What are the best estimates of McCormick & Companys capital structure used for the acquisition of new product lines.

What are the best estimates of McCormick & Companys capital structure used for the acquisition of new product lines.

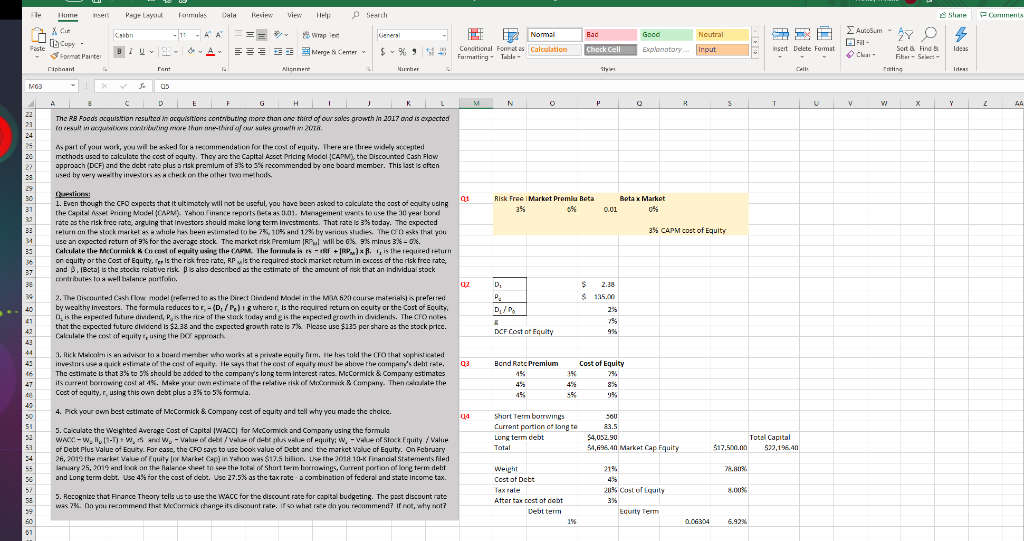

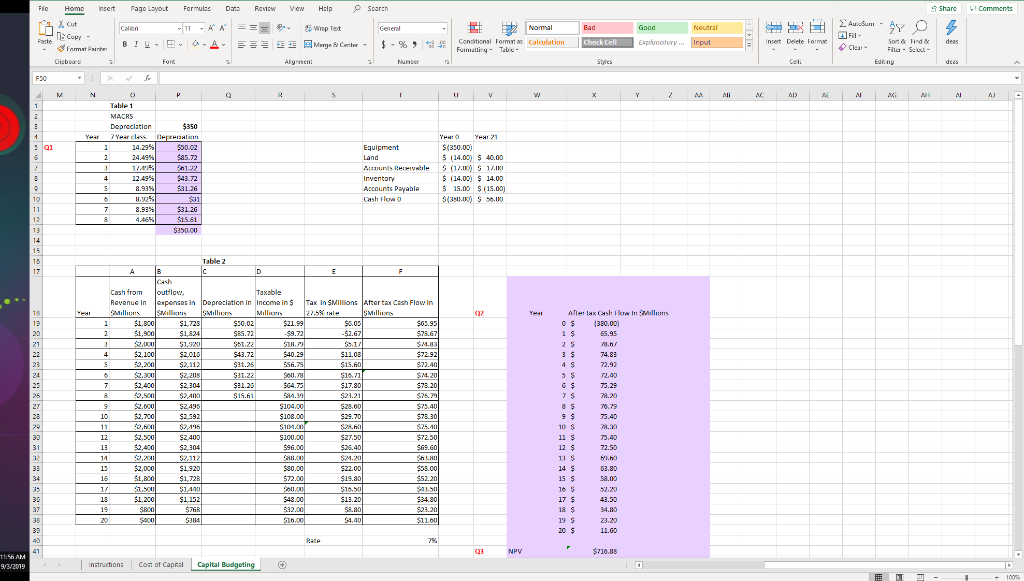

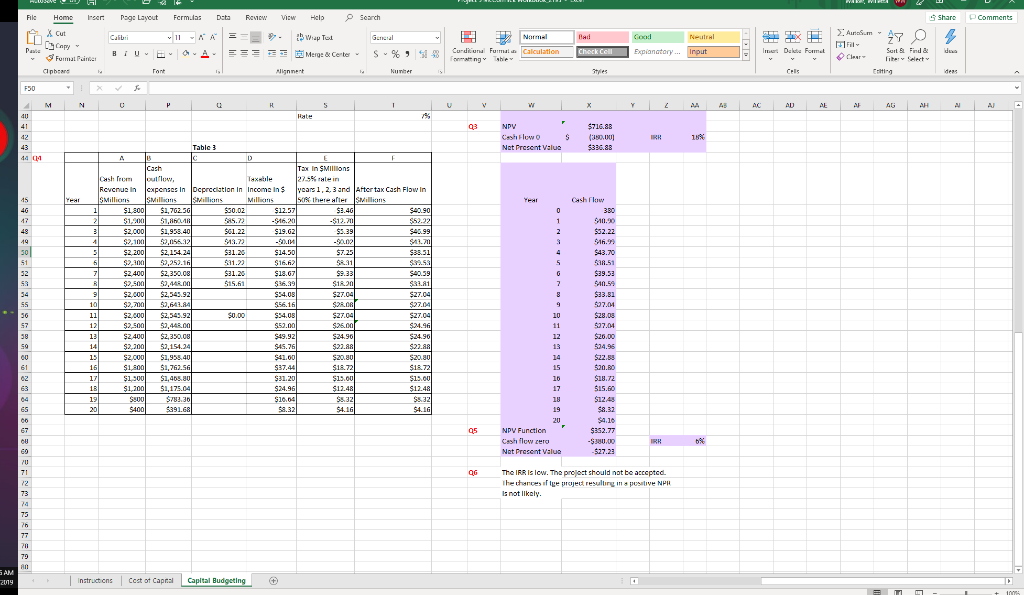

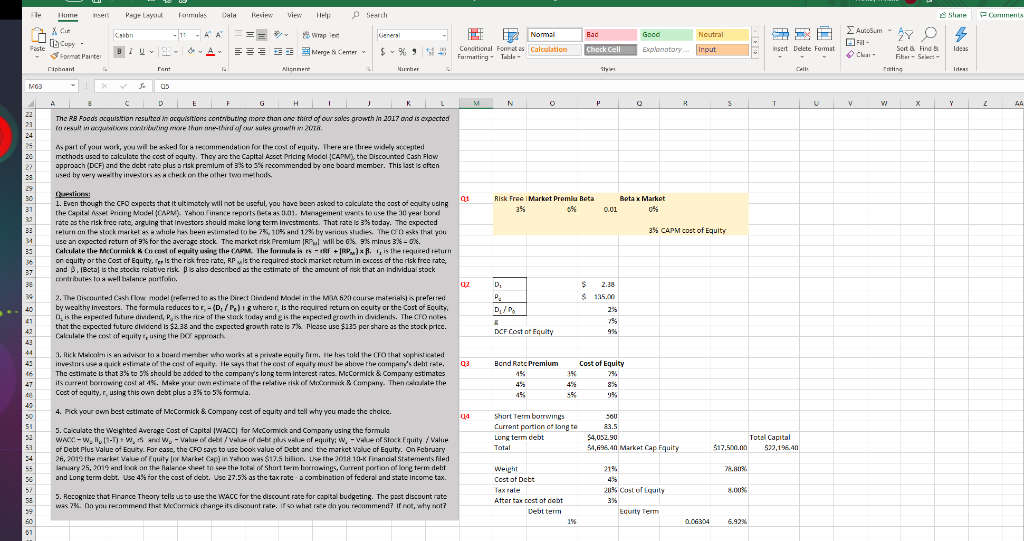

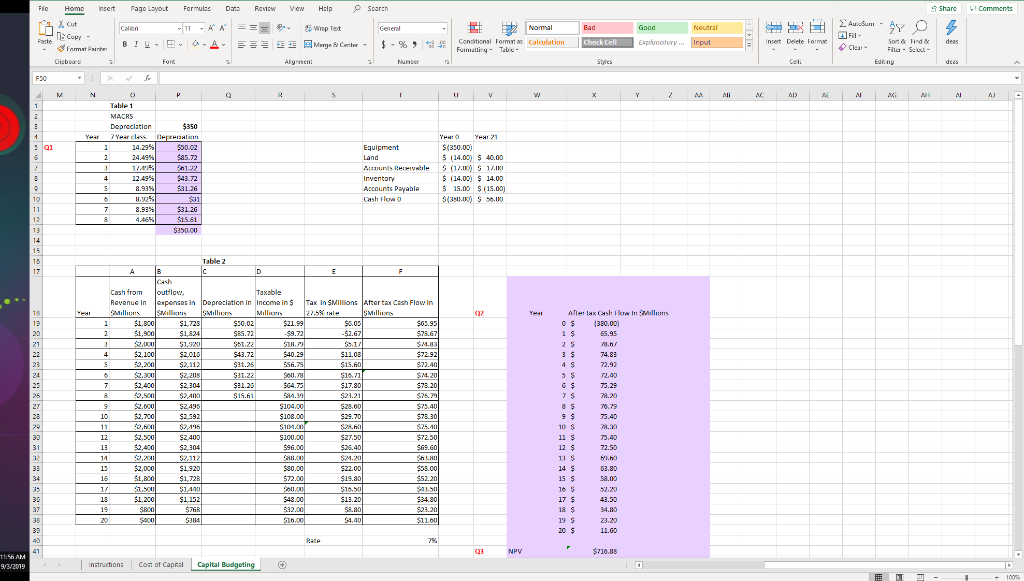

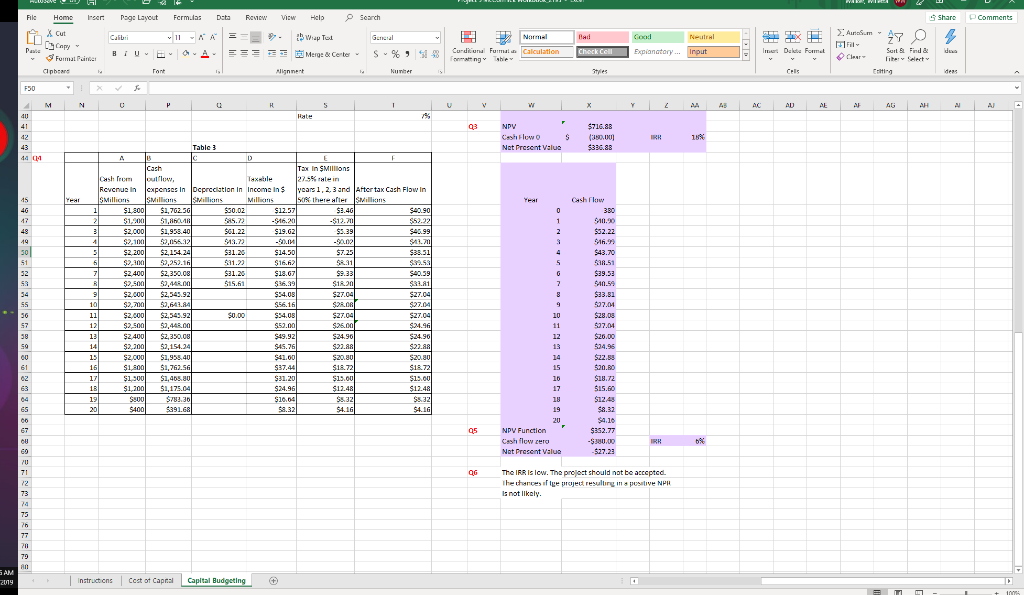

Serch inser Fle Psge Layout Farmulas Resiew iw Help Share FComments Home S.m. AYO 11 A A" Wrep len Noutral Geners == Nomal Ead Gocd Caibn Fae 45Cupy Format Painte Fil Explanatory Irput E Concitional Fommat as Calculation FarmattingTable Check Cell Insert Delete Format Sort & Find 5 Ideas Menge &Cemer BIU A Clear Fiber Select Cell att ipnad Fant Alignnen NUTher Stle Ideas M03 g5 K L M A F G H N P T 22 The RB Foods acquistion resulted in acquisitions contributing more than one tiird of our sales growth in 2017 ond is cxpocted o result in acuiatios cotritng moe thun ane-third of our sules growth in 2018 23 24 As part of your work, you will be asked for a recommendstion for the cost of equity. There are three widely accepted 25 20 mcthods used to ralculote the ccet of equity. They are the Capital Acsct Pricing Model CAPM), the Discounted Cash Flow approsch (DCF) and the debt rate plus a risk premium of s% to 3% recommended by one board member. This last is cften used by very weathy investors as a check on the other two metheds Questions 1. Even though the CFO expects that it ultimatcly will not be useful, you have boon askod to calculate the cost of cquity using the Capital Asset Pricing Model (CAPM). Finnce reports Beta as 0.01. Management wants to use the 30 year bond rate sthe risk free rate, arguing that Investors should make long tomm imvestments. That rate is 3 % today. The expected return an the stock market as a whcle has been estimated to be 2%, 10% and 12% by vericus studies. The CFO esks that you use an cxpocted return of 9 % for the average stock The markct risk Premlum RPl will be G 9 % minus 3%-0%. Risk Free IMarket Premiu Beta Betax Market 30 3% 31 0.01 37 3% CAPM cost of Equity 34 Calulate the Mc Cormick & Co cost of equity using the CAPM. The formula is rs-Rr P)x . , is the required return on cquity or the Cost of Equity, F ls the risk free ratc, RP ls the requircd stock markct rctum in oxcess of the risk free rate, and ,IBotal s the stocks relative risk pis also described as the estimate of the amcunt of risk that an Indvidual stock oetriutes to a well balance portfalio 36 37 D 38 . 2.38 2. The Discunted Cash Flow madel (referred to as the Direct Dhvidend Model in the Man 620 course materisls) is prefered by wealthy Investors. The formula reduces to r,- (D, /P) gwherer, Is the required return on cquity or the Cost of Equilty 0, is the espected future dividend, P,is the rice of the stack today andgis the espected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the xpected growth rate is 7% Plesse use $135 per share as the stock pricc. Calculste the cost of equity r, usinge the DCF approadh 30 P. S 13500 2% 41 DCF Cost of Equity 42 9% 43 44 3. Rick Malcalm is an advisor to a hoard member wtho warks at a private equity firm. He hes told the CFO that sophist icated investors use a quick estimate of the cost of equity. He says that the cast of equity must be above the campany's debt rate. The cstimate Is that 3% to 5 % should be added to the company's long term intercst ratcs. McCormick & Company estimates its curent borrowing cost at 4 %. Make your awnestimate of the relative risk of Moamick & Company. Then caloulate the Cost of equity. r, using this own debt plus a 3% to 5% formula. Cost of Equity Bcnd Ratc Premium 43 4% 3% 7% 47 4% 4% 8% 4% % 40 4. Pick your awn best estimate of McCormick & Company cest of equity and tell why you made the cholce. short Term borrwings 4 Current porticn ot lang te 51 83.5 5. Calculate the Weighted Average Cost of Capital (MACC) for McComick and Company using the formuls WACC-w, R [1-T)t w, s and w-Value of debt/value of debt plus vale of equity: w-value of Stock Equity /Value of Debt Flus Value of Equity. For case, the CFO says to usc book value of Dcbt and the market Value of Equity. On February Total Capital 52 $4,052.90 A,69640 Market Cap Fquity Long term debt $17,500.00 53 Total $2,196.40 4 26, 2019 the market Value of Fquity lor Market Cap) in Yahoo was $17.5 hilinn. Use the 2018 10-K Financial Statements filed lanuary 25, 2019 and look on the Ralance sheet to spp the total of Shart term borrowings, Current portion of long term deht and Long term debt. Use 4% for the cost of cebt. Use 27.5 % as the tax rate acombinotion of federal and state income tax. Weight Ccct of Deb 55 21% 78.a03 4% 2% Cust of Equity 8.00% 57 Tax rale 5. Recognize that Firance Theory tclls us to use the WACC for the discount rate for capital budgeting. The pat discount rate was 7 %. Da yu recommend that MeCarmick dhangpe its discount rate. If so what rate do you recammend? if not, why not? Atter tax ccst ot debt 3% Debt term Equity Term 60 1 % 0.c6304 6.92 % 51 Page Layout Hlp Share File Home Insert Formulas Das Recw Vew Search Comments AuSu Fil Cut 11 AAT General Wrap Tet Nomal Bad Good Neutral Calern PateCopy Formst ainte Sot&nd 8o Fll Selt Conditional Formst as Caloulation Femali Talb'e - Explanatory Irput A Check Cell E Merge & Canter Insert Delete Forms deas B!U- Clear Oisboa Algrnen Font Nunser Styles Cel Eding deas F50 U N N Q V w AA ADX G Table 1 1 2 MACRS $350 Depreciation 7 Year class Year 21 4. Year Depreatin $50.02 Year 14.29% $(350.00) Equipment (14.00 40.00 (17.00 17.00 $(14.00) 14.00 15.00 (15.00) $tas. s00 sas.72 2 24.49% Land 14400 Sn1-22 Acuns Reeivsle 3 1249% $43.72 4 Inventory Accounts Payable Cash Hlow $31.26 8.93% 10 $31 20 $15.61 11 8.93% 12 4.46% Ss0.00 13 14 15 Table 2 15 A 17 D E Cash outlow, expensas in Sills Taxable Cash from Dapreciation in Income in $ SMillcns Tax in $Millions Atter tax Cash Flow in 27.5% al Rovenue in Ater lax Cash flrw In illions. SMillure 18 Millons Millicrs Yesr 1 $1.800 $1,900 $21.99 -$9.72 s05 $65.95 19 $1725 $30.02 0S (350.00 -$2.67 20 $1824 SES.72 $78.67 65.95 $1 SM83 $72.92 .b S1.22 S1 21 2 $2.100 $2,200 $40.29 22 4 $2,010 $43.72 $11.08 74.83 $56.75 23 $2,112 S31.2 $15.60 $72.40 4 S 72.92 $2,20 SOu. $2,300 $31.22 $4.20 $78.20 $75.79 $75.40 $78.30 $2540 24 72.40 $2400 2,500 S64.75 25 $2304 $31.20 $17.80 G S 73.29 a.3 $2A00 25 $15.61 $23.21 7 S .20 $104/00 sic8.00 $101.00 $100.00 96.00 $2,000 27 $2495 $28.00 7079 $2,700 28 10 $2.592 $29.70 75.40 $2495 $2400 S 10 S 29 11 $72.50 $69.60 Sha $27.50 $2,500 $2,400 30 12 11 s 75.40 31 13 $2,304 $26400 12 S 72.50 SM.20 $2,112 13S 32 14 $2,000 S80.00 $58.00 33 15 $1920 $22.00 14 S 03.80 $1.800 $72.00 $52.20 34 16 $1,728 $19.a0 15 S 58.00 1 $1,00 $1,40 52.20 $34.80 S $1.200 $48.00 30 13 $1152 $13.20 17 S 43.50 S768 532.00 37 19 Saco S8.a0 $23.20 18 S 34.8 S384 S10.0 $4.40 $11.00 Z3.20 38 2 19 S 32 20 11.00 40 Bate 7% $710.85 41 t156 AM NPV instruchion: Co ot Capral Capital Budgeting Instructions 96/2019 100% PComments File Home Irser oge Layout Fcrm.Jas Dcta Rvicw Vicw Hela Search Share Cut Aum Caibri h Wp Tod Bad Good Neutral Ganeal Norma Fal Pa Cpy Fumal Puir Curdiun Furmal Calculation Imar Dak Fome ... Chock Cell Expianatory Input Surt Find & dvo B U S% d 48 Clear onmatt ng she ahiev iteSelect Cpbar Tont ign merh Nunhen yles Cels ting deas F50 A M N u H AA AC ALl AL AG H 40 Hale $716.88 41 03 NPV Cashlow o 183 42 IRH $336.88 43 Table 3 Net Present Valuo A 44 E L Cash Tax In SMIlllons Cash from Revcnue in SMillions oullow Cxpenses In Depreciation In Incoma In $ SMillions $1800 27.5% tale in Taxsble years 1,2,3 and After tax Cash Flow in 50% there after SMillians SMillions Cash low TeaL Millins 45 Year $40.90 $52.22 $1,702.50 s50.02 $3.40 0 4G $12.57 380 S10.90 -$16.20 -$12.7 47 $1,00 $1,8648 Sas.72 1 $19.02 48 $1,958.40 S61.22 5.3 $52.22 $2,000 $40.99 46.99 49 4 $2,100 52,056.32 $2,154.24 $2,25.16 $2,350.00 ,44R00 13.72 -0,02 SA3.7 30 $7.25 $38.51 Ss3 S4039 $2,200 $2,300 S31.20 S31.2 $43.70 $14.50 sa8.51 51 $16.62 S31 5 $2400 S31.20 $9.33 Sa9.53 S40.59 2 $18.67 $36.39 515.61 53 $2,500 $1820 $33.81 7 $27.04 $27.04 $27.04 $24.96 $2,543.92 5,64184 S33.81 34 $2,000 $2,0 $2000 S2,500 $2400 $2,200 $34.08 $27.04 527.04 55 1/0 $56.16 s4.0s $2,545.92 $,44800 $2,350.0 $2,154.24 $195840 $1,762.56 $0.00 $28.08 11 $27.04 10 $27.04 S7 12 $50.00 $26.00 11 13 $49.92 $45.76 $26.00 $24.96 38 $24.90 $24.90 12 $22.an $2080 59 14 $22.am 13 S22.88 15 $2,000 $41.00 $20.80 14 $18.72 S37.44 $20.80 61 16 $1800 $18.72 15 $15.00 $12.48 $1,408.80 $1,175.04 S783.30 $391.68 $31.20 $18.72 $15.60 17 $1300 $15.00 16 $1,200 63 18 $24.96 $12.48 17 $10.04 19 .. 20 Ss00 S32 S532 S1248 $8.32 04 18 $400 $4.16 a.32 $4.16 65 19 $4.1 20 67 Q5 NPV Function $352.77 Cash flew cero -$38U.00 b IRH -$27.23 60 Not PresentValuo The IR8 Is Icw, The prolect should not be accepted 71 06 he thances f lge projet resultirg in postve NP Is not likely 73 24 75 77 70 79 80 AM I Ccst ot Capral Capital Budgeting Instructions 209 4 10005 Serch inser Fle Psge Layout Farmulas Resiew iw Help Share FComments Home S.m. AYO 11 A A" Wrep len Noutral Geners == Nomal Ead Gocd Caibn Fae 45Cupy Format Painte Fil Explanatory Irput E Concitional Fommat as Calculation FarmattingTable Check Cell Insert Delete Format Sort & Find 5 Ideas Menge &Cemer BIU A Clear Fiber Select Cell att ipnad Fant Alignnen NUTher Stle Ideas M03 g5 K L M A F G H N P T 22 The RB Foods acquistion resulted in acquisitions contributing more than one tiird of our sales growth in 2017 ond is cxpocted o result in acuiatios cotritng moe thun ane-third of our sules growth in 2018 23 24 As part of your work, you will be asked for a recommendstion for the cost of equity. There are three widely accepted 25 20 mcthods used to ralculote the ccet of equity. They are the Capital Acsct Pricing Model CAPM), the Discounted Cash Flow approsch (DCF) and the debt rate plus a risk premium of s% to 3% recommended by one board member. This last is cften used by very weathy investors as a check on the other two metheds Questions 1. Even though the CFO expects that it ultimatcly will not be useful, you have boon askod to calculate the cost of cquity using the Capital Asset Pricing Model (CAPM). Finnce reports Beta as 0.01. Management wants to use the 30 year bond rate sthe risk free rate, arguing that Investors should make long tomm imvestments. That rate is 3 % today. The expected return an the stock market as a whcle has been estimated to be 2%, 10% and 12% by vericus studies. The CFO esks that you use an cxpocted return of 9 % for the average stock The markct risk Premlum RPl will be G 9 % minus 3%-0%. Risk Free IMarket Premiu Beta Betax Market 30 3% 31 0.01 37 3% CAPM cost of Equity 34 Calulate the Mc Cormick & Co cost of equity using the CAPM. The formula is rs-Rr P)x . , is the required return on cquity or the Cost of Equity, F ls the risk free ratc, RP ls the requircd stock markct rctum in oxcess of the risk free rate, and ,IBotal s the stocks relative risk pis also described as the estimate of the amcunt of risk that an Indvidual stock oetriutes to a well balance portfalio 36 37 D 38 . 2.38 2. The Discunted Cash Flow madel (referred to as the Direct Dhvidend Model in the Man 620 course materisls) is prefered by wealthy Investors. The formula reduces to r,- (D, /P) gwherer, Is the required return on cquity or the Cost of Equilty 0, is the espected future dividend, P,is the rice of the stack today andgis the espected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the xpected growth rate is 7% Plesse use $135 per share as the stock pricc. Calculste the cost of equity r, usinge the DCF approadh 30 P. S 13500 2% 41 DCF Cost of Equity 42 9% 43 44 3. Rick Malcalm is an advisor to a hoard member wtho warks at a private equity firm. He hes told the CFO that sophist icated investors use a quick estimate of the cost of equity. He says that the cast of equity must be above the campany's debt rate. The cstimate Is that 3% to 5 % should be added to the company's long term intercst ratcs. McCormick & Company estimates its curent borrowing cost at 4 %. Make your awnestimate of the relative risk of Moamick & Company. Then caloulate the Cost of equity. r, using this own debt plus a 3% to 5% formula. Cost of Equity Bcnd Ratc Premium 43 4% 3% 7% 47 4% 4% 8% 4% % 40 4. Pick your awn best estimate of McCormick & Company cest of equity and tell why you made the cholce. short Term borrwings 4 Current porticn ot lang te 51 83.5 5. Calculate the Weighted Average Cost of Capital (MACC) for McComick and Company using the formuls WACC-w, R [1-T)t w, s and w-Value of debt/value of debt plus vale of equity: w-value of Stock Equity /Value of Debt Flus Value of Equity. For case, the CFO says to usc book value of Dcbt and the market Value of Equity. On February Total Capital 52 $4,052.90 A,69640 Market Cap Fquity Long term debt $17,500.00 53 Total $2,196.40 4 26, 2019 the market Value of Fquity lor Market Cap) in Yahoo was $17.5 hilinn. Use the 2018 10-K Financial Statements filed lanuary 25, 2019 and look on the Ralance sheet to spp the total of Shart term borrowings, Current portion of long term deht and Long term debt. Use 4% for the cost of cebt. Use 27.5 % as the tax rate acombinotion of federal and state income tax. Weight Ccct of Deb 55 21% 78.a03 4% 2% Cust of Equity 8.00% 57 Tax rale 5. Recognize that Firance Theory tclls us to use the WACC for the discount rate for capital budgeting. The pat discount rate was 7 %. Da yu recommend that MeCarmick dhangpe its discount rate. If so what rate do you recammend? if not, why not? Atter tax ccst ot debt 3% Debt term Equity Term 60 1 % 0.c6304 6.92 % 51 Page Layout Hlp Share File Home Insert Formulas Das Recw Vew Search Comments AuSu Fil Cut 11 AAT General Wrap Tet Nomal Bad Good Neutral Calern PateCopy Formst ainte Sot&nd 8o Fll Selt Conditional Formst as Caloulation Femali Talb'e - Explanatory Irput A Check Cell E Merge & Canter Insert Delete Forms deas B!U- Clear Oisboa Algrnen Font Nunser Styles Cel Eding deas F50 U N N Q V w AA ADX G Table 1 1 2 MACRS $350 Depreciation 7 Year class Year 21 4. Year Depreatin $50.02 Year 14.29% $(350.00) Equipment (14.00 40.00 (17.00 17.00 $(14.00) 14.00 15.00 (15.00) $tas. s00 sas.72 2 24.49% Land 14400 Sn1-22 Acuns Reeivsle 3 1249% $43.72 4 Inventory Accounts Payable Cash Hlow $31.26 8.93% 10 $31 20 $15.61 11 8.93% 12 4.46% Ss0.00 13 14 15 Table 2 15 A 17 D E Cash outlow, expensas in Sills Taxable Cash from Dapreciation in Income in $ SMillcns Tax in $Millions Atter tax Cash Flow in 27.5% al Rovenue in Ater lax Cash flrw In illions. SMillure 18 Millons Millicrs Yesr 1 $1.800 $1,900 $21.99 -$9.72 s05 $65.95 19 $1725 $30.02 0S (350.00 -$2.67 20 $1824 SES.72 $78.67 65.95 $1 SM83 $72.92 .b S1.22 S1 21 2 $2.100 $2,200 $40.29 22 4 $2,010 $43.72 $11.08 74.83 $56.75 23 $2,112 S31.2 $15.60 $72.40 4 S 72.92 $2,20 SOu. $2,300 $31.22 $4.20 $78.20 $75.79 $75.40 $78.30 $2540 24 72.40 $2400 2,500 S64.75 25 $2304 $31.20 $17.80 G S 73.29 a.3 $2A00 25 $15.61 $23.21 7 S .20 $104/00 sic8.00 $101.00 $100.00 96.00 $2,000 27 $2495 $28.00 7079 $2,700 28 10 $2.592 $29.70 75.40 $2495 $2400 S 10 S 29 11 $72.50 $69.60 Sha $27.50 $2,500 $2,400 30 12 11 s 75.40 31 13 $2,304 $26400 12 S 72.50 SM.20 $2,112 13S 32 14 $2,000 S80.00 $58.00 33 15 $1920 $22.00 14 S 03.80 $1.800 $72.00 $52.20 34 16 $1,728 $19.a0 15 S 58.00 1 $1,00 $1,40 52.20 $34.80 S $1.200 $48.00 30 13 $1152 $13.20 17 S 43.50 S768 532.00 37 19 Saco S8.a0 $23.20 18 S 34.8 S384 S10.0 $4.40 $11.00 Z3.20 38 2 19 S 32 20 11.00 40 Bate 7% $710.85 41 t156 AM NPV instruchion: Co ot Capral Capital Budgeting Instructions 96/2019 100% PComments File Home Irser oge Layout Fcrm.Jas Dcta Rvicw Vicw Hela Search Share Cut Aum Caibri h Wp Tod Bad Good Neutral Ganeal Norma Fal Pa Cpy Fumal Puir Curdiun Furmal Calculation Imar Dak Fome ... Chock Cell Expianatory Input Surt Find & dvo B U S% d 48 Clear onmatt ng she ahiev iteSelect Cpbar Tont ign merh Nunhen yles Cels ting deas F50 A M N u H AA AC ALl AL AG H 40 Hale $716.88 41 03 NPV Cashlow o 183 42 IRH $336.88 43 Table 3 Net Present Valuo A 44 E L Cash Tax In SMIlllons Cash from Revcnue in SMillions oullow Cxpenses In Depreciation In Incoma In $ SMillions $1800 27.5% tale in Taxsble years 1,2,3 and After tax Cash Flow in 50% there after SMillians SMillions Cash low TeaL Millins 45 Year $40.90 $52.22 $1,702.50 s50.02 $3.40 0 4G $12.57 380 S10.90 -$16.20 -$12.7 47 $1,00 $1,8648 Sas.72 1 $19.02 48 $1,958.40 S61.22 5.3 $52.22 $2,000 $40.99 46.99 49 4 $2,100 52,056.32 $2,154.24 $2,25.16 $2,350.00 ,44R00 13.72 -0,02 SA3.7 30 $7.25 $38.51 Ss3 S4039 $2,200 $2,300 S31.20 S31.2 $43.70 $14.50 sa8.51 51 $16.62 S31 5 $2400 S31.20 $9.33 Sa9.53 S40.59 2 $18.67 $36.39 515.61 53 $2,500 $1820 $33.81 7 $27.04 $27.04 $27.04 $24.96 $2,543.92 5,64184 S33.81 34 $2,000 $2,0 $2000 S2,500 $2400 $2,200 $34.08 $27.04 527.04 55 1/0 $56.16 s4.0s $2,545.92 $,44800 $2,350.0 $2,154.24 $195840 $1,762.56 $0.00 $28.08 11 $27.04 10 $27.04 S7 12 $50.00 $26.00 11 13 $49.92 $45.76 $26.00 $24.96 38 $24.90 $24.90 12 $22.an $2080 59 14 $22.am 13 S22.88 15 $2,000 $41.00 $20.80 14 $18.72 S37.44 $20.80 61 16 $1800 $18.72 15 $15.00 $12.48 $1,408.80 $1,175.04 S783.30 $391.68 $31.20 $18.72 $15.60 17 $1300 $15.00 16 $1,200 63 18 $24.96 $12.48 17 $10.04 19 .. 20 Ss00 S32 S532 S1248 $8.32 04 18 $400 $4.16 a.32 $4.16 65 19 $4.1 20 67 Q5 NPV Function $352.77 Cash flew cero -$38U.00 b IRH -$27.23 60 Not PresentValuo The IR8 Is Icw, The prolect should not be accepted 71 06 he thances f lge projet resultirg in postve NP Is not likely 73 24 75 77 70 79 80 AM I Ccst ot Capral Capital Budgeting Instructions 209 4 10005

What are the best estimates of McCormick & Companys capital structure used for the acquisition of new product lines.

What are the best estimates of McCormick & Companys capital structure used for the acquisition of new product lines.