Answered step by step

Verified Expert Solution

Question

1 Approved Answer

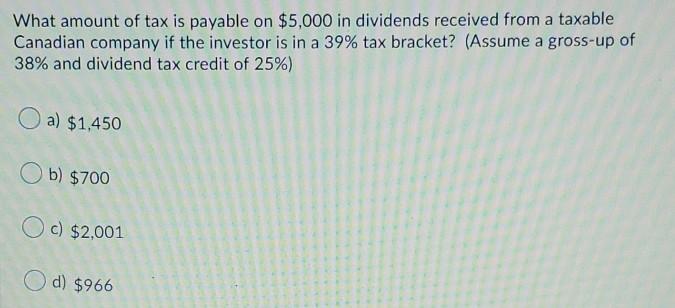

What amount of tax is payable on $5,000 in dividends received from a taxable Canadian company if the investor is in a 39% tax bracket?

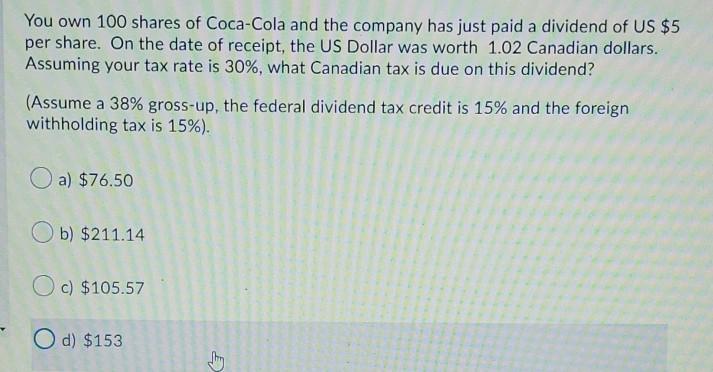

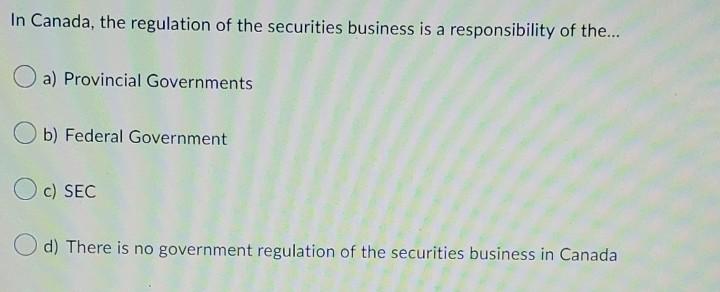

What amount of tax is payable on $5,000 in dividends received from a taxable Canadian company if the investor is in a 39% tax bracket? (Assume a gross-up of 38% and dividend tax credit of 25%) a) $1,450 b) $700 c) $2,001 d) $966 You own 100 shares of Coca-Cola and the company has just paid a dividend of US $5 per share. On the date of receipt, the US Dollar was worth 1.02 Canadian dollars. Assuming your tax rate is 30%, what Canadian tax is due on this dividend? (Assume a 38% gross-up, the federal dividend tax credit is 15% and the foreign withholding tax is 15%). O a) $76.50 Ob) $211.14 O c) $105.57 O d) $153 BE In Canada, the regulation of the securities business is a responsibility of the... a) Provincial Governments b) Federal Government c) SEC O d) There is no government regulation of the securities business in Canada

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started