Question

What are the Benefits of disclosing the EVA information in annual report? Comment on the Value reporting policy of Infosys? Reference: International Research Journal of

- What are the Benefits of disclosing the EVA information in annual report?

- Comment on the Value reporting policy of Infosys?

Reference:

International Research Journal of Applied Finance ISSN 2229 - 6891 Vol. VII Issue - 4 April, 2016 Case Study Series

Infosys (INFY) - A Wealth Creator or Destroyer Dr. Anupam Mehta

Abstract

Infosys an Indian multinational provider of business consulting, technology, engineering, and

outsourcing services with revenue of $7,398 million and net income of $1,725 million in the

fiscal year 2013, has been declaring Economic Value Added (EVA) in its annual reports since

1996. The case gives an opportunity to analyze and evaluate Economic Value Added by Infosys from year 2000 to 2012 and to draw interpretations regarding the wealth creation done by Infosys over a period.

The Case

Utterly confused with the numbers on Economic Value Added, Mr. Paul, an MBA 1st Semester student sighed while holding a cup of coffee in his hostel room of the LBG business School in India. Even the hot summer season was sending a chill down his spine, since 15 marks, individual case study was due for submission in less than 24 hours. The Infosys EVA appeared to be a mystery to him. Being in MBA 1st semester with B.Com background, he had some basic knowledge of accounting, but he regretted missing out the vital session on Economic Value Added. As a result, he was still struggling to solve the case on EVA analysis given by the Finance faculty. After all, analyzing the EVA of Infosys was no joke, especially when 10 year trend needed for a billion dollar company. Although the case gave the basic information, but still he found it to be a massive task to analyze and evaluate the EVA of Infosys. Did Infosys generated the wealth or was a wealth destroyer over the past years, were the questions that constantly challenged him? Paul knew that the only way to solve the case was to go back to the basics and dig out the information about the company and class notes on EVA.

About Infosys

Infosys limited (formerly Infosys Technologies Limited) is an Indian multinational provider of business consulting, technology, engineering, and outsourcing services. Headquartered in Bangalore, Karnataka, has acquired the third-largest India-based IT services company status by 2012 revenues. It started with just $ 250 in 1981 by the seven engineers, and within few years, it had become a global leader in consulting, technology and outsourcing with revenues of US $ 7.2 billion (Q3 FY13), while managing clients from 30 countries. The company has a global presence with more than 155,000 employees worldwide, across 67 offices and 69 development centers in the United States, India, China, Australia, Japan, Middle East and Europe. According to the company, its huge success has been based on bringing to life great ideas and enterprise solutions that drive progress for its clients. (http://www.infosys.com/about/Pages/index.aspx)

Strategy

Infosys has strengthened its position as a leading global consulting and technology company by: ? Strengthening its strategic partnership with clients;

? Increasing its relevance to clients by being able to work in the entire spectrum of their business; ? Delivering higher business value to clients through the alignment of our structure and offerings to their business objectives. (Source: Infosys's annual report)

Products and Services

- Consulting and systems integration comprising consulting, enterprise solutions, systems integration and advanced technologies;

- Business IT services comprising application development and maintenance, independent validation services, infrastructure management, engineering services comprising product engineering and life cycle solutions and business process management.

- Products, business platforms and solutions to accelerate intellectual property led innovation, including Finacle, which offers solutions to address the core banking, mobile banking and e- banking needs of retail, corporate and universal banks worldwide; and

- Newer areas such as cloud computing, enterprise mobility and sustainability. (Infosys annual report 2012-13, Form 20-F | 33)

Sources of Revenue

Infosys delivered high quality solutions through the Global Delivery Model. Using Global Delivery Model, the company divided projects into components that it executed simultaneously at client sites and at its development centers in India and around the world. It optimized its cost structure by maintaining the flexibility to execute project components, with its scalable infrastructure and ability to execute project components around the clock and across time zones, enabled to reduce project delivery times. The company's main clients are US and European companies. Although the company has been increasing it services to the Middle East, India, Japan and China. Infosys greatly benefit from the growth of these nations while the adversity directly impacted its revenue generating ability. (Annual report, Infosys annual report 2012-13, form 20-K, 33)

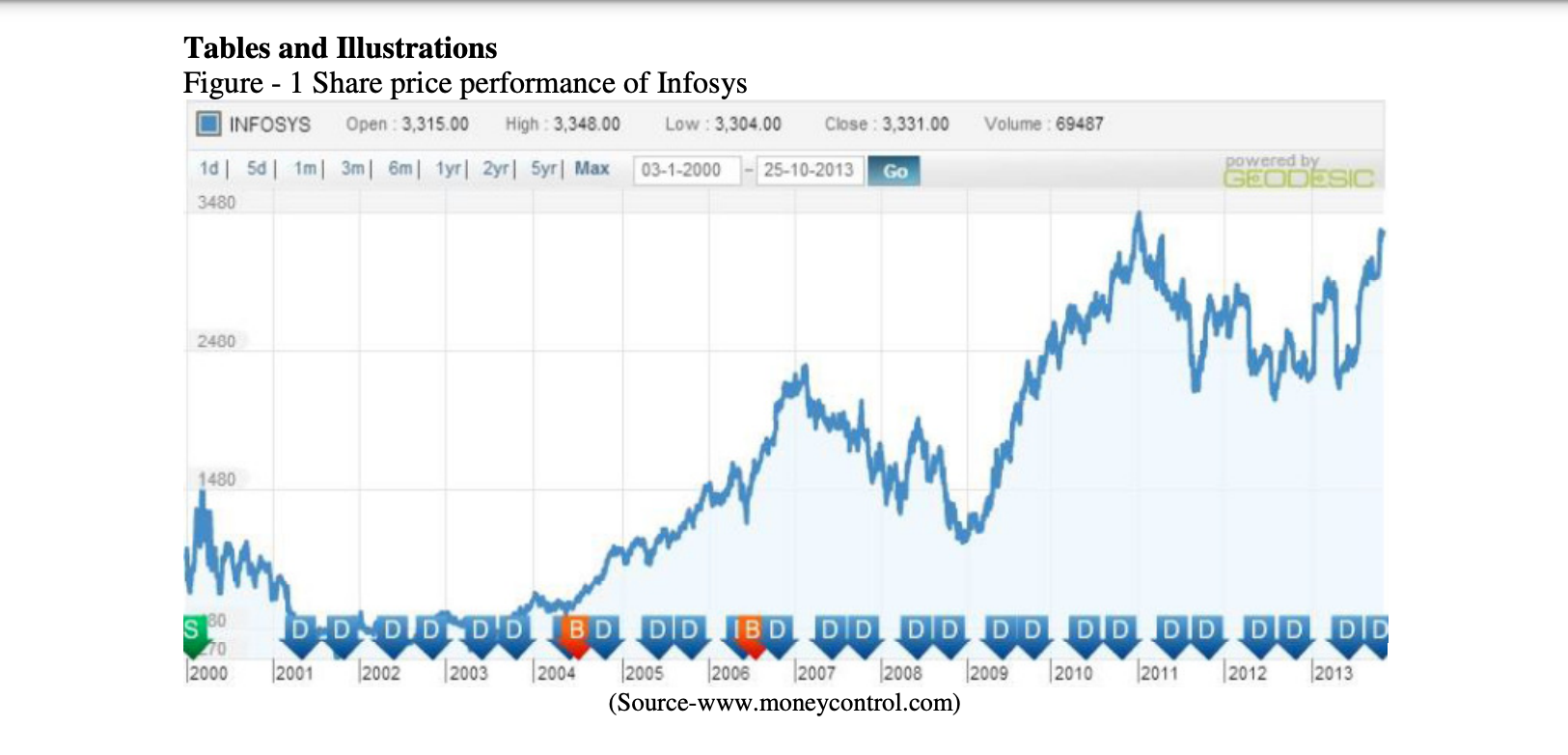

Financial Performance - The revenues of the company grew from $4,663 million in fiscal 2009 to $7,398 million in fiscal 2013 and the net income growth from $1,281 million to $1,725 million during the same period, representing a compound annualized growth of 7.7%. The share prices of the company had grown many folds since 2000 (Refer figure 1).

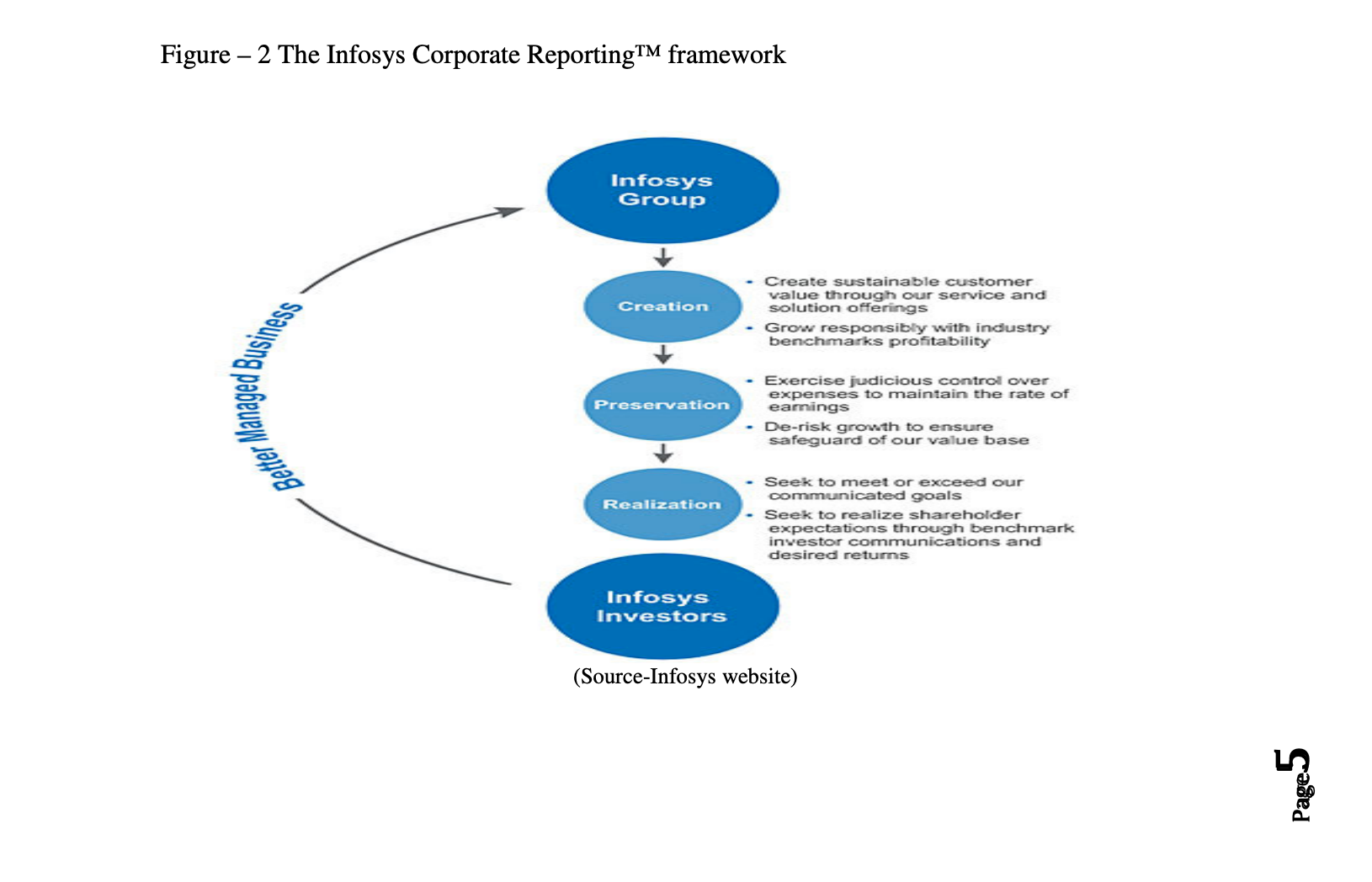

The Infosys Corporate ReportingTM framework

Infosys has always pioneered in adopting reporting policies that minimized the information asymmetry between the management and shareholders. Infosys was the first Indian company to adopt the US Generally Accepted Accounting Principles (US GAAP) and the first foreign private issuer from India to file primary financial statements with the Securities and Exchange Commission (SEC) in accordance to International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board. It had issued the brand valuation statement, balance sheet including intangible assets, intangible asset scorecard, risk management report, human resource accounting and value-added statement in its annual report (Refer figure 2).

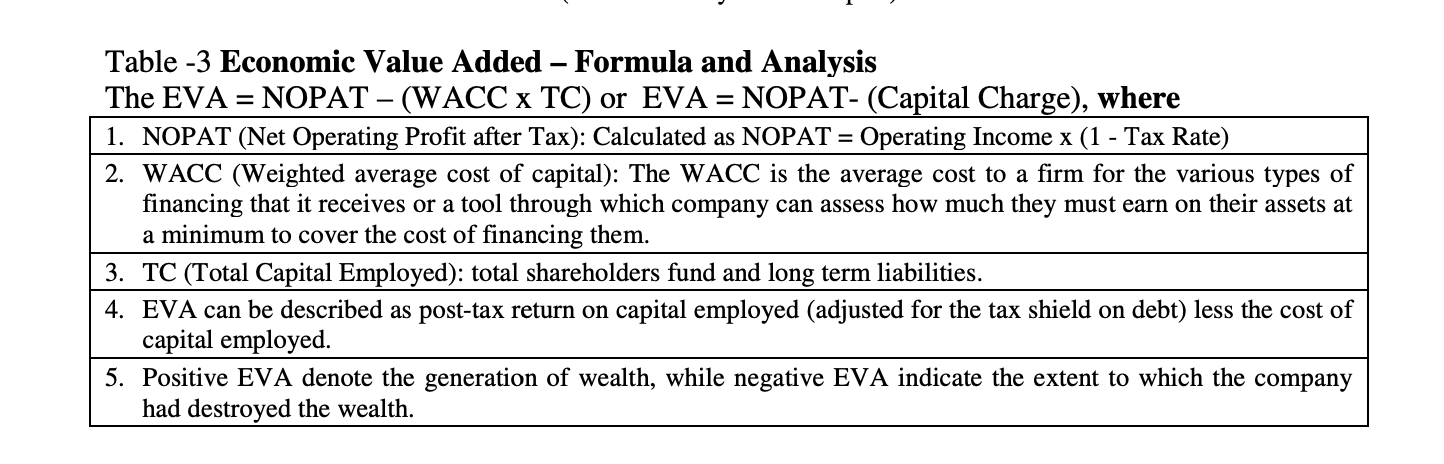

Economic Value Added (EVA) and Return on Investment (ROI)

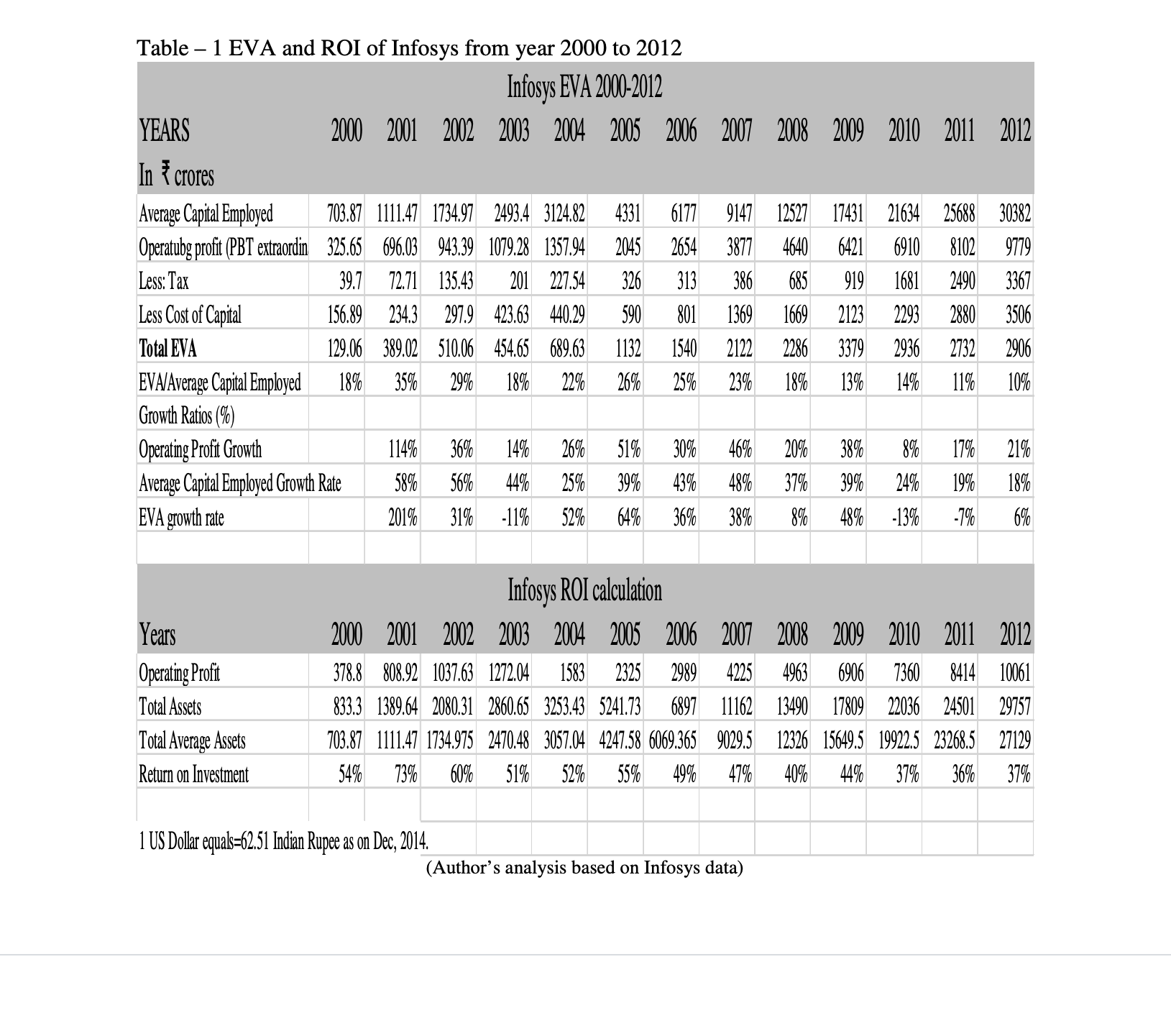

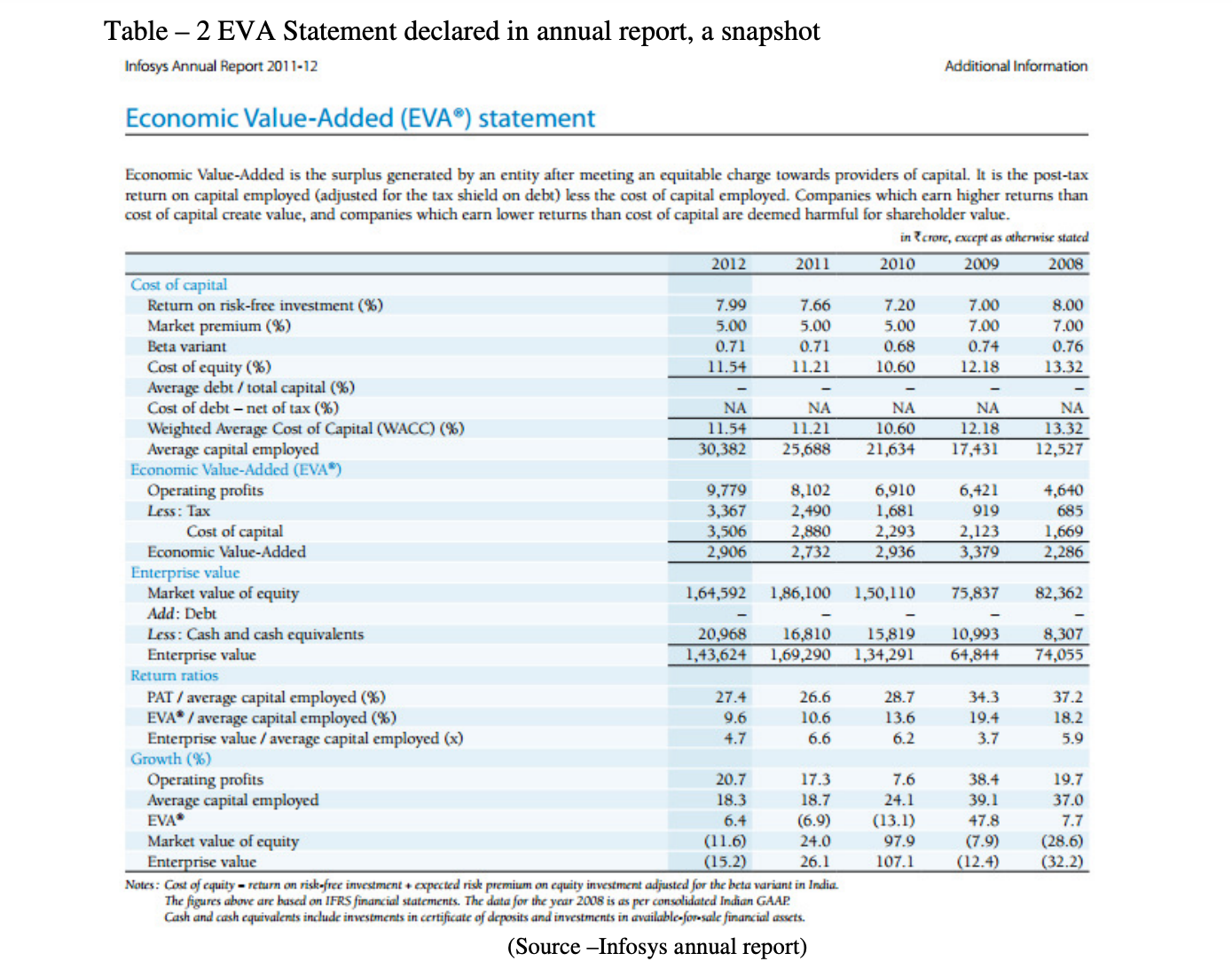

The Infosys had been disclosing the EVA statement for years, as a part of its value reporting, the Infosys had been amongst the few companies in India those have continued to disclose the EVA information in the annual reports since 1996. A statement of EVA and ROI has been given in Table - 1.

As Mr. Paul started to draw interpretations from the reported values of EVA of Infosys given in annual reports, he noticed that, although the EVA of Infosys had been positive throughout 2000- 2012, but there are fluctuations in EVA generation from year to year. What does it mean? What was happening to the EV A and ROI growth rate? He kept wondering.

After hours of work and going through the information provided in faculty notes, he was sure that Infosys had been a wealth creator ever since year 2000 and not even for a year the company destroyed wealth of shareholders.

Perhaps the strategic focus of the company had been key to its wealth creation or probably something else. He also noticed that the company sales had been increasing year on year, but the ROI gave a very different trend. What parameters he should rely on? Although he had prepared and made basic evaluations, but was that sufficient? Was EVA a better performance measure than ROI? Not sure, about his analysis, Paul looked for expert guidance in EVA analysis of Infosys.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started