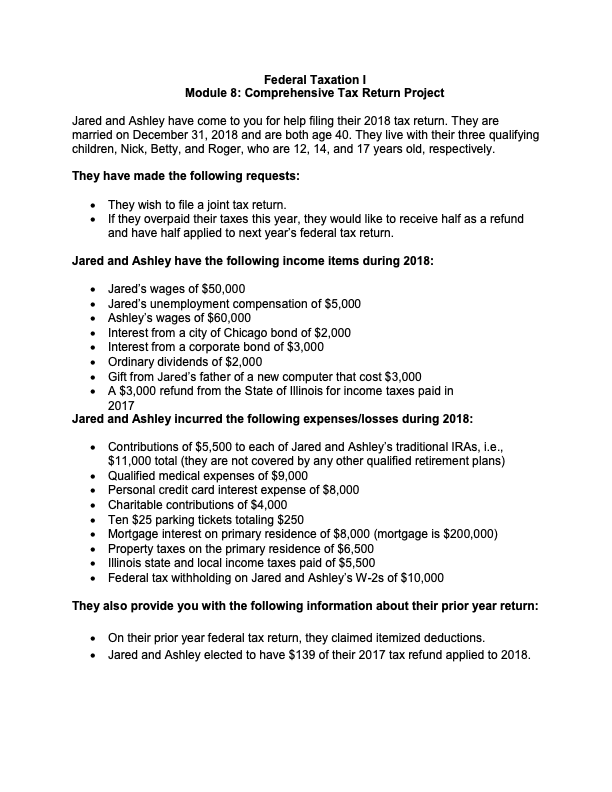

Federal Taxation I Module 8: Comprehensive Tax Return Project Jared and Ashley have come to you for help filing their 2018 tax return. They are married on December 31, 2018 and are both age 40 . They live with their three qualifying children, Nick, Betty, and Roger, who are 12, 14, and 17 years old, respectively. They have made the following requests: - They wish to file a joint tax return. - If they overpaid their taxes this year, they would like to receive half as a refund and have half applied to next year's federal tax return. Jared and Ashley have the following income items during 2018: - Jared's wages of $50,000 - Jared's unemployment compensation of $5,000 - Ashley's wages of $60,000 - Interest from a city of Chicago bond of $2,000 - Interest from a corporate bond of $3,000 - Ordinary dividends of $2,000 - Gift from Jared's father of a new computer that cost $3,000 - A $3,000 refund from the State of Illinois for income taxes paid in 2017 Jared and Ashley incurred the following expenses/losses during 2018 : - Contributions of $5,500 to each of Jared and Ashley's traditional IRAs, i.e., $11,000 total (they are not covered by any other qualified retirement plans) - Qualified medical expenses of $9,000 - Personal credit card interest expense of $8,000 - Charitable contributions of $4,000 - Ten $25 parking tickets totaling $250 - Mortgage interest on primary residence of $8,000 (mortgage is $200,000 ) - Property taxes on the primary residence of $6,500 - Illinois state and local income taxes paid of $5,500 - Federal tax withholding on Jared and Ashley's W-2s of $10,000 They also provide you with the following information about their prior year return: - On their prior year federal tax return, they claimed itemized deductions. - Jared and Ashley elected to have $139 of their 2017 tax refund applied to 2018. Federal Taxation I Module 8: Comprehensive Tax Return Project Jared and Ashley have come to you for help filing their 2018 tax return. They are married on December 31, 2018 and are both age 40 . They live with their three qualifying children, Nick, Betty, and Roger, who are 12, 14, and 17 years old, respectively. They have made the following requests: - They wish to file a joint tax return. - If they overpaid their taxes this year, they would like to receive half as a refund and have half applied to next year's federal tax return. Jared and Ashley have the following income items during 2018: - Jared's wages of $50,000 - Jared's unemployment compensation of $5,000 - Ashley's wages of $60,000 - Interest from a city of Chicago bond of $2,000 - Interest from a corporate bond of $3,000 - Ordinary dividends of $2,000 - Gift from Jared's father of a new computer that cost $3,000 - A $3,000 refund from the State of Illinois for income taxes paid in 2017 Jared and Ashley incurred the following expenses/losses during 2018 : - Contributions of $5,500 to each of Jared and Ashley's traditional IRAs, i.e., $11,000 total (they are not covered by any other qualified retirement plans) - Qualified medical expenses of $9,000 - Personal credit card interest expense of $8,000 - Charitable contributions of $4,000 - Ten $25 parking tickets totaling $250 - Mortgage interest on primary residence of $8,000 (mortgage is $200,000 ) - Property taxes on the primary residence of $6,500 - Illinois state and local income taxes paid of $5,500 - Federal tax withholding on Jared and Ashley's W-2s of $10,000 They also provide you with the following information about their prior year return: - On their prior year federal tax return, they claimed itemized deductions. - Jared and Ashley elected to have $139 of their 2017 tax refund applied to 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started