Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What are the adjusting entries and the ending balances? The company's loan for P60,000 was approved and released by the bank on Dec. 31, 2010.

What are the adjusting entries and the ending balances?

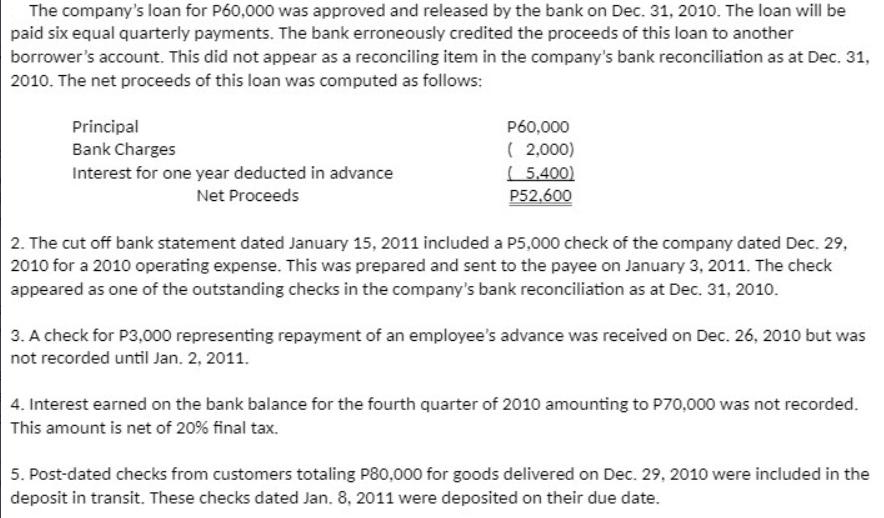

The company's loan for P60,000 was approved and released by the bank on Dec. 31, 2010. The loan will be paid six equal quarterly payments. The bank erroneously credited the proceeds of this loan to another borrower's account. This did not appear as a reconciling item in the company's bank reconciliation as at Dec. 31, 2010. The net proceeds of this loan was computed as follows: Principal Bank Charges Interest for one year deducted in advance Net Proceeds P60,000 ( 2,000) (5,400) P52,600 2. The cut off bank statement dated January 15, 2011 included a P5,000 check of the company dated Dec. 29, 2010 for a 2010 operating expense. This was prepared and sent to the payee on January 3, 2011. The check appeared as one of the outstanding checks in the company's bank reconciliation as at Dec. 31, 2010. 3. A check for P3,000 representing repayment of an employee's advance was received on Dec. 26, 2010 but was not recorded until Jan. 2, 2011. 4. Interest earned on the bank balance for the fourth quarter of 2010 amounting to P70,000 was not recorded. This amount is net of 20% final tax. 5. Post-dated checks from customers totaling P80,000 for goods delivered on Dec. 29, 2010 were included in the deposit in transit. These checks dated Jan. 8, 2011 were deposited on their due date.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting Entries 1 Loan proceeds Debit Loan Proce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started